Abstract

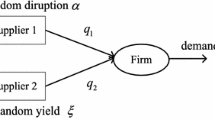

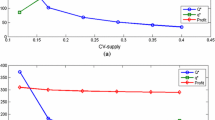

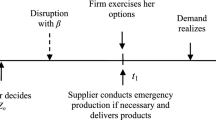

We consider a firm that procures a product from a regular supplier whose production is subject to both supply disruption and random yield risks and a backup supplier whose production capacity requires reservation in advance. Under both deterministic and stochastic demand, we study the impact of the two types of supply risks on the firm’s optimal procurement decisions and the importance of correctly identifying the source of supply risks. We find that if the overall supply risk is unchanged but its main source shifts from random yield to supply disruption, the firm should order more from the regular supplier and reserve less capacity from the backup supplier. Ignoring the existence of supply disruption leads to under-utilization of the regular supplier and over-utilization of the backup supplier. Moreover, we examine the option value of the reserved capacity that is affected by the uncertainty of customer demand. We find that the option value increases/decreases in demand uncertainty if the reservation capacity is exercised after/before demand is realized.

Similar content being viewed by others

References

Babich, V., Burnetas, A., & Ritchken, P. (2007). Competition and diversification effects in supply chains with supplier default risk. Manufacturing & Service Operations Management, 9(2), 123–146.

Barnes-Schuster, D., Bassok, Y., & Anupindi, R. (2002). Coordination and flexibility in supply contracts with options. Manufacturing & Service Operations Management, 4(3), 171–207.

Birge, J. R., & Louveaux, F. V. (1997). Introduction to stochastic programming. Berlin: Springer.

Bojanowski, A., Briseno, C., & EI-Sharif, Y. (2010). Flight chaos post-mortem: Europe’s airlines prepare for next gloom plume. In Spiegel online. 23 April 2010.

Bradsher, K. (2010). Strike forces honda to shut plants in China. In The New York times. 27 May 2010.

Chopra, S., Reinhardt, G., & Mohan, U. (2007). The importance of decoupling recurrent and disruption risks in a supply chain. Naval Research Logistics, 54(5), 544–555.

Cooper, W., Donnelly, J., & Johnson, R. (2011). Japan’s 2011 earthquake and tsunami: economic effects and implications for the united states. In Congressional research service.

Dada, M., Petruzzi, N. C., & Schwarz, L. B. (2007). A newsvendor’s procurement problem when suppliers are unreliable. Manufacturing & Service Operations Management, 9(1), 9–32.

Derman, C. (1962). On sequential decisions and Markov chains. Management Science, 9(1), 16–24.

Derman, C. (1970). Finite state Markovian decision processes. San Diego: Academic Press

Federgruen, A., & Yang, N. (2008). Selecting a portfolio of suppliers under demand and supply risks. Operations Research, 56(4), 916–936.

He, Y., & Zhang, J. (2008). Random yield risk sharing in a two-level supply chain. International Journal of Production Economics, 112(2), 769–781.

Kall, P., & Wallace, S. W. (1994). Stochastic programming. New York: Wiley.

Kaut, M., Vladimirou, H., Wallace, S. W., & Zenios, S. A. (2007). Stability analysis of portfolio management with conditional value-at-risk. Quantitative Finance, 7(4), 397–409.

Li, J., Wang, S., & Cheng, T. (2009). Competition and cooperation in a single-retailer two-supplier supply chain with supply disruption. International Journal of Production Economics, 124(1), 137–150.

Mas-Colell, A., Whinston, M. D., & Green, J. (1995). Microeconomic theory. New York: Oxford University Press.

Qi, L., & Shen, Z. (2007). A supply chain design model with unreliable supply. Naval Research Logistics, 54(8), 829–844.

Sarkar, A., & Mohapatra, P. (2009). Determining the optimal size of supply base with the consideration of risks of supply disruptions. International Journal of Production Economics, 119(1), 122–135.

Sounderpandian, J., Prasad, S., & Madan, M. (2008). Supplies from developing countries: optimal order quantities under loss risks. Omega, 36(1), 122–130.

Tang, C., & Tomlin, B. (2008). The power of flexibility for mitigating supply chain risks. International Journal of Production Economics, 116(1), 12–27.

Tang, C. S., & Yin, R. (2007). Responsive pricing under supply uncertainty. European Journal of Operational Research, 182(1), 239–255.

Tomlin, B. (2006). On the value of mitigation and contingency strategies for managing supply chain disruption risks. Management Science, 52(5), 639–657.

Tomlin, B. (2009). Disruption-management strategies for short life-cycle products. Naval Research Logistics, 56(4), 318–347.

Tomlin, B., & Wang, Y. (2005). On the value of mix flexibility and dual sourcing in unreliable newsvendor networks. Manufacturing & Service Operations Management, 7(1), 37–57.

Topkis, D. M. (1998). Supermodularity and complementarity. Princeton: Princeton University Press.

Wang, Y., Gilland, W., & Tomlin, B. (2010). Mitigating supply risk: dual sourcing or process improvement? Manufacturing & Service Operations Management, 12(3), 489–510.

Xu, N., & Nozick, L. (2009). Modeling supplier selection and the use of option contracts for global supply chain design. Computers & Operations Research, 36(10), 2786–2800.

Yang, S., Yang, J., & Abdel-Malek, L. (2007). Sourcing with random yields and stochastic demand: a newsvendor approach. Computers & Operations Research, 34(12), 3682–3690.

Yu, H., Zeng, A., & Zhao, L. (2009). Single or dual sourcing: decision-making in the presence of supply chain disruption risks. Omega, 37(4), 788–800.

Acknowledgements

The first two authors acknowledge the support of the National Natural Science Foundation of China under projects Nos. 70771053 and 71031005.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 A.1 Proof of propositions

Proof of Proposition 1

Notice that if x r =0, by (8), we have the profit function \(\pi(0,x_{k})=\lim_{x_{r}\rightarrow 0}\pi(x_{r},x_{k})=(p-c_{e})x_{k}-l(d-x_{k})-c_{k}x_{k}=(p+l-c_{e}-c_{k})x_{k}-ld\), where x k ∈[0,d]. Hence, \(x_{k}^{*}(0)=d\) if p+l>c e +c k ; otherwise, \(x_{k}^{*}(0)=0\). If x r >0, then we have

where the last equality follows from \(F(x\mid x_{r})=q+(1-q)G(\frac{x}{x_{r}})\) and integration by parts. Thus,

Since l+p>c e , π(x r ,x k ) is concave in x k . Also note that \(\frac{\partial \pi(x_{r},x_{k})}{\partial x_{k}}\) is decreasing in x r , but increasing in q. If G 1≤ st G 2, then G 1(ξ)≥G 2(ξ), where ξ≥0. Hence, \(\frac{\partial \pi(x_{r},x_{k})}{\partial x_{k}}\) is decreasing in G. By Theorem 2.8.2 of Topkis (1998), the claims hold. □

Proof of Proposition 2

By (13) we have \(\frac{\partial^{2} \pi(x_{r},x_{k})}{\partial x_{k}\partial x_{r}}\leq 0\). This implies that π(x r ,x k ) is submodular in (x r ,x k ). Notice that \(\frac{\partial \pi(x_{r},x_{k})}{\partial x_{k}}\) is increasing in q. By (12), we have

Hence, \(\frac{\partial \pi(x_{r},x_{k})}{\partial x_{r}}\) is decreasing in q. By Theorem 2.8.2 of Topkis (1998), the claim holds. □

Proof of Proposition 3

Given deterministic demand d, the optimal decision must satisfies: \(x_{r}^{\ast }\in [ 0,\frac{d}{\delta } ] \), \(x_{k}^{\ast }\in [ 0,d ] \), and \(x_{r}^{\ast }+x_{k}^{\ast }\geq d\). The firm’s expected profit is

For given x r ,

Since p+l−c e >0, \(\frac{\partial \pi ( x_{r},x_{k} ) }{\partial x_{k}}\) is decreasing in x k . If (q+(1−q)q r )(p+l−c e )<c k , then \(x_{k}^{\ast } ( x_{r} ) =0\). Else if (q+(1−q)q r )(p+l−c e )≥c k ≥q(p+l−c e ), then \(x_{k}^{\ast } ( x_{r} ) =d-\delta x_{r}\). Else, c k <q(p+l−c e ) and \(x_{k}^{\ast } ( x_{r} ) =d\). This completes the proof of Claim (1).

For c k ∈[q(p+l−c e ),(q+(1−q)q r )(p+l−c e )], since \(x_{k}^{\ast } ( x_{r} ) =d-\delta x_{r}\), the expected profit in (14) can be rewritten as

which is a piecewise linear function of x r . Since

\(x_{r}^{\ast }\in \{ 0,d,\frac{d}{\delta } \} \). By \(x_{k}^{\ast } ( x_{r} ) =d-\delta x_{r}\) we have \(( x_{r}^{\ast },x_{k}^{\ast } ) \in \{ ( 0,d ) , ( d, ( 1-\delta ) d ) , ( \frac{d}{\delta },0 ) \} \). This completes the proof of Claim (2).

When \(( x_{r}^{\ast },x_{k}^{\ast } ) = ( d, ( 1-\delta ) d ) \), here we show \(x_{k}^{\ast }\) is decreasing in q within set \(A_{\mu ,\sigma ^{2}}\) by showing δ(q) is increasing in q. According to the definition of \(A_{\mu,\sigma^{2}}\) in (10), any given risk type (q,δ(q),q r (q)) within set \(A_{\mu ,\sigma ^{2}}\) satisfies \(\delta(q)= \frac{\mu(1-\mu)-\sigma^{2}}{1-\mu-q}\) and q r (q)= \(\frac{1-\mu -q}{ ( 1-q ) ( 1-\delta ) }\). By some algebra, we have

Thus, in order to keep q r >0 we need q<1−μ. By the implicit function theorem and (15) we have \(\frac{d\delta }{dq}=\frac{\delta }{1-\mu -q}\). Thus, \(\frac{d\delta }{dq}>0\). This completes the proof of Claim (3). □

Proof of Proposition 4

When \(x_{r}^{\ast }>0\) and \(x_{k}^{*}\in(0,d)\) the optimal solution \(( x_{r}^{\ast },x_{k}^{\ast } ) \) is obtained by solving a first order condition J(x r )=0 and \(x_{k}^{\ast }=d-y^{\ast }x_{r}^{\ast }\), where \(y^{*}=G^{-1}(1-\frac{l+p-c_{e}-c_{k}}{(l+p-c_{e})(1-q)})\) (see Sect. A.2 for details of J(x r ) and the procedure of solving for the optimal solution). With random yield that follows uniform distribution on [γ−δ,γ+δ], we have \(y^{\ast }=2\delta ( 1-\frac{l+p-c_{e}-c_{k}}{ ( l+p-c_{e} ) ( 1-q ) } ) + ( \gamma -\delta ) \), and

First, we show \(\frac{dx_{r}^{\ast } ( q ) }{dq}>0\). The first term in (16), c(q,G), is defined as c(q,G)=s(1−q)E[ξ r ]−(λ+(1−λ)(1−q)E[ξ r ])c r . Since \(E [ \xi _{r} ] =\gamma ( q ) =\frac{\mu }{1-q}\), c(q,G)=sμ−(λ+(1−λ)μ)c r . Thus, within set \(A_{\mu ,\sigma ^{2}}\), c(q,G) is independent of q for all λ∈[0,1]. Based on (16), \(J ( x_{r}^{\ast } ( q ) ) =0\), and the implicit function theorem, we have

By some algebra, we have

Since c e >s and δ>0, the necessary and sufficient condition for \(\frac{dx_{r}^{\ast} ( q ) }{dq}>0\) is

Now we show: if \(1/2<v<\frac{\mu }{2\sqrt{3}\sigma }\), then there exists \(\hat{q}\in [ 0,1 ] \) such that for \(q\in ( 0,\hat{q} ) \) inequality (17) holds and \(\frac{dx_{r}^{\ast } ( q ) }{dq}>0\). More specifically, we show: (a) \(\delta + ( 1-q ) \frac{d\delta }{dq}<0\), (b) \(\frac{dy^{\ast } ( q ) }{dq}>0\). Since l+p−c e >0 and c e −s>0, Claims (a) and (b) imply that each of the terms in the left-hand side of inequality (17) is positive, and therefore the inequality holds and \(\frac{dx_{r}^{\ast } ( q ) }{dq}>0\).

Proof of (a) By definition of δ(q), we have

By some algebra, we have

Thus, \(\delta + ( 1-q ) \frac{d\delta }{dq}<0\) if and only if \(( 3q+1 ) ( 1+\frac{\mu ^{2}}{\sigma ^{2}} ) >4\), which is true since \(\mu >\sqrt{3}\sigma \) and 3q+1>1.

Proof of (b) By the definition of γ(q), we have

According to the definition of y ∗ and v,

Thus,

Since \(\mu >\sqrt{3}\sigma \), \(2- ( q+1 ) ( 1+\frac{\mu ^{2}}{\sigma ^{2}} ) <0\). To show \(\frac{dy^{\ast } ( q ) }{dq}>0\), sufficient conditions are

Condition (C1) holds since \(v>\frac{1}{2}\) implies \(\frac{2v}{ ( 1-q ) }>1\) for all q∈[0,1]. By the definition of δ(q), condition (C2) is equivalent to

The left-hand side of above inequality is a convex function of q and is equal to \(\frac{\mu ^{2}}{12v^{2}\sigma ^{2}}\) when q=0. The right-hand side of above inequality is a linear function of q with negative slope and is equal to 1 at q=0. Together with \(\mu >2\sqrt{3}\sigma v\) that implies \(\frac{\mu ^{2}}{12v^{2}\sigma ^{2}}>1\), there exists \(\hat{q}\in [ 0,1 ] \) such that for \(q\in ( 0,\hat{q} ) \) condition (C2) holds. This completes the proof of \(\frac{dx_{r}^{\ast } ( q ) }{dq}>0\).

Now we show \(\frac{dx_{k}^{\ast } ( q ) }{dq}<0\) under the given condition. This is a direct implication of \(\frac{dy^{\ast } ( q ) }{dq}>0\) and \(\frac{dx_{r}^{\ast } ( q ) }{dq}>0\) as \(x_{k}^{\ast }=d-y^{\ast }x_{r}^{\ast }\). □

1.2 A.2 Optimal procurement decisions when demand is deterministic

First, we solve for the optimal level of reserved capacity \(x_{k}^{*}(x_{r})\) given the quantity x r ordered from the regular supplier. Notice that if x r =0, by (8), we have the profit function \(\pi(0,x_{k})=\lim_{x_{r}\rightarrow 0}\pi(x_{r},x_{k})=(p-c_{e})x_{k}-l(d-x_{k})-c_{k}x_{k}=(p+l-c_{e}-c_{k})x_{k}-ld\), where x k ∈[0,d]. Hence, \(x_{k}^{*}(0)=d\) if p+l>c e +c k ; otherwise, \(x_{k}^{*}(0)=0\). If x r >0, then we have \(\frac{\partial \pi(x_{r},x_{k})}{\partial x_{k}}=(l+p-c_{e})q-c_{k}+(l+p-c_{e})(1-q)G(\frac{d-x_{k}}{x_{r}})\), where \(F(\cdot\mid x_{r})=q+(1-q)G(\frac{\cdot}{x_{r}})\). Since l+p>c e , π(x r ,x k ) is concave in x k . Hence, we have the optimal reservation capacity

We let the firm’s optimal profit be \(\pi^{*}(x_{r})=\pi(x_{r},x_{k}^{*}(x_{r}))\). Finally, we solve for the optimal order quantity from the regular supplier \(x_{r}^{*}\). By (8) and (20) and the envelope theorem (see, e.g., p. 964 Mas-Colell et al. 1995), we have

where c(q,G)=s(1−q)E[ξ r ]−(λ+(1−λ)(1−q)E[ξ r ])c r and the last equation follows from \(\int_{0}^{y}G(\xi)d\xi-yG(y)=-\int_{0}^{y}\xi g(\xi)d\xi\). By (20) and (21), we have

where \(y^{*}=G^{-1}(1-\frac{l+p-c_{e}-c_{k}}{(l+p-c_{e})(1-q)})\).

Since we assume c(q,G)<0, by (22) we have three cases that depend on the cost of reserving capacity from the backup supplier.

- Case 1 (\(\frac{c_{k}}{l+p-c_{e}}\leq q\))::

-

The optimal order quantity from the regular supplier is \(x_{r}^{*}= \inf\{x_{r}\geq 0\mid c(q,G)+(c_{e}-s)(1-q)\int_{0}^{\frac{d}{x_{r}}}\xi g(\xi)d\xi\leq 0\}\). If c e (1−q)E[ξ r ]<(λ+(1−λ)(1−q)E[ξ r ])c r , then \(x_{r}^{*}=0\). Otherwise, \(x_{r}^{*}\) is the unique solution of \(c(q,G)+(c_{e}-s)(1-q)\int_{0}^{\frac{d}{x_{r}}}\xi g(\xi)d\xi=0\). By (20), the optimal level of reserved capacity from the backup supplier is \(x_{k}^{*}=x_{k}^{*}(x_{r}^{*})=d\). The firm reserves d units of capacity to satisfy all customer demand from the backup supplier, since the reservation cost (c k ) is low.

- Case 2 (\(\frac{c_{k}}{l+p-c_{e}}\geq 1\))::

-

The optimal order quantity from the regular supplier is \(x_{r}^{*}= \inf\{x_{r}\geq 0\mid c(q,G)+(l+p-s)(1-q)\int_{0}^{\frac{d}{x_{r}}}\xi g(\xi)d\xi\leq 0\}\). If (l+p)(1−q)E[ξ r ]<(λ+(1−λ)(1−q)E[ξ r ])c r , then \(x_{r}^{*}=0\). Otherwise, \(x_{r}^{*}\) is the unique solution of \(c(q,G)+(l+p-s)(1-q)\int_{0}^{\frac{d}{x_{r}}}\xi g(\xi)d\xi=0\). By (20), the optimal level of reserved capacity from the backup supplier is \(x_{k}^{*}=x_{k}^{*}(x_{r}^{*})=0\). The firm reserves zero capacity from the backup supplier, since the reservation cost (c k ) is high.

- Case 3 (\(q<\frac{c_{k}}{l+p-c_{e}}<1\))::

-

By (22), we have \(\frac{d\pi^{*}(x_{r})}{dx_{r}}=J(x_{r})\), where

$$ J(x_r)= \left \{ \begin{array}{l} c(q,G)+(l+p-c_e)(1-q)\int_0^{y^*}\xi g(\xi)d\xi\\ \quad{}+(c_e-s)(1-q)\int_0^{\frac{d}{x_r}}\xi g(\xi)d\xi,\quad \hbox{if $x_{r}<\frac{d}{y^{*}}$;} \\ c(q,G)+(l+p-s)(1-q)\int_0^{\frac{d}{x_r}}\xi g(\xi)d\xi,\quad \hbox{if $x_{r}\geq \frac{d}{y^{*}}$.} \end{array} \right . $$(23)Since J(x r ) is decreasing in x r , π ∗(x r ) is concave in x r . The optimal order quantity from the regular supplier is \(x_{r}^{*}=\inf\{x_{r}\geq 0\mid J(x_{r})\leq 0\}\). If \(c_{e}(1-q)E[\xi_{r}]+ (l+p-c_{e})(1-q)\int_{0}^{y^{*}}\xi g(\xi)d\xi<(\lambda+(1-\lambda)(1-q)E[\xi_{r}])c_{r}\), then \(x_{r}^{*}=0\).

If the regular supplier’s random yield ξ r follows a uniform distribution on [γ−δ,γ+δ], then we have a closed form solution of \(x_{r}^{*}\). Notice that E[ξ r ]=γ and \(\operatorname{Var}[\xi_{r}]=\frac{\delta^{2}}{3}\).

- Case 1 (\(\frac{c_{k}}{l+p-c_{e}}\leq q\))::

-

In this case, we have \(x_{k}^{*}=d\). If c e (1−q)γ<(λ+(1−λ)(1−q)γ)c r , then \(x_{r}^{*}=0\). Otherwise, \(x_{r}^{*}=d/\sqrt{\frac{-4c(q,G)\delta}{(c_{e}-s)(1-q)}+(\gamma-\delta)^{2}}\).

- Case 2 (\(\frac{c_{k}}{l+p-c_{e}}\geq 1\))::

-

In this case, we have \(x_{k}^{*}=0\). If \((l+p)(1-q)\gamma<(\lambda+(1-\lambda) (1-q)\gamma)c_{r}\), then \(x_{r}^{*}=0\). Otherwise, \(x_{r}^{*}=d/\sqrt{\frac{-4c(q,G)\delta}{(l+p-s)(1-q)}+(\gamma-\delta)^{2}}\).

- Case 3 (\(q<\frac{c_{k}}{l+p-c_{e}}<1\))::

-

Notice that \(y^{*}=\gamma-\delta+2\delta\frac{c_{k}-q(l+p-c_{e})}{(l+p-c_{e})(1-q)}\) and \(\int_{\gamma-\delta}^{y^{*}}\xi g(\xi)d\xi=\frac{c_{k}-q(l+p-c_{e})}{(l+p-c_{e})(1-q)} [\gamma-\frac{\delta(l+p-c_{e}-c_{k})}{(l+p-c_{e})(1-q)} ]\).

-

If \(c_{e}(1-q)\gamma+[c_{k}-q(l+p-c_{e})] [\gamma-\frac{\delta(l+p-c_{e}-c_{k})}{(l+p-c_{e})(1-q)} ]<(\lambda+(1-\lambda)(1-q)\gamma)c_{r}\), then \(x_{r}^{*}=0\) and \(x_{k}^{*}=d\).

-

If \(s(1-q)\gamma+[c_{k}-q(l+p-c_{e})] [\gamma-\frac{\delta(l+p-c_{e}-c_{k})}{(l+p-c_{e})(1-q)} ]\frac{l+p-s}{l+p-c_{e}} >(\lambda+(1-\lambda) (1-q)\gamma)c_{r}\), then \(x_{r}^{*}=d/\sqrt{\frac{-4c(q,G)\delta}{(l+p-s)(1-q)}+(\gamma-\delta)^{2}}\) and \(x_{k}^{*}=0\).

-

Otherwise, \(x_{r}^{*}=d/\{\{-4c(q,G)\delta -4\delta[c_{k}-q(l+p-c_{e})] [\gamma-\frac{\delta(l+p-c_{e}-c_{k})}{(l+p-c_{e})(1-q)} ]\}/ \{(c_{e}-s)(1-q)\}+(\gamma-\delta)^{2}\}^{1/2}\) and \(x_{k}^{*}=d-x_{r}^{*}y^{*}\).

-

Rights and permissions

About this article

Cite this article

Guo, S., Zhao, L. & Xu, X. Impact of supply risks on procurement decisions. Ann Oper Res 241, 411–430 (2016). https://doi.org/10.1007/s10479-013-1422-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1422-4