Abstract

This paper considers a vendor-managed inventory (VMI) supply chain consisting of a risk-averse supplier and a risk-neutral retailer engaging in sales promoting efforts. Under the conditional risk at value, we examine three different types of contracts with the replenishment option for coordinating the VMI supply chain, namely, a risk diversification and cost sharing (RDCS) contract, an option and cost sharing contract, and a subsidy and cost sharing contract. Firstly, we derive the optimal production strategy and analyze the capability of each of the proposed contracts in coordinating the VMI supply chain. We find that all of those contracts can achieve coordination of the supply chain with Pareto improvement. Secondly, we also show that both the supplier and the retailer prefer the RDCS contract over the other two contracts. Finally, we use numerical experiments to analyze the impact of risk aversion on contracts’ parameters.

Similar content being viewed by others

References

Bai Q, Chen M, Xu L (2017) Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int J Prod Econ 187:85–101

Bernstein F, Li Y, Shang K (2016) A simple heuristic for joint inventory and pricing models with lead time and backorders. Manag Sci 62(8):2358–2373

Cachon GP (2003) Supply chain coordination with contracts. Handb Oper Res Manag Sci 11:227–339

Cai J, Hu X, Han Y, Cheng H, Huang W (2016) Supply chain coordination with an option contract under vendor-managed inventory. Int Trans Oper Res 23(6):1163–1183

Cai J, Hu X, Tadikamalla PR, Shang J (2017a) Flexible contract design for VMI supply chain with service-sensitive demand: revenue-sharing and supplier subsidy. Eur J Oper Res 261(1):143–153

Cai J, Tadikamalla PR, Shang J, Huang G (2017b) Optimal inventory decisions under vendor managed inventory: substitution effects and replenishment tactics. Appl Math Model 43:611–629

Cai J, Zhong M, Shang J, Huang W (2017c) Coordinating VMI supply chain under yield uncertainty: option contract, subsidy contract, and replenishment tactic. Int J Prod Econ 185:196–210

Cai J, Hu X, Chen K, Tadikamalla PR, Shang J (2019) Supply chain coordination under production yield loss and downside risk aversion. Comput Ind Eng 127:353–365

Chen LT, Wei CC (2012) Multi-period channel coordination in vendor-managed inventory for deteriorating goods. Int J Prod Res 50(16):4396–4413

Chen X, Wang X, Chan HK (2016) Channel coordination through subsidy contract design in the mobile phone industry. Int J Prod Econ 171:97–104

Chen L, Peng J, Liu Z, Zhao R (2017) Pricing and effort decisions for a supply chain with uncertain information. Int J Prod Res 55(1):264–284

Choi TM (2011) Coordination and risk analysis of VMI supply chains with RFID technology. IEEE Trans Ind Inf 7(3):497–504

Dong Y, Dresner M, Yao Y (2014) Beyond information sharing: an empirical analysis of vendor-managed inventory. Prod Oper Manag 23(5):817–828

ElHafsi M, Camus H, Craye E (2010) Managing an integrated production inventory system with information on the production and demand status and multiple non-unitary demand classes. Eur J Oper Res 207(2):986–1001

He Y, Zhao X (2016) Contracts and coordination: supply chains with uncertain demand and supply. Nav Res Log (NRL) 63(4):305–319

He J, Ma C, Pan K (2017) Capacity investment in supply chain with risk averse supplier under risk diversification contract. Transp Res Part E Log Transp Rev 106:255–275

Hemmati M, Fatemi Ghomi SMT, Sajadieh MS (2017) Vendor managed inventory with consignment stock for supply chain with stock-and price-dependent demand. Int J Prod Res 55(18):5225–5242

Hu W, Li Y, Wang W (2017) Benefit and risk analysis of consignment contracts. Ann Oper Res 257(1–2):641–659

Hu B, Meng C, Xu D, Son YJ (2018) Supply chain coordination under vendor managed inventory-consignment stocking contracts with wholesale price constraint and fairness. Int J Prod Econ 202:21–31

Huang F, He J, Lei Q (2018) Coordination in a retailer-dominated supply chain with a risk-averse manufacturer under marketing dependency. Int Trans Oper Res. https://doi.org/10.1111/itor.12520

Huang F, He J, Wang J (2019) Coordination of VMI supply chain with a loss-averse manufacturer under quality-dependency and marketing-dependency. J Ind Manag Optim 15(4):1753–1772

Kraiselburd S, Narayanan VG, Raman A (2004) Contracting in a supply chain with stochastic demand and substitute products. Prod Oper Manag 13(1):46–62

Lee JY, Cho RK, Paik SK (2016) Supply chain coordination in vendor-managed inventory systems with stockout-cost sharing under limited storage capacity. Eur J Oper Res 248(1):95–106

Lee W, Wang SP, Chen WC (2017) Forward and backward stocking policies for a two-level supply chain with consignment stock agreement and stock-dependent demand. Eur J Oper Res 256(3):830–840

Li B, An SM, Song DP (2018) Selection of financing strategies with a risk-averse supplier in a capital-constrained supply chain. Transp Res Part E Log Transp Rev 118:163–183

Liu M, Cao E, Salifou CK (2016) Pricing strategies of a dual-channel supply chain with risk aversion. Transp Res Part E Log Transp Rev 90:108–120

Nagler MG (2006) An exploratory analysis of the determinants of cooperative advertising participation rates. Mark Lett 17(2):91–102

Phan DA, Vo TLH, Lai AN, Nguyen TLA (2019) Coordinating contracts for VMI systems under manufacturer-CSR and retailer-marketing efforts. Int J Prod Econ 211:98–118

Ramani V, Swami S (2017) Demand expansion and price premium effects of marketing effort: modeling and comparative analysis. Econ Bull 37(2):1234–1246

Ru J, Shi R, Zhang J (2018) When does a supply chain member benefit from vendor managed inventory? Prod Oper Manag 27(5):807–821

Sabitha D, Rajendran C, Kalpakam S, Ziegler H (2016) The value of information sharing in a serial supply chain with AR (1) demand and non-zero replenishment lead times. Eur J Oper Res 255(3):758–777

Sainathan A, Groenevelt H (2019) Vendor managed inventory contracts-coordinating the supply chain while looking from the vendor’s perspective. Eur J Oper Res 272(1):249–260

Torres F, García-Díaz C (2018) Evolutionary dynamics of two-actor VMI-driven supply chains. Comput Math Organ Theory 24(3):351–377

Tsao YC, Sheen GJ (2012) Effects of promotion cost sharing policy with the sales learning curve on supply chain coordination. Comput Oper Res 39(8):1872–1878

Wang C, Chen J, Chen X (2017) Pricing and order decisions with option contracts in the presence of customer returns. Int J Prod Econ 193:422–436

Xie J, Wei JC (2009) Coordinating advertising and pricing in a manufacturer–retailer channel. Eur J Oper Res 197(2):785–791

Xu L, Govindan K, Bu X, Yin Y (2015) Pricing and balancing of the sea-cargo service chain with empty equipment repositioning. Comput Oper Res 54:286–294

Yang L, Cai G, Chen J (2018) Push, pull, and supply chain risk-averse attitude. Prod Oper Manag 27(8):1534–1552

Yao Y, Dong Y, Dresner M (2010) Managing supply chain backorders under vendor managed inventory: an incentive approach and empirical analysis. Eur J Oper Res 203(2):350–359

Zhao Y, Choi TM, Cheng TCE, Wang S (2018) Supply option contracts with spot market and demand information updating. Eur J Oper Res 266(3):1062–1071

Acknowledgements

This research was supported in part by the National Natural Science Foundation of China (Grant No. 71873111), the Humanities and Social Science Youth Foundation of Ministry of Education of China (Grant No. 17YJC630084), the Philosophy and Social Sciences of Education Department of Hubei Province (Grant No. 19Q162), and Hubei Superior and Distinctive Discipline Group of “Mechatronics and Automobiles”. The authors would like to thank the Editor and the anonymous referees for their helpful comments and suggestions, which significantly improved the paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interests regarding the publication of this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

1.1 A. Proof of Lemma 1

From the definition of CVaR, the supplier’s CVaR performance with wholesale price contract satisfies that

where \(\sigma _1 = (v - c)Q + +(w-v)e+(w_1 - c_1 )\mu -e^2\), and \(\sigma _2 = (w - c - w_1 + c_1 )Q + (w_1 - c_1 )(e+\mu )-e^2\).

Since \(\sigma _1-\sigma _2=-w-v-w_1+c_1)(Q-e)<0\). Thus, we have

Obviously, \(\varUpsilon (\sigma )\) is left-continuous in \(\sigma \) at the point \(\sigma =\sigma _2\). And for any \(\delta >0\),we have

Thus, \(\varUpsilon (\sigma )\) is right-continuous in \(\sigma \) at the point \(\sigma =\sigma _2\), therefore, \(\varUpsilon (\sigma )\) is continuous in \(\sigma \) at the point \(\sigma =\sigma _2\).

Noting that, it holds \(\frac{{\partial \varUpsilon (\sigma )}}{{\partial \sigma }} <0\) for \(\sigma >\sigma _2\) and \(\frac{{\partial \varUpsilon (\sigma )}}{{\partial \sigma }} >0\) for \(\sigma \le \sigma _1\). Thus, for \(\sigma _1\le \sigma <\sigma _2\), there exists a point \(\sigma _0=(w-v-w_1+c_1)F^{-1}(\eta )+\sigma _1\) such that \(\frac{{\partial \varUpsilon (\sigma )}}{{\partial \sigma }}\mid _{\sigma =\sigma _0} =0\) and \(Q>F^{-1}(\eta )\). It follows that

Suppose \( \frac{{\partial \varUpsilon (\sigma )}}{{\partial \sigma }}\mid _{\sigma \rightarrow [\sigma _2 ]^ - } = 1 - \frac{1}{\eta }F(Q) \le 0 .\) Due to \(\frac{{\partial \varUpsilon (\sigma _0 )}}{{\partial Q}} = v - c < 0\), it holds the optimal order quantity \(Q_0^* = F^{ - 1} (\eta )\). However, this is contradictory to \(Q>F^{-1}(\eta )\). Hence, it holds \(\frac{{\partial \varUpsilon (\sigma )}}{{\partial \sigma }}>0\) for any \(\sigma _1\le \sigma <\sigma _2\), and therefore \(\sigma _{d}^* = (w - c - w_1 + c_1 )Q + (w_1 - c_1 )(e+\mu )-e^2\).

1.2 B. Proof of the existence and uniqueness of the optimal strategies for \(H_{d,i}^s\)

We consider the first-order and second-order subdeterminants of \(H_{d}^s\) as follows

According to the definition of the negative definite matrix, the Hessian matrix of \(H_{d}^s\) is negative definite with regard to Q and e. Thus, the first-order condition holds. Specifically, the optimal ordering quantity and optimal effort level satisfy Eq. (5).

1.3 C. Proof of Theorem 1

Take the first-order partial derivatives of both the two sides of the first equation of Eq. (5) regarding \(\eta \), \(w_1\), and \(c_1\), respectively. It yields

1.4 D. Proof of the existence of the supplier’s CVaR utility function with the RDCS contract

According to the description of CVaR, the supplier’s CVaR performance with the RDCS contract satisfies

where\(\sigma _3=[w-c-\lambda (w-v)]Q-\theta e^2+T+\lambda (w-v)e+(w_1-c_1)\mu \), and \(\sigma _4=(w-c-w_1+c_1)Q-\theta e^2-T+(w_1-c_1)(e+\mu )\).

The other proof is similar to proof of Lemma 1.

1.5 E. Proof of Theorem 2

Take the first-order partial derivatives of both the two sides of the first equation of Eq. (11) regarding \(\eta \), \(w_1\), and \(c_1\), respectively. It yields

1.6 F. Proof of Theorem 3

According to the definition of coordination, we let \(e_a^*=e_I^*\) and \(Q_a^*=Q_I^*\), then we have Eq. (12).

Obviously, \(\lambda ^*>\frac{w_1-c_1}{w-v}\) and \(\theta _a^*\in (0,1)\). Since \(\lambda ^*\le 1\), then \(\frac{\eta (w-c-w_1+c_1)(c_1-v)}{(w-v)(c_1-c)} + \frac{w_1 - c_1}{w-v} -1\le 0\), which leads to \(\eta \le 1\le \frac{(w-v-w_1+c_1)(c_1-c)}{(w-c-w_1+c_1)(c_1-v)} \).

That is, the supply chain can be coordinated by the RDECS contract for all \(\eta \in (0,1]\).

1.7 G. Proof of Theorem 4

If the RDCS contract achieves the Pareto improvement, then

Thus, we can obtain \(T\in [T_{\min },T_{\max }]\) by solving the previously presented equation set, where \(T_{\min }\) and \(T_{\max }\) satisfy Eq. (13).

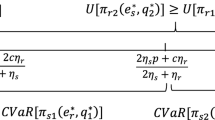

Noting that

Thus, only \(T_{\max }\ge T_{\min }\) holds, this coordinating contract achieves the Pareto improvement. Therefore, the risk aversion coefficient satisfies that

1.8 H. Proof of the existence of the supplier’s CVaR utility function with the OCS contract

According to the description of CVaR, the supplier’s CVaR performance with the OCS contract satisfies

where \(\sigma _5=(v-c+k)Q-\theta e^2+(o-v)e+(w_1-c_1)\mu \), and \(\sigma _6=(o-c+k-w_1+c_1)Q-\theta e^2+(w_1-c_1)(e+\mu )\).

The other proof is similar to proof of Lemma 1.

1.9 I. Proof of Theorem 5

Take the first-order partial derivatives of both the two sides of the first equation of Eq. (17) regarding \(\eta \), \(w_1\), and \(c_1\), respectively. It yields

1.10 J. Proof of Theorem 6

If the OCS contract can coordinate the supply chain, that is, \(e_\varepsilon ^*=e_I^*\) and \(Q_\varepsilon ^*=Q_I^*\), then we have

Obviously, \(\theta _\varepsilon ^*\in (0,1)\) due to \(p-o>k\) and \(o-c\ge w_1-c_1\). Note that \(c-v>k\) and \(p-o>k\), then \(\frac{c_1-c}{c_1-v}<\eta \le 1\) for \(p-c+v>o\).

If the coordinating OCS contract achieves the Pareto improvement, namely,

Then, we can obtain that \(o\in [o_{\min },o_{\max }]\), where

Thus, only \(o_{\max }\ge o_{\min }\), this coordinating OCS contract has a Pareto improvement, therefore the risk aversion \(\eta \) also satisfies that

1.11 K. Proof of the existence of the supplier’s CVaR utility function with the SCS contract

According to the description of CVaR, the supplier’s CVaR performance with the SCS contract satisfies

where \(\sigma _7=(v+b-c)Q-\theta e^2+(w_z-v-b)e+(w_1-c_1)\mu \), and \(\sigma _8=(w_z-c-w_1+c_1)Q-\theta e^2+(w_1-c_1)(e+\mu )\).

The other proof is similar to proof of Lemma 1.

1.12 L. Proof of Theorem 7

Take the first-order partial derivatives of both the two sides of the first equation of Eq. (21) regarding \(\eta \), \(w_1\), and \(c_1\), respectively. It yields

1.13 M. Proof of Theorem 8

If the SCS contract can coordinate the supply chain, that is, \(e_z^*=e_I^*\) and \(Q_z^*=Q_I^*\), then we have

Obviously, \(\theta _z^*\in (0,1)\) due to \(p>w>c\). Note that \(w_z-v>b^*>0\), then \(\eta \le 1\).

If the coordinating SCS contract achieves the Pareto improvement, namely,

Then, we can obtain that \(w_z\in [w_{z,\min },w_{z,\max }]\), where

Thus, only \(w_{z,\max }\ge w_{z,\min }\), this coordinating SCS contract has a Pareto improvement, therefore the risk aversion \(\eta \) also satisfies that

1.14 N. Proof of Theorem 9

First, we compare the OCS contract with the RDCS contract by setting the following equations

Then, combing with \(o\in [o_{\min },o_{\max }]\), we have

Thus, the following results hold. In the interval \([T_1,T_2]\), it holds that \(H_a^s\ge H_\varepsilon ^s\) and \(\pi _a^r\ge \pi _\varepsilon ^r\). However, \(H_a^s>H_\varepsilon ^s\) and \(\pi _a^r<\pi _\varepsilon ^r\) if \(T<T_1\); \(H_a^s<H_\varepsilon ^s\) and \(\pi _a^r>\pi _\varepsilon ^r\) if \(T>T_2\). Thus, only in interval \([T_1,T_2]\), both firms can earn a higher performance with a same contract between the OCS contract and the RDCS contract, i.e., both firms would adopt a same contract, namely the RDCS contract, only if \(T\in [T_1,T_2]\).

Second, we compare the SCS contract with the RDCS contract by setting the following expressions

Then, combing with \(w_z\in [w_{z,\min },w_{z,\max }]\), we have

Thus, the following results hold. In the interval \([T_3,T_4]\), it holds that \(H_a^s\ge H_z^s\) and \(\pi _a^r\ge \pi _z^r\). However, \(H_a^s>H_z^s\) and \(\pi _a^r<\pi _z^r\) if \(T<T_3\); \(H_a^s<H_z^s\) and \(\pi _a^r>\pi _z^r\) if \(T>T_4\). Thus, only in interval \([T_3,T_4]\), both firms can earn a higher performance with a same contract between the SCS contract and the RDCS contract, i.e., both firms would adopt a same contract, namely the RDCS contract, only if \(T\in [T_3,T_4]\).

Rights and permissions

About this article

Cite this article

Liu, J., Huang, F. & Ma, C. Coordination of VMI supply chain with replenishment tactic under risk aversion and sales effort. 4OR-Q J Oper Res 19, 389–414 (2021). https://doi.org/10.1007/s10288-020-00450-1

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10288-020-00450-1