Abstract

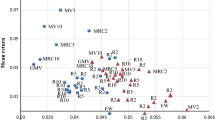

This paper shows that a large-scale maximal predictability portfolio (MPP) optimization problem can be solved within a practical amount of computational time using absolute deviation instead of squared deviation in the definition of the coefficient of determination. Also, we will show that MPP portfolio outperforms the mean-absolute deviation portfolio using real asset data in Tokyo Stock Exchange.

Similar content being viewed by others

References

Charnes A, Cooper WW (1962) Programming with linear fractional functions. Nav Res Logist Q 9: 181–186

Fama F, French K (1993) Common risk factors in the returns on stock and bonds. J Finance Econ 33: 3–56

Gotoh J, Konno H (2001) Maximization of the ratio of two convex quadratic functions over a polytope. Comput Optim Appl 20: 43–60

Konno H, Takaya Y (2008) Multi-Step methods for choosing the best set of variables in regression analysis, Comput Optim Appl (in press)

Konno H, Tsuchiya K, Yamamoto R (2007) Minimization of the ratio of functions defined as a sum of absolute values of affine functions. J Optim Theory Appl 135: 399–410

Konno H, Yamamoto R (2007) Choosing the best set of variables in regression analysis using integer programming, ISE 07-01, Department of Industrial and Systems Engineering, Chuo University

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its applications to Tokyo Stock Market. Manage Sci 37: 519–531

Lo A, MacKinlay C (1997) Maximizing predictability in the stock and bond markets. Macroecon Dyn 1: 102–134

Lo A, Wang J (2006) Trading volume: implications of an intertemporal capital asset pricing model. J Finance 61: 2805–2840

Markowitz H (1959) Portfolio selection: efficient diversification of investment. Wiley, London

Pardalos PM, Phillips A (1991) Global optimization of fractional programming. J Global Optim 1: 173–182

Pardalos PM, Tsitsiringos V (2002) Financial engineering, supply chain and E-commerce. Kluwer, Dordrecht

Phong TQ, An LTH, Tao PD (1995) Decomposition branch and bound method for globally solving linearly constrained indefinite quadratic minimization problems. Oper Res Lett 17: 215–220

Yamamoto R, Konno H (2007) An efficient algorithm for solving convex–convex quadratic fractional programs. J Optim Theory Appl 133: 241–255

Yamamoto R, Ishii D, Konno H (2007) A maximal predictability portfolio model—algorithm and performance evaluation. Int J Theor Appl Finance 10: 1095–1109

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Konno, H., Morita, Y. & Yamamoto, R. A maximal predictability portfolio using absolute deviation reformulation. Comput Manag Sci 7, 47–60 (2010). https://doi.org/10.1007/s10287-008-0075-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-008-0075-2