Abstract

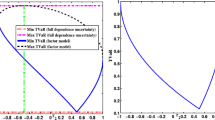

We study portfolio credit risk management using factor models, with a focus on optimal portfolio selection based on the tradeoff of expected return and credit risk. We begin with a discussion of factor models and their known analytic properties, paying particular attention to the asymptotic limit of a large, finely grained portfolio. We recall prior results on the convergence of risk measures in this “large portfolio approximation” which are important for credit risk optimization. We then show how the results on the large portfolio approximation can be used to reduce significantly the computational effort required for credit risk optimization. For example, when determining the fraction of capital to be assigned to particular ratings classes, it is sufficient to solve the optimization problem for the large portfolio approximation, rather than for the actual portfolio. This dramatically reduces the dimensionality of the problem, and the amount of computation required for its solution. Numerical results illustrating the application of this principle are also presented.

Similar content being viewed by others

References

Anderson, F., H. Mausser, D. Rosen, and S. Uryasev. (2001). “Credit Risk Optimization with Conditional Value-at-Risk Criterion.” Mathematical Programming, Series B 89, 273–291.

Artzner, P., F. Delbaen, J.M. Eber, and D. Heath. (1999). “Coherent Measures of Risk.” Mathematical Finance, 9(3), 203–228.

Basel Committee on Banking Supervision. (1999). “Credit Risk Modelling: Current Practices and Applications.” Technical report, Bank for International Settlements.

Basel Committee on Banking Supervision. (2004). “International Convergence of Capital Measurement and Capital Standards: A Revised Framework.” Technical report, Bank for International Settlements. Available at http://www.bis.org/publ/bcbs107.pdf.

Bielecki, T. and M. Rutkowski. (2001). Credit Risk: Modelling, Valuation and Hedging. Springer.

Chow, Y. and H. Teicher. (1997). Probability Theory: Independence, Interchangeability, Martingales, 3rd edition. Springer.

Crouhy, M., D. Galai, and R. Mark. (2000). “A Comparative Analysis of Current Credit Risk Models.” Journal of Banking and Finance, 24, 57–115.

Crouhy, M., D. Galai, and R. Mark. (2001). Risk Management. McGraw-Hill.

Delbaen, F. (2002). “Coherent Risk Measures on General Probability Spaces.” In K. Sandmann and P. Schönbucher (eds.), Advances in Finance and Stochastics. pp. 1–37. Springer,

Dembo, A., J. Deuschel, and D. Duffie. (2004). “Large Portfolio Losses.” Finance and Stochastics, 8(1), 3–16.

Denault, M. (2001). “Coherent Allocation of Risk Capital.” Journal of Risk, 4(1), 1–34.

Duffie, D. and K. Singleton. (2003). Credit Risk. Princeton University Press.

Düllman, K. and H. Scheule. (2003). “Asset Correlation of German Corporate Obligors: Its Estimation, its Drivers and Implications for Regulatory Capital.” Preprint.

Embrechts, P., A. McNeil, and D. Straumann. (2002). “Correlation and Dependence in Risk Management: Properties and Pitfalls.” In M. Dempster (ed.), Risk Management: Value at Risk and Beyond. pp. 176–223. Cambridge University Press,

Finger, C. (1999). “Conditional Approaches for CreditMetrics Portfolio Distributions.” CreditMetrics Monitor, 14–33.

Finkelstein, V., G. Pan, J. Lardy, T. Ta, and J. Tierney. (2002). “CreditGrades Technical Document.” Available at: www.creditgrades.com.

Frey, R. and A. McNeil. (2003). “Dependent Defaults in Models of Portfolio Credit Risk.” Journal of Risk, 6(1), 59–92.

Frey, R. and A.J. McNeil. (2001). “Modelling Dependent Defaults.” Technical report, Department of Mathematics, ETH Zürich. Available at: http://www.math.ethz.ch~mcneil/pub_list.html.

Giesecke, K. (2004). “Correlated Default with Incomplete Information.” To appear, Journal of Banking and Finance. Available at: www.orie.cornell.edu~giesecke/research.htm.

Giesecke, K. and S. Weber. (2004). “Cyclical Correlations, Credit Contagion, and Portfolio Losses.” To appear, Journal of Banking and Finance. Available at: www.orie.cornell.edu~giesecke/research.htm.

Gordy, M. (2003). “A Risk-factor Model Foundation for Ratings-based Bank Capital Rules.” Journal of Financial Intermediation, 12, 199–232.

Gordy, M. (2004). “Granularity Adjustments in Portfolio Credit Risk Measurment.” In G. Szegö (ed.), Risk Measures for the 21st Centurty. pp. 109–121. John Wiley & Sons,

Hall, P. and C.C. Heyde. (1980). Martingale Limit Theory and Its Applications. New York: Academic Press.

Helland, I. (1982). “Central Limit Theorems for Martingales with Discrete or Continuous Time.” Scandinavian Journal of Statisitics, 9, 79–94.

Kallenberg, O. (2001). Foundations of Modern Probability, 2nd edition. New York, Berlin, Heidelberg: Springer.

Kealhofer, S. and J.R. Bohn. (2001). “Portfolio Management of Default Risk.” Technical Document, KMV Corporation.

Kealhofer, S., S. Kwok, and W. Weng. (1998). “Uses and Abuses of Bond Default Rates.” Technical report, KMV Corporation, San Francisco.

Koyluoglu, H.U. and A. Hickman. (1998). “A Generalized Framework for Credit Risk Portfolio Models.” Working Paper, “DefaultRisk.com”.

Lucas, A., P. Klaassen, P. Spreij, and S. Straetmans. (2001). “An Analytic Approach to Credit Risk of Large Corporate Bond and Loan Portfolios.” Journal of Banking and Finance, 25(9), 1635–1664.

Martin, R. and T. Wilde. (2002). “Unsystematic Credit Risk.” Risk, 15(11), 123–128.

Mausser, H. and D. Rosen. (2001). “Applying Scenario Optimization to Portfolio Credit Risk.” Journal of Risk Finance, 2(2), 36–48.

Merino, S. and M. Nyfeler (2002). “Calculating Portfolio Loss.” Risk, 82–86.

Merton, R.C. (1974). “On the Pricing of Corporate Debt: The Risk Structure of Interest Rates.” Journal of Finance, 29, 449–470.

Pflug, G.C. (2003). “Stochastic Optimization and Statistical Inference.” In A. Shapiro and A. Ruszczynski (eds.), Stochastic Programming, volume 10 of Handbooks in Operations Research and Management Science, pp. 427–482. Elsevier,

Rockafellar, R.T. and S. Uryasev. (2000). “Optimization of Conditional Value-at-Risk.” The Journal of Risk, 2(3), 21–41.

Rockafellar, R.T. and S. Uryasev. (2002). “Conditional Value-at-Risk for General Distributions.” Journal of Banking and Finance, 26(7), 1443–1471.

Rockafellar, R.T. and R.J.-B. Wets. (1998). Variational Analysis. New York, Berlin, Heidelberg: Springer.

Rogge, E. and P. Schönbucher. (2003). “Modelling Dynamic Portfolio Credit Risk.” Available at: www.schonbucher.de/papers.

Römisch, W. (2003). “Stability of Stochastic Programming Problem.” In A. Shapiro and A. Ruszczynski (eds.), Stochastic Programming, volume 10 of Handbooks in Operations Research and Management Science. pp. 483–554. Elsevier,

Saunders, D., C. Xiouros, and S.A. Zenios. (2002). “Portfolio Credit Risk for a Cypriot Commercial Bank.” Technical report, HERMES European Center of Excellence on Computational Finance and Economics. Working Paper 02-11.

Schönbucher, P.J. (2000). “Factor Models for Portfolio Credit Risk.” Working Paper, Department of Statistics, Bonn University.

Schönbucher, P.J. (2002). “Taken To The Limit: Simple and Not So Simple Loan Loss Distributions.” Working Paper, Department of Statistics, Bonn University.

Schönbucher, P.J. and D. Schubert. (2001). “Copula-dependent Default Risk in Intensity Models.” Technical report, Department of Statistics, Bonn University. Working Paper.

Standard & Poor’s. (1999). “Standard & Poor’s Rating Performance 1998.” Technical report, S&P New York.

Tasche, D. (1999). “Risk Contributions and Performance Measurement.” Working Paper, Technische Universität München.

Tasche, D. (2002). “Expected Shortfall and Beyond.” Journal of Banking and Finance, 26, 1519–1533.

Vasicek, O. (1987). “The Loan Loss Distribution.” Technical Document, KMV Corporation, San Fransisco.

Wilde, T. (2001). “Probing Granularity.” Risk, 14(8), 103–106.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification G11

Rights and permissions

About this article

Cite this article

Saunders, D., Xiouros, C. & Zenios, S.A. Credit risk optimization using factor models. Ann Oper Res 152, 49–77 (2007). https://doi.org/10.1007/s10479-006-0136-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-006-0136-2