Abstract

In this paper we present new evidence on the relation between idiosyncratic risk and mutual fund performance using asset pricing models. We use a unique data set containing monthly returns of 949 UK equity mutual funds over a 28-year period to measure fund performance. We find that idiosyncratic risk cannot be eliminated in UK mutual funds. We show that idiosyncratic risk is negatively related to returns for all funds investment style categories. We present evidence that the inclusion of idiosyncratic risk significantly increases the number of funds showing statistically significant and positive selectivity skills (alpha). Furthermore, all equity mutual funds turn to show significant volatility timing performance when idiosyncratic risk is considered. Finally, we find that idiosyncratic risk can forecast fund returns after controlling for macroeconomic variables.

Similar content being viewed by others

Notes

Assuming the market portfolio is well diversified.

See, Vidal-García et al. (2016b) for more details on the short-term persistence of international mutual fund performance.

References

Admati, A. R., Bhattacharya, S., Pfleiderer, P., & Ross, S. A. (1986). On timing and selectivity. Journal of Finance, 41, 715–730.

Ai, H., & Kiku, D. (2016). Volatility risks and growth options. Management Science, 62, 741–763.

Amihud, Y., & Goyenko, R. (2013). Mutual fund’s R2 as predictor of performance. Review of Financial Studies, 26, 667–694.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 61, 259–299.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2009). High idiosyncratic volatility and low returns: International and further U.S. evidence. Journal of Financial Economics, 91, 1–23.

Babenko, I., Boguth, O., & Tserlukevich, Y. (2016). Idiosyncratic cash flows and systematic risk. Journal of Finance, 71, 425–456.

Bali, T., Cakici, N., Yan, X., & Zhang, Z. (2005). Does idiosyncratic risk really matter? Journal of Finance, 60, 905–929.

Banegas, A., Gillen, B. J., Timmermann, A. G., & Wermers, R. (2013). The cross-section of conditional mutual fund performance in European stock markets. Journal of Financial Economics, 180, 699–726.

Basso, A., & Funari, S. (2001). A data envelopment analysis approach to measure the mutual fund performance. European Journal of Operational Research, 135, 477–492.

Bekaert, G., Hodrick, R., & Zhang, X. (2009). International stock return comovements. Journal of Finance, 64, 2591–2626.

Brandt, M. W., Brav, A., Graham, J. R., & Kumar, A. (2013). The idiosyncratic volatility puzzle: Time trend or speculative episodes? Review of Financial Studies, 23, 863–899.

Busse, J. A. (1999). Volatility timing in mutual funds: Evidence from daily returns. Review of Financial Studies, 12, 1009–1041.

Campbell, J. Y., Martin, L., Malkiel, B. G., & Xu, Y. (2001). Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk. Journal of Finance, 56, 1–43.

Cao, J., & Han, B. (2013). Cross section of option returns and idiosyncratic stock volatility. Journal of Financial Economics, 108, 231–249.

Chen, C., Huang, A. G., & Jha, R. (2012). Idiosyncratic return volatility and the information quality underlying managerial discretion. Journal of Financial and Quantitative Analysis, 47, 873–899.

Chevalier, J., & Ellison, G. (1999). Are some mutual fund managers better than others? Cross-sectional patterns in behavior and performance. Journal of Finance, 54, 875–899.

Cremers, K. J. M., & Petajisto, A. (2009). How active is your fund manager? A new measure that predicts performance. Review of Financial Studies, 22, 3329–3365.

Doran, J., Jiang, D., & Peterson, D. (2012). Short-sale constraints and the non-January idiosyncratic volatility puzzle. SSRN Working Paper.

Eiling, E. (2013). Industry-specific human capital, idiosyncratic risk, and the cross-section of expected stock returns. Journal of Finance, 68, 43–84.

Elton, E. J., Gruber, M. J., Das, S., & Hlavka, M. (1993). Efficiency with costly information: A reinterpretation of evidence from managed portfolios. Review of Financial Studies, 6, 1–22.

Fama, E., & French, K. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Fama, E., & French, K. (1996). Multifactor explanation of asset pricing anomalies. Journal of Finance, 51, 55–84.

Ferreira, M. A., Keswani, A., Miguel, A. F., & Ramos, S. B. (2012). The flow-performance relationship around the world. Journal of Banking & Finance, 36, 1759–1780.

Goyal, A., & Santa-Clara, P. (2003). Idiosyncratic risk matters! Journal of Finance, 58, 975–1007.

Guo, H. (2004). Limited stock market participation and asset prices in a dynamic economy. Journal of Financial and Quantitative Analysis, 39, 495–516.

Guo, H., & Savickas, R. (2006). Idiosyncratic volatility, stock market volatility, and expected stock returns. Journal of Business and Economic Statistics, 24, 43–56.

Kearney, C., & Poti, V. (2008). Have European stocks become more volatile? An empirical investigation of idiosyncratic and market risk in the Euro area. European Financial Management, 14, 419–444.

Kosowski, R., Timmermann, A., Wermers, R., & White, H. (2005). Can mutual fund “stars” really pick stocks? New evidence from a bootstrap analysis. Journal of Finance, 61, 2551–2595.

Lin, J., & Chiang, M. (2013). Idiosyncratic risk in mutual fund. Working paper, Tainan University of Technology.

Lo, A.W., & MacKinlay, A.C. (1990). When are contrarian profits due to stock market overreaction?. Review of Financial Studies, 3, 175–205.

Lozano, S., & Gutiérrez, E. (2008). Data envelopment analysis of mutual funds based on second-order stochastic dominance. European Journal of Operational Research, 189, 230–244.

Malkiel, B. G., & Xu, Y. (1997). Risk and return revisited. Journal of Portfolio Management, 23, 9–14.

Malkiel, B. G., & Xu, Y. (1999). The structure of stock market volatility. Working paper, Princeton University.

Malkiel, B. G., & Xu, Y. (2006). Idiosyncratic risk and security returns. Working paper, SOM, University of Texas at Dallas.

Moreno, D., Marco, P., & Olmeda, I. (2006). Self-organizing maps could improve the classification of Spanish mutual funds. European Journal of Operational Research, 174, 1039–1054.

Panousi, V., & Papanikolaou, D. (2012). Investment, idiosyncratic risk, and ownership. Journal of Finance, 67, 1113–1148.

Plyakha, Y., Uppal, R., & Vilkov, G. (2016). Equal or value weighting? Implications for asset pricing tests. SSRN Working paper.

Qin, N. (2013). Idiosyncratic risk and mutual fund performance persistence. SSRN Working paper.

Treynor, J., & Mazuy, K. (1966). Can mutual funds outguess the market? Harvard Business Review, 44, 131–136.

Vidal, M., Vidal-García, J., & Boubaker, S. (2015). Market timing around the world. Journal of Alternative Investments, 18, 61–89.

Vidal-García, J., & Vidal, M. (2014). Seasonality and idiosyncratic risk in mutual fund performance. European Journal of Operational Research, 233, 613–624.

Vidal-García, J., Vidal, M., Boubaker, S., & Uddin, G. S. (2016a). The short-term persistence of international mutual fund performance. Economic Modelling, 52, 926–938.

Vidal-García, J., Vidal, M., & Nguyen, D. K. (2016b). Do liquidity and idiosyncratic risk matter? Evidence from the European mutual fund market. Review of Quantitative Finance and Accounting, 47, 213–247.

Wei, S. X., & Zhang, C. (2005). Idiosyncratic risk does not matter: A re-examination of the relationship between average returns and average volatilities. Journal of Banking & Finance, 29, 603–621.

Author information

Authors and Affiliations

Corresponding author

Additional information

We appreciate helpful comments and suggestions from Keith Cuthbertson, Aneel Keswani, Doron Avramov, Natasha Todorovic, Germán López Espinosa, Marcin Kacperczyk, Massimo Guidolin, and Elaine Hutson, as well as seminar participants at Stevens Institute of Technology, Bristol Business School, Cass Business School, University of Stirling, Complutense University of Madrid, the Southwestern Finance Association Annual Conference, the Eastern Finance Association Annual Meeting, the Infiniti Conference, and the Paris Financial Management Conference. The work described in this paper was partially supported by a grant from Santander UK Bank. This paper was written while Sabri Boubaker was visiting professor in Finance at the International School, Vietnam National University, Hanoi, Vietnam.

Appendix A

Appendix A

See Tables 1, 2, 3, 4, 5, 6 and Figs. 1, 2, 3, 4.

Average return for all funds and the FTSE All Share Index. This figure plots average monthly returns for the whole sample of funds and the FTSE All Share Index for the period 1987:01 to 2015:12. It is possible to appreciate abnormal returns prior to the traditional turn of the year, as well as the “sell in May and go away” effect

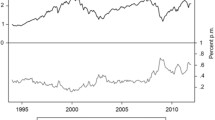

Market and idiosyncratic volatility. Panel A of this figure plots the average standard deviation of the whole sample of funds for the period 1987:01 to 2015:12. The average fund volatility is calculated using monthly data for the time period under consideration. Standard deviation is a statistical term that provides a good indication of volatility. It measures how widely fund closing prices are dispersed from the average. Panel B of this figure plots the annual idiosyncratic volatility for all funds for the period 1987:01 to 2015:12. Average idiosyncratic volatility is calculated using monthly data from regression (14). Market volatility fluctuates more than idiosyncratic volatility for the sample period. a Market volatility for all funds and b Idiosyncratic volatility for all funds

Rights and permissions

About this article

Cite this article

Vidal-García, J., Vidal, M., Boubaker, S. et al. Idiosyncratic risk and mutual fund performance. Ann Oper Res 281, 349–372 (2019). https://doi.org/10.1007/s10479-018-2794-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2794-2