Abstract

Prior literature has shown that retailer ex ante sharing imperfect demand information hurts the retailer, benefits the manufacturer and reduces the total profit of the supply chain. This paper extends the investigation of information sharing to the context where the manufacturer may have encroachment capability and may face production diseconomy or economy. We find that, when not considering the manufacturer’s production cost, manufacturer encroachment encourages the retailer to share demand information with manufacturer and improves the supply chain performance. As information sharing in this scenario does not hurt the retailer but do benefit the manufacturer, thus making the supply chain better off. In addition, the manufacturer may have an incentive to encourage the retailer to improve the demand forecast accuracy. When the manufacturer encroaches and faces production diseconomy, information sharing benefits the retailer and it benefits the manufacturer and the supply chain on condition that production diseconomy is relatively small. When either the demand becomes more variable or the demand signal of the retailer becomes more accurate, the retailer benefits more from information sharing. When the manufacturer encroaches and faces production economy, information sharing hurts the retailer. And it benefits the manufacturer and the supply chain if the production economy is relatively small. Furthermore, for either production diseconomy or economy, information sharing improves the manufacturer profit and the supply chain performance if and only if the demand signal is very accurate and demand variable is relatively large.

Similar content being viewed by others

References

Amornpetchkul, T., Duenyas, I., & Sahin, O. (2015). Mechanisms to induce buyer forecasting: Do suppliers always benefit from better forecasting? Production and Operations Management, 24(11), 1724–1749.

Anand, K. S., & Mendelson, H. (1997). Information and organization for horizontal multimarket coordination. Management Science, 43(12), 1609–1627.

Arya, A., Mittendorf, B., & Sappington, D. E. (2007). The bright side of supplier encroachment. Marketing Science, 26(5), 651–659.

Balakrishnan, A., & Geunes, J. (2000). Requirements planning with substitutions: Exploiting bill-of-materials flexibility in production planning. Manufacturing and Service Operations Management, 2(2), 166–185.

Cachon, G. P., & Lariviere, M. A. (2001). Contracting to assure supply: How to share demand forecasts in a supply chain. Management Science, 47(5), 629–646.

Clarke, R. N. (1983). Collusion and incentives for information sharing. Bell Journal of Economics, 14, 383–394.

Donohue, K. L. (2000). Efficient supply contracts for fashion goods with forecast updating and two production modes. Management Science, 46(11), 1397–1411.

Eliashberg, J., & Steinberg, R. (1991). Competitive strategies for two firms with asymmetric production cost structures. Management Science, 37(11), 1452–1473.

Emmons, H., & Gilbert, S. M. (1998). The role of returns policies in pricing and inventory decisions for catalogue goods. Management Science, 44(2), 276–283.

Ericson, W. A. (1969). A note on the posterior mean of a population mean. Journal of the Royal Statistical Society, 31(2), 332–334.

Froeb, L., & McCann, B. (2009). Managerial economics: A problem solving approach. Independence, KY: South-Western Cengage Learning.

Ha, A., Tong, S., & Zhang, H. (2011). Sharing imperfect demand information in competing supply chains with production diseconomies. Management Science, 57(3), 566–581.

Keifer, S. (2010). Beyond point of sale data: Looking forward, not backwards for demand forecasting. White paper. Middlesex, UK: GXS.

Kreps, D. (1990). A course in microeconomic theory. Princeton, NJ: Princeton University Press.

Kudyba, S., & Diwan, R. (2002). Research report: Increasing returns to information technology. Information Systems Research, 13(1), 104–111.

Lariviere, M. A., & Porteus, E. L. (2001). Selling to the newsvendor: An analysis of price-only contracts. Manufacturing and Service Operations Management, 3(4), 293–305.

Lee, H. L., So, K. C., & Tang, C. S. (2000). The value of information sharing in a two-level supply chain. Management Science, 46(5), 626–643.

Lee, H. L., & Whang, S. (2000). Information sharing in a supply chain. International Journal of Manufacturing Technology and Management, 1(1), 79–93.

Li, L. (1985). Cournot oligopoly with information sharing. Rand Journal of Economics, 16(4), 521–536.

Li, L. (2002). Information sharing in a supply chain with horizontal competition. Management Science, 48(9), 1196–1212.

Li, L., & Zhang, H. (2002). Supply chain information sharing in a competitive environment. In J. S. Song & D. D. Yao (Eds.), Supply chain structures: Coordination, information and optimization (pp. 161–201). Norwell, MA: Kluwer Academic Publishers.

Li, L., & Zhang, H. (2008). Confidentiality and information sharing in supply chain coordination. Management Science, 54(8), 1467–1481.

Li, Q., Li, B., Chen, P., & Hou, P. (2015). Dual-channel supply chain decisions under asymmetric information with a risk-averse retailer. Annals of Operations Research. https://doi.org/10.1007/s10479-015-1852-2.

Li, T., & Zhang, H. (2015). Information sharing in a supply chain with a make-to-stock manufacturer. Omega-The International Journal of Management Science, 50, 115–125.

Li, Z., Gilbert, S. M., & Lai, G. (2014). Supplier encroachment under asymmetric information. Management Science, 60(2), 449–462.

Li, Z., Ryan, J. K., Shao, L., & Sun, D. (2015). Supply contract design for competing heterogeneous suppliers under asymmetric information. Production and Operations Management, 24(5), 791–807.

Mankiw, N. (2015). Principles of economics. Stamford: Cengage Learning.

Mieghem, J. V. (1999). Coordinating investment. Production and Subcontracting. Management Science, 45(7), 954–971.

Mishra, B. K., Raghunathan, S., & Yue, X. (2009). Demand forecast sharing in supply chains. Production and Operations Management, 18(2), 152–166.

Pasternack, B. A. (1985). Optimal pricing and return policies for perishable commodities. Marketing Science, 4(2), 166–176.

Samuelson, P., & Nordhaus, W. (1998). Economics (photocopied ed.). Beijing: China Machine Press.

Shang, W., Ha, A. Y., & Tong, S. (2016). Information sharing in a supply chain with a common retailer. Management Science, 62(1), 245–263.

Taylor, T. A., & Xiao, W. (2009). Incentives for retailer forecasting: Rebates vs returns. Management Science, 55(10), 1654–1669.

Taylor, T. A., & Xiao, W. (2010). Does a manufacturer benefit from selling to a better-forecasting retailer? Management Science, 56(9), 1584–1598.

Tsay, A. (1999). Quantity flexibility contract and supplier-customer incentives. Management Science, 45(10), 1339–1358.

Vives, X. (1984). Duopoly information equilibrium: Cournot and Bertrand. Journal of Economic Theory, 34(1), 71–94.

Xue, W., Zuo, J., & Xu, X. (2015). Analysis of market competition and information asymmetry on selling strategies. Annals of Operations Research. https://doi.org/10.1007/s10479-015-1809-5.

Zhang, H. (2002). Vertical information exchange in a supply chain with Duopoly retailers. Production and Operations Management, 11(4), 531–546.

Acknowledgements

The authors gratefully acknowledge the reviewers for their constructive comments and helpful suggestions that were instrumental in improving this paper. This work is supported by the Program for the National Natural Science Foundation of China under Grant No. 71472134.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

1.1 Appendix A: Proofs of Main Results

Proof of Proposition 1

From Eqs. (12) and (18), we can easily show that

which is sufficient to prove Proposition 1. \(\square \)

Proof of Proposition 2

From Eqs. (12) and (18), the manufacturer’s profit increment due to retailer’s information sharing is

where the numerator \(\delta \) in the above expression is an increasing function of demand uncertainty \(\sigma ^{2}\) or demand signal accuracy t. This proves Proposition 2. \(\square \)

Proof of Proposition 3

From Eqs. (19), (20), (21) and (22), we have the following comparative results:

\(\Pi _S^{N,P_d } <\Pi _N^{N,P_d } ,\) if \(c_d <c(k)\) and \(\Pi _S^{N,P_d } >\Pi _N^{N,P_d } \), if \(c_d >c(k)\),

where c(k) is a function of k and we have

\(\square \)

Proof of Proposition 4

From Eqs. (28) and (34), we have the following comparative results:

Let \(\tilde{\delta }=\frac{4cm^{2}(4k+c)}{12k^{2}+3c(2k+c)}\), then \(\Pi _{M,S}^{\mathrm{E},P_d } -\Pi _{M,N}^{\mathrm{E},P_d } >0\) if \(\delta >\tilde{\delta }\), and \(\Pi _{M,S}^{\mathrm{E},P_d } -\Pi _{M,N}^{\mathrm{E},P_d } <0\) if \(\delta <\tilde{\delta }\).

The supply chain profit is \(\Pi _N^{\mathrm{E},P_d } \) if the retailer does not share demand information and is \(\Pi _S^{\mathrm{E},P_d } \) if the retailer does share, where

Similarly, we have

Let \(\hat{{\delta }}=\frac{4ckm^{2}(4k+c)}{12k^{3}+3ck(2k+c)+6c(2k+c)^{2}}\), then \(\Pi _S^{\mathrm{E},P_d } -\Pi _N^{\mathrm{E},P_d } >0\) if \(\delta >\hat{{\delta }}\), and \(\Pi _S^{\mathrm{E},P_d } -\Pi _N^{\mathrm{E},P_d } <0\) if \(\delta <\hat{{\delta }}\). \(\square \)

Proof of Corollary 2

and \(\delta \) is increasing with respect to \(\sigma ^{2}\) or t. \(\square \)

Proof of Proposition 5

We assume that both \(3a-5m>0\) and \(a\ge b\) hold. And \(q_{R,N}^{E,P_d } >0\) implies \(0<c<c_4 \), where

(i) From Eqs. (28) and (34), we have

\((ii){-}(iv)\) From Eqs. (28) and (34),

Let \(F(c)\buildrel \Delta \over = (3\delta -4m^{2})c^{2}+(6k\delta -16km^{2})c+12k^{2}\delta \) denotes the numerator in the above expression.

If \(3\delta -4m^{2}=0\), \(F(c)>0\) is equivalent to \(0<c<2k\);

If \(3\delta -4m^{2}\ne 0\), then \(F(c)=0\) has two solutions denoted by \(c_1 \), \(c_2 \), where

Note that \(F(0)=12k^{2}\delta >0\). And if \(3\delta -4m^{2}>0\) holds, then \(0<c_1 <c_2 \); if \(3\delta -4m^{2}<0\) holds, then \(c_2<0<c_1 \).

\((v)\hbox {--}(vi)\) From Eqs. (28) and (34),

Let \(G(c)\buildrel \Delta \over = 6\delta c^{3}+k(27\delta -4m^{2})c^{2}+2k^{2}(15\delta -8m^{2})c+12k^{3}\delta \).

If \(3\delta -4m^{2}\ge 0\) holds, or \(3\delta -4m^{2}<0\) and \(15\delta -8m^{2}>0\) hold, it is obvious that \(G(c)>0\);

Note that \(G(0)=12k^{3}\delta >0\), if both \(3\delta -4m^{2}<0\) and \(15\delta -8m^{2}<0\) hold, \(G(c)=0\) has three roots (one negative root and two positive roots) and we denote the smaller positive root by \(c_5 \). \(\square \)

Proof of Proposition 6

Similar to the proof of Proposition 3, and we omit it here. \(\square \)

Proof of Proposition 7

Replacing c in the proof of Proposition 4 by \((-c_e )\) and substituting \(0<c_e <k\) into the proof presents the results, and we omit it here. \(\square \)

Proof of Corollary 3

and \(\delta \) is increasing with respect to \(\sigma ^{2}\) or t. In addition, the numerator first increases with respect to \(c_e \) and then decreases with respect to \(c_e \). \(\square \)

Proof of Proposition 8

Replacing c in the proof of Proposition 5 by \((-c_e )\) and substituting \(0<c_e <k\) into the proof presents the results, and we omit it here. \(\square \)

Appendix B: Simultaneous Encroachment Setting

In this section, we study the simultaneous encroachment setting in which the manufacturer and the retailer choose quantities at the same time. We first examine the equilibrium results in the simultaneous encroachment setting and then compare the profits between the sequential encroachment setting and the simultaneous encroachment setting. We show that in most cases, both the retailer and the manufacturer are better off under sequential encroachment than under simultaneous encroachment.

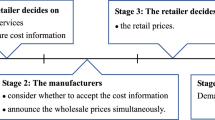

1.1 B.1 Simultaneous encroachment and no-production cost

We first do not consider the manufacturer’s production cost. The retailer decides whether to share demand information, then the manufacturer sets the wholesale price and finally the manufacturer and the retailer choose quantities at the same time. We use backward induction to obtain the equilibrium outcomes.

1.1.1 B.1.1 Noncommunicative

When the retailer does not share demand signal Y with the manufacturer. Given wholesale price w, the manufacturer and the retailer simultaneously choose their respective quantities. The manufacturer chooses \(q_M \) to:

where \(\mathrm{E}[\theta ]=0\) is the expectation of demand uncertainty and the superscript (E, N) indicates encroachment and no-production cost. Performing the optimization in Eq. (S1), we obtain \(q_{M,N}^{E,N} (q_R )\), the manufacturer’s optimal direct sales quantity to consumers in the (E, N) scenario given the retailer’s order quantity \(q_R\):

Meanwhile, given the manufacturer’s wholesale price w, the retailer chooses his order quantity \(q_R \) to:

Therefore, his optimal response function with respect to the manufacturer’s direct sales quantity \(q_M \) is

Note that there is information asymmetry when the supply chain is noncommunicative, and in this scenario, the manufacturer evaluates the demand uncertainty based on the prior distribution. For manufacturer, the expectation of her direct sales quantity \(q_{M,N}^{E,N} (q_R )\) is

and the expectation of the retailer’s response function \(q_{R,N}^{E,N} ({q_M})\) is given by

Solving the equation set consisting of \(\mathrm{E}[q_M ]\) and \(\mathrm{E}[q_R ]\), we obtain

Replacing \(q_M \) in Eq. (S1) with \(\mathrm{E}[q_M ]\) and replacing \(q_R \) in Eq. (S1) with \(\mathrm{E}[q_R ]\) gives the manufacturer’s expected profit function:

Substituting the expressions of \(\mathrm{E}[q_M ]\) and \(\mathrm{E}[q_R ]\) into the above profit function permits a representation of the manufacturer’s profit, which is a function of the wholesale price w:

Maximizing this expression with respect to wholesale price w gives us \(w_N^{E,N} \), the manufacturer’s optimal wholesale price in the (E, N) scenario. Substituting the expression for \(w_N^{E,N} \) into \(\mathrm{E}[q_R ]={(a+m-2w)}/{(3k)}\), then substituting the expression for \(\mathrm{E}[q_R ]\) into Eq. (S2) yields the manufacturer’s profit-maximizing direct sales output (\(q_{M,N}^{E,N} )\). And then substituting the expression for \(q_{M,N}^{E,N} \) into Eq. (S4) yields the retailer’s profit-maximizing order quantity (\(q_{R,N}^{E,N} )\):

Note that \(5m<3a\) in Sect. 3.2.1 naturally implies that \(7m<5a\) holds here.

Using the expressions in Eq. (S5), we can easily compute the retailer’s profit and the manufacturer’s profit in the (E, N) scenario:

1.1.2 B.1.2 Communicative

In this subsection, we examine the equilibrium outcomes when the retailer shares demand signal Y with the manufacturer. Therefore, information is symmetric in this setting, and the manufacturer incorporates the demand signal into her decision making as well as the retailer does. Given wholesale price w, the manufacturer and the retailer simultaneously choose their respective quantities. The manufacturer chooses \(q_M \) to:

where \(\mathrm{E}[\theta |Y]={(t\sigma ^{2})Y}/{(1+t\sigma ^{2})}\). Performing the optimization in Eq. (S7), we obtain \(q_{M,S}^{E,N} (q_R )\), the manufacturer’s optimal direct sales quantity to consumers given the retailer’s order quantity \(q_R \):

Given the manufacturer’s wholesale price w, the retailer chooses his order quantity \(q_R \) to:

Performing the optimization in Eq. (S9) we obtain the retailer’s optimal response function with respect to manufacturer’s quantity decision \(q_M \):

Note that information is symmetric when the supply chain is communicative, and in this scenario, the manufacturer evaluates the demand uncertainty based on the received demand signal Y. For manufacturer, the expectation of her optimal direct sales quantity \(q_{M,S}^{E,N} (q_R )\) conditional on Y is

and the expectation of the retailer’s optimal response function \(q_{R,S}^{E,N} (q_M )\) is given by

Solving the equation set consisting of \(\mathrm{E}[q_M |Y]\) and \(\mathrm{E}[q_R |Y]\), we have

Replacing \(q_M \) in Eq. (S7) with \(\mathrm{E}[q_M |Y]\) and replacing \(q_R \) in Eq. (S7) with \(\mathrm{E}[q_R |Y]\) gives the manufacturer’s expected profit function:

Substituting the expressions of \(\mathrm{E}[q_M |Y]\) and \(\mathrm{E}[q_R |Y]\) into the above equation permits a representation of the manufacturer’s profit, which is a function of the wholesale price w:

Maximizing this expression with respect to wholesale price w gives us \(w_S^{E,N} \), the manufacturer’s optimal wholesale price if the retailer shares demand signal. Substituting the expression for \(w_S^{E,N} \) into \(\mathrm{E}[q_R |Y]={(a+\mathrm{E}[\theta |Y]+m-2w)}/{(3k)}\), then substituting the expression for \(\mathrm{E}[q_R |Y]\) into Eq. (S8) yields the manufacturer’s profit-maximizing direct sales output (\(q_{M,S}^{E,N} )\), and then substituting the expression for \(q_{M,S}^{E,N} \) into Eq. (S10) yields the retailer’s profit-maximizing order quantity (\(q_{R,S}^{E,N} )\):

Using the expressions in Eq. (S11), we can compute the retailer’s profit and the manufacturer’s profit:

1.1.3 B.1.3 Comparisons: noncommunicative versus communicative

In this simultaneous encroachment setting, through comparing the profits when the supply chain is communicative with the profits when the supply chain is noncommunicative, we obtain the following proposition.

Proposition 9

With simultaneous encroachment, information sharing makes the retailer’s profit decrease, the manufacturer’s profit increase, and it makes the profit of the whole supply chain stay the same. Therefore, information sharing is impossible in simultaneous encroachment setting.

On one hand, information sharing makes the double marginalization more pronounced (\(w_S^{E,N} >w_N^{E,N} \), \(q_{R,S}^{E,N} <q_{R,N}^{E,N} )\); on the other hand, it makes the sum of the retailer’s sales quantity and manufacturer’s direct sales quantity stay the same (\(q_{R,S}^{E,N} +q_{M,S}^{E,N} =q_{R,N}^{E,N} +q_{M,N}^{E,N} )\), which leads to the same clearing price. Therefore, the unchanged market clearing price plus the increased wholesale price hurts the retailer. Though information sharing makes the manufacturer’s direct sales quantity increase (\(q_{M,S}^{E,N} >q_{M,N}^{E,N} )\), her profit increment from increased wholesale price and increased direct sales quantity is equal to the retailer’s profit decrement. Therefore, information sharing cannot lead to Pareto improvement and information sharing from retailer to manufacturer is impossible.

1.1.4 B.1.4 Comparisons: sequential versus simultaneous

In this subsection, we compare the profits in the sequential encroachment setting with those in the simultaneous encroachment setting. In the following, the subscript “Se” indicates sequential encroachment setting and the subscript “Si” indicates simultaneous encroachment setting.

When the supply chain is noncommunicative:

Therefore, \((\Pi _{R,N}^{\mathrm{E},N} )_{Se} >(\Pi _{R,N}^{\mathrm{E},N} )_{Si} \) if \(m^{2}>{225\delta }/{56}\) and \((\Pi _{R,N}^{\mathrm{E},N} )_{Se} <(\Pi _{R,N}^{\mathrm{E},N} )_{Si} \) otherwise.

Therefore, \((\Pi _N^{\mathrm{E},N} )_{Se} >\left( \Pi _N^{\mathrm{E},N}\right) _{Si} \) if \(m^{2}>{225\delta }/{176}\) and \((\Pi _N^{\mathrm{E},N} )_{Se} <(\Pi _N^{\mathrm{E},N} )_{Si} \) otherwise.

When the supply chain is communicative:

In our paper, \(\delta ={t\sigma ^{4}}/{(1+t\sigma ^{2})}<\sigma ^{2}\) and we assume the variability \(\sigma ^{2}\) is small enough (as stated in Sect. 2). Based on the above comparisons, we have the following proposition.

Proposition 10

In most cases, both the retailer and the manufacturer are better off under sequential encroachment than under simultaneous encroachment.

1.2 B.2 Simultaneous encroachment and production diseconomy setting

Similar to section B.1, we consider simultaneous encroachment setting in which the manufacturer and the retailer choose quantities at the same time. But now, the manufacturer faces production diseconomy. Again, we use backward induction to obtain the equilibrium outcomes.

1.2.1 B.2.1 Noncommunicative

When the supply chain is noncommunicative, then given wholesale price w, the manufacturer and the retailer simultaneously choose their respective quantities. The manufacturer chooses \(q_M \) to:

where \(\mathrm{E}[\theta ]=0\) is the expectation of demand uncertainty. Performing the optimization in Eq. (S13), we obtain \(q_{M,N}^{E,P_d } (q_R )\), the manufacturer’s optimal direct sales quantity to consumers in the \((E,P_d )\) scenario given the retailer’s order quantity \(q_R \):

Meanwhile, given the manufacturer’s wholesale price w, the retailer chooses his order quantity \(q_R \) to:

Therefore, his optimal response function with respect to manufacturer’s quantity \(q_M \) is:

Solving the equation set consisting of Eqs. (S14) and (S15), we obtain respectively the retailer’s and the manufacturer’s optimal response to wholesale price w:

Note that there is information asymmetry when the supply chain is noncommunicative, and in this scenario, the manufacturer evaluates the demand uncertainty based on the prior distribution. For manufacturer, the expectation of her optimal direct sales quantity is

and the expectation of the retailer’s optimal response function is given by

Replacing \(q_M \) in Eq. (S13) with \(\mathrm{E}[q_M ]\) and replacing \(q_R \) in Eq. (S13) with \(\mathrm{E}[q_R ]\) gives the manufacturer’s expected profit function:

where the expressions for \(\mathrm{E}[(q_R +q_M )]\) and \(\mathrm{E}[(q_R +q_M )^{2}]\) are respectively given by

Substituting the expressions of \(\mathrm{E}[q_M ]\), \(\mathrm{E}[q_R ]\), and the above two expressions into the manufacturer’s profit function permits a representation of the manufacturer’s profit, which is a function of the wholesale price w:

Maximizing this expression with respect to wholesale price w gives us \(w_N^{E,P_d } \), the manufacturer’s optimal wholesale price in the \((E,P_d )\) scenario. Substituting the expression for \(w_N^{E,P_d } \) into \(\mathrm{E}[q_R ]={(c(a-w)+k(a+b+m-2w))}/{(k(3k+c))}\), then substituting the expression for \(\mathrm{E}[q_R ]\) into Eq. (S14) yields the manufacturer’s profit-maximizing direct sales output (\(q_{M,N}^{E,P_d } )\). And then substituting the expression for \(q_{M,N}^{E,P_d } \) into Eq. (S16) yields the retailer’s profit-maximizing order quantity (\(q_{M,N}^{E,P_d } )\):

Using the expressions in Eq. (S17), we can easily compute the retailer’s profit and the manufacturer’s profit in the \((E,P_d )\) simultaneous encroachment scenario:

1.2.2 B.2.2 Communicative

If the supply chain is communicative, then given wholesale price w, the manufacturer and the retailer simultaneously choose their respective quantities. The manufacturer chooses \(q_M \) to:

where \(\mathrm{E}[\theta |Y]={(t\sigma ^{2})Y}/{(1+t\sigma ^{2})}\). Performing the optimization in Eq. (S19), we obtain \(q_{M,S}^{E,P_d } (q_R )\), the manufacturer’s optimal direct sales quantity to consumers given the retailer’s order quantity \(q_R \):

Given the manufacturer’s wholesale price w, the retailer chooses his order quantity \(q_R \) to:

Performing maximization in Eq. (S21), we obtain the retailer’s optimal response function with respect to the manufacturer’s quantity decision \(q_M \):

Solving the equation set consisting of Eqs. (S20) and (S22) gives us the manufacturer’s quantity function \(q_M (w)\) and the retailer’s quantity function \(q_R (w)\) respectively:

Note that information is symmetric when the supply chain is communicative, therefore the manufacturer evaluates the demand uncertainty based on the received demand signal Y. For manufacturer, the expectation of her direct sales quantity conditional on Y is

and the expectation of the retailer’s quantity function is given by

Replacing \(q_M \) in Eq. (S19) with \(\mathrm{E}[q_M |Y]\) and replacing \(q_R \) in Eq. (S19) with \(\mathrm{E}[q_R |Y]\) gives the manufacturer’s expected profit function:

where the expressions for \(\mathrm{E}[(q_R +q_M )|Y]\) and \(\mathrm{E}[(q_R +q_M )^{2}|Y]\) are respectively given by

Substituting the expressions of \(\mathrm{E}[q_M |Y]\), \(\mathrm{E}[q_R |Y]\), and the above two expressions into the manufacturer’s profit function permits a representation of the manufacturer’s profit, which is a function of the wholesale price w:

Maximizing this profit function with respect to wholesale price w gives us \(w_S^{E,P_d } \), the manufacturer’s optimal wholesale price when the retailer shares demand information. Substituting the expression for \(w_S^{E,P_d } \) into \(\mathrm{E}[q_R |Y]\) and then substituting the expression for \(\mathrm{E}[q_R |Y]\) into Eq. (S20) yields the manufacturer’s profit-maximizing direct sales output (\(q_{M,S}^{E,P_d } )\). Then substituting the expression for \(q_{M,S}^{E,P_d } \) into Eq. (S22) yields the retailer’s profit-maximizing order quantity (\(q_{R,S}^{E,P_d } )\):

Using the expressions in Eq. (S23), we can easily compute the retailer’s profit and the manufacturer’s profit:

1.2.3 B.2.3 Comparisons: noncommunicative versus communicative

In the simultaneous encroachment setting, when manufacturer faces production diseconomy, information sharing makes the sum of retailer’s sales quantity and manufacturer’s direct sales quantity decreased, which results in an increased market clearing price. Though information sharing increases the wholesale price, which hurts the retailer, the resulting increased market clearing price benefits the whole supply chain. In this simultaneous encroachment setting, through comparing the profits when the supply chain is communicative with the profits when the supply chain is noncommunicative, we obtain the following proposition.

Proposition 11

In the simultaneous encroachment setting, when manufacturer faces production diseconomy, information sharing increases the manufacturer’s wholesale price, decreases the retailer’s order quantity. It makes the retailer worse off, the manufacturer better off and it makes the supply chain better off.

Similar to Sect. 3.2.3, information sharing makes the double marginalization more pronounced (\(w_S^{E,P_d } >w_N^{E,P_d } \), \(q_{R,S}^{E,P_d } <q_{R,N}^{E,P_d } )\), it also makes the sum of the retailer’s sales quantity and the manufacturer’s direct sales quantity decreased (\(q_{R,S}^{E,P_d } +q_{M,S}^{E,P_d } <q_{R,N}^{E,P_d } +q_{M,N}^{E,P_d } )\), which leads to a higher market clearing price. For retailer, however, the increased wholesale price dominates the increased market clearing price, thus leading to a lower profit margin for the retailer. Therefore, information sharing hurts the retailer. For manufacturer, her direct sales quantity is increased (\(q_{M,S}^{E,P_d } >q_{M,N}^{E,P_d } )\). Therefore, the increased wholesale price, increased market clearing price and the increased direct sales quantity, all these together, makes the manufacturer benefit from information sharing.

By comparing profits, we have

In our paper, we have

where \(t=1/{\mathrm{E}[\hbox {Var}[Y|\theta ]]}\) measures the demand signal accuracy. As \(\delta \) becomes larger if the signal is more accurate (larger t) or the demand is more uncertain (larger \(\sigma ^{2})\), we have the following corollary.

Corollary 4

The manufacturer (supply chain) benefits more from information sharing if the demand becomes more variable (larger \(\sigma ^{2})\) or the demand signal becomes more accurate (larger t).

1.2.4 B.2.4 Comparisons: sequential versus simultaneous

Now we consider the \((E,P_d )\) scenario. We compare the profits in the sequential encroachment setting with those in the simultaneous encroachment setting. The subscript “Se” indicates sequential encroachment setting and the subscript “Si” indicates simultaneous encroachment setting.

When the supply chain is noncommunicative:

For the retailer,

Therefore, \((\Pi _{R,N}^{\mathrm{E},P_d } )_{Se} >(\Pi _{R,N}^{\mathrm{E},P_d } )_{Si} \) if

and \((\Pi _{R,N}^{\mathrm{E},P_d } )_{Se} <(\Pi _{R,N}^{\mathrm{E},P_d } )_{Si} \) otherwise.

For the manufacturer,

For the supply chain,

Therefore, \((\Pi _N^{\mathrm{E},P_d } )_{Se} >(\Pi _N^{\mathrm{E},P_d })_{Si} \) if \(m^{2}>(36c^{4}+252c^{3}k+621c^{2}k^{2}+630ck^{3}+225k^{4})\delta /(40c^{3}k+208c^{2}k^{2}+344ck^{3}+176k^{4})\) and \((\Pi _N^{\mathrm{E},P_d } )_{Se} <(\Pi _N^{\mathrm{E},P_d } )_{Si} \) otherwise.

When the supply chain is communicative:

Therefore, \((\Pi _{M,S}^{\mathrm{E},P_d } )_{Se} >(\Pi _{M,S}^{\mathrm{E},P_d } )_{Si} \) if \(c>{2(-k+\sqrt{7}k)}/3\) and \((\Pi _{M,S}^{\mathrm{E},P_d } )_{Se} <(\Pi _{M,S}^{\mathrm{E},P_d } )_{Si} \) if \(0<c<{2(-k+\sqrt{7}k)}/3\).

For the supply chain,

In our paper, \(\delta ={t\sigma ^{4}}/{(1+t\sigma ^{2})}<\sigma ^{2}\) and we assume the variability \(\sigma ^{2}\) is small enough (as stated in Sect. 2). When the manufacturer faces production diseconomy, in most cases both the retailer and the manufacturer are better off under sequential encroachment than under simultaneous encroachment. This finding is similar to Proposition 10 in Sect. B.1.4.

As the procedure and results in production economy scenario are similar to those in production diseconomy scenario, we omit the production economy scenario here.

Rights and permissions

About this article

Cite this article

Zhao, D., Li, Z. The impact of manufacturer’s encroachment and nonlinear production cost on retailer’s information sharing decisions. Ann Oper Res 264, 499–539 (2018). https://doi.org/10.1007/s10479-017-2717-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2717-7