Abstract

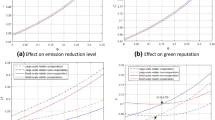

Environmental impact is one of the major causes of tax and subsidy interactions between the government and firms. The government sets the tax of the upstream impact and designs the subsidy threshold value to promote the green effort of firms. This paper presents the optimal decision of the supply chain and the effective environmental governance strategy of the government. A Stackelberg game between the government and a two-echelon supply chain is constructed, where a supplier makes core parts for a manufacturer. First, we compared the effects of subsidy on the pricing decisions of firms and identified the profitable condition of the green effort of manufacturers. Results corroborate that a negotiated space for suppliers and manufacturers exists to reduce the environmental impact from the source, especially when the tax legislation is strict. Second, we obtained the optimal upstream contract of environmental impact in supply chains, which appears a phenomenon of the Matthew effect under any type of governance strategies. This finding affirms that subsidies make supply chains inclined to choose a greener upstream decision. The condition when subsidies make sense by effective environment improvement in the supply phase was further derived. Finally, with tax and subsidy governance strategies, the multi-perspective social welfare was simulated and analyzed. Accordingly, we verified that the growth boundary of the supply-chain profit with high subsidy threshold is better than that of the social welfare or the environment performance. It implies that setting the green subsidy standard originally high is a comprehensively sustainable choice for social welfare. In addition, the simulations of three tax structures were analyzed in extensions.

Similar content being viewed by others

References

Aflaki, S., & Mazahir, S. (2015). Recovery targets and taxation/subsidy policies to promote product reuse. Rochester: Social Science Electronic Publishing.

Agrawal, V. V., Ferguson, M., Toktay, L. B., & Thomas, V. M. (2012). Is leasing greener than selling? Management Science,58(3), 523–533.

Allevi, E., Gnudi, A., Konnov, I. V., & Oggioni, G. (2016). Evaluating the effects of environmental regulations on a closed-loop supply chain network: A variational inequality approach. Annals of Operations Research,1, 1–43.

Anmeilite. (2017). Green technology (online). http://en.anmeilite.com/index.php?catid=17. Accessed 10 Nov 2017.

Ata, B., Lee, D., & Tongarlak, M. H. (2012). Optimizing organic waste to energy operations. Manufacturing & Service Operations Management,14(2), 231–244.

Atasu, A., & Subramanian, R. (2012). Extended producer responsibility for e-waste: Individual or collective producer responsibility? Production & Operations Management,21(6), 1042–1059.

Basu, R. J., Subramanian, N., Gunasekaran, A., & Palaniappan, P. L. K. (2017). Influence of non-price and environmental sustainability factors on truckload procurement process. Annals of Operations Research,250(2), 1–26.

Bi, G., Jin, M., Ling, L., & Yang, F. (2017). Environmental subsidy and the choice of green technology in the presence of green consumers. Annals of Operations Research,255(1), 1–22.

Cairns, J., Myers, N., & Kent, J. V. (1999). Perverse subsidies: Tax $s undercutting our economies and environments alike. BioScience,49(4), 334–336.

Chen, S. Y. (2011). Marginal cost of emission reduction and China’s environmental tax reform. Chinese Journal of Social Sciences,3, 85–100.

Cohen, M. C., Lobel, R., & Perakis, G. (2016). The impact of demand uncertainty on consumer subsidies for green technology adoption. Management Science,62(4), 868–878.

Colapinto, C., Liuzzi, D., & Marsiglio, S. (2017). Sustainability and intertemporal equity: A multicriteria approach. Annals of Operations Research,251(1–2), 271–284.

Dmitry, K., Timur, N., & Anton, O. (2013). Environmental taxes and the choice of green technology. Production & Operations Management,22(5), 1035–1055.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research,228(1), 135–149.

Feng, L., Govindan, K., & Li, C. (2017). Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. European Journal of Operational Research,260(2), 601–612.

Finland-OECD. (2012). Science and Innovation: Finland (online). http://www.oecd.org/finland/sti-outlook-2012-finland.pdf. Accessed 24 July 2018.

Gadenne, D., Sharma, B., Kerr, D., & Smith, T. (2011). The influence of consumers’ environmental beliefs and attitudes on energy saving behaviours. Energy Policy,39(12), 7684–7694.

Geyer, R., Jambeck, J. R., & Law, K. L. (2017). Production, use, and fate of all plastics ever made. Science Advances,3(7), e1700782.

Giovanni, P. D. (2014). Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Annals of Operations Research,220(1), 135–157.

GOV.CN. (2017). Environmental protection tax law of the People’s Republic of China (online). http://www.chinalaw.gov.cn/art/2017/4/5/art_11_88264.html. Accessed 28 Dec 2017.

GOV.UK. (2017). Environmental taxes, reliefs and schemes for businesses (online). http://www.gov.uk/green-taxes-and-reliefs. Accessed 20 Oct 2017.

Hawkins, T., Hendrickson, C., Higgins, C., Matthews, H. S., & Suh, S. (2007). A mixed-unit input-output model for environmental life-cycle assessment and material flow analysis. Environmental Science and Technology,41(3), 1024.

Huang, T., Allon, G., & Bassamboo, A. (2013a). Bounded rationality in service systems. Manufacturing & Service Operations Management,15(2), 263–279.

Huang, J., Leng, M., Liang, L., & Liu, J. (2013b). Promoting electric automobiles: Supply chain analysis under a government’s subsidy incentive scheme. IIE Transactions,45(8), 826–844.

Joglekar, N. R., Davies, J., & Anderson, E. G. (2016). The role of industry studies and public policies in production and operations management. Production & Operations Management,25, 1977–2001.

Kleer, R. (2010). Government R&D subsidies as a signal for private investors. Research Policy,39(10), 1361–1374.

Kosmo, M. N. (1987). Money to burn?: The high costs of energy subsidies. Washington DC: World Resources Institute.

Lee, H. L., & Tang, C. S. (2017). Socially and environmentally responsible value chain innovations: New operations management research opportunities. Management Science,64, 983–996.

Lenox, M., King, A., & Ehrenfeld, J. (2000). An assessment of design-for-environment practices in leading us electronics firms. Interfaces,30(3), 83–94.

Li, X., Li, Y., & Govindan, K. (2014a). An incentive model for closed-loop supply chain under the EPR law. Journal of the Operational Research Society,65(1), 88–96.

Li, W., Li, Y., & Shi, D. (2016a). Research on the theory of supply chain governance: Concept, connotation and normative analysis framework. Nankai Management Review,19(1), 4–15.

Li, Y., Xu, F., & Zhao, X. (2016b). Governance mechanisms of dual-channel reverse supply chains with informal collection channel. Journal of Cleaner Production,155, 125–140.

Li, Y., Zhao, X., Shi, D., & Li, X. (2014b). Governance of sustainable supply chains in the fast fashion industry. European Management Journal,32(5), 823–836.

Ma, W. M., Zhao, Z., & Ke, H. (2013). Dual-channel closed-loop supply chain with government consumption-subsidy. European Journal of Operational Research,226(2), 221–227.

OECD. (2001). Environmentally related taxes in OECD countries: Issues and strategies. New York: Humana Press.

OECD. (2012). Green technology and innovation (online). https://www.oecd.org/sti/outlook/e-outlook/stipolicyprofiles/newchallenges/greentechnologyandinnovation.htm. Accessed 20 Oct 2017.

Pearce, D. (2003). Environmentally harmful subsidies: Barriers to sustainable development. Environmentally harmful subsidies: Policy issues and challenges. Paris: OECD.

Raz, G., Druehl, C. T., & Blass, V. (2013). Design for the environment: Life-cycle approach using a newsvendor model. Production and Operations Management,22(4), 940–957.

Sharma, S., & Ruud, A. (2003). On the path to sustainability: Integrating social dimensions into the research and practice of environmental management. Business Strategy and the Environment,12(4), 205–214.

Shibin, K. T., Dubey, R., Gunasekaran, A., Hazen, B., Roubaud, D., Gupta, S., & Foropon, C. (2017). Examining sustainable supply chain management of SMEs using resource based view and institutional theory. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2706-x.

Song, M., Wang, S., & Wu, K. (2016). Environment-biased technological progress and industrial land-use efficiency in China’s new normal. Annals of Operations Research. https://doi.org/10.1007/s10479-016-2307-06.

Song, M. L., Zhang, W., & Qiu, X. M. (2015). Emissions trading system and supporting policies under an emissions reduction framework. Annals of Operations Research,228(1), 125–134.

Sunar, N., & Plambeck, E. (2016). Allocating emissions among co-products: Implications for procurement and climate policy. Manufacturing & Service Operations Management,18(3), 414–428.

U.S. Environmental Protection Agency. (2017). Subsidies for Pollution Control (online). http://yosemite.epa.gov/ee/epa/eerm.nsf/vwAN/EE-0216B-08.pdf/$file/EE-0216B-08.pdf.

Wang, L., Cai, G. G., Tsay, A. A., & Vakharia, A. J. (2017). Design of the reverse channel for remanufacturing: Must profit-maximization harm the environment? Production and Operations Management,26, 1585–1603.

Wei, S., Tang, O., & Liu, W. (2015). Refund policies for cores with quality variation in OEM remanufacturing. International Journal of Production Economics, 170, 629–640.

Xia, Y., Chen, B., & Kouvelis, P. (2008). Market-based supply chain coordination by matching suppliers’ cost structures with buyers’ order profiles. Management Science,54(11), 1861–1875.

Xu, Y., & Yan, C. H. (2017). Sustainability-based selection decisions for e-waste recycling operations. Annals of Operations Research,248(1–2), 531–552.

Zhang, Z., Guo, J. E., Qian, D., Xue, Y., & Cai, L. (2013). Effects and mechanism of influence of China’s resource tax reform: A regional perspective. Energy Economics,36, 676–685.

Acknowledgements

We acknowledge the support of (i) National Natural Science Foundation of China (NSFC), Research Fund Nos. 71372100 and 71725004 for Y.J. Li; and (ii) National Natural Science Foundation of China (NSFC), Research Fund No. 71702129 for C. Zhou.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proofs

Proof of Proposition 1

Taking the scenario of subsidizing manufacturer as an example, the proof of the other conditions can be alike. Taking the first order derivative of \( \pi_{m}^{{S_{m} }} \left( p \right) \) regarding \( p \), we obtained:

which implies that

Substituting \( p \) with (A1) and taking the first order derivative of \( \pi_{s}^{{S_{m} }} \left( w \right) \) regarding \( w \), we acquired:

which implies that

Substituting \( w \) with the optimal expression (A2) in (A1), we obtained the results of Proposition 1. Reasonably supposing that consumers are always sensitive to the price, we obtained the following:

Thus, we acquired the second order derivative of \( \pi_{s}^{{{\text{S}}_{\text{m}} }} \left( {\text{w}} \right) \) and \( \pi_{m}^{{{\text{S}}_{\text{m}} }} \left( {\text{p}} \right), \) respectively, as follows:

The solution satisfies the optimal conditions; thus, \( \left( {w^{{S_{m} *}} ,p^{{S_{m} *}} } \right) \) is an optimal price decision.

Proof of Proposition 3

As

we acquired the result (1) in Proposition 3.

As

we obtained the result (2) in Proposition 3.

As

we acquired the result (3) in Proposition 3.

Proof of Proposition 4

With optimal results in Proposition 2, we obtained the profit as follows.

Condition (1) in Proposition 4 can be obtained by simplifying the following:

i.e.,

Condition (2) in Proposition 4 can be obtained by the simplifying the following:

i.e.,

Proof of Proposition 5

Taking Model R as an example. Given that the first and second order derivative of \( \pi^{1} \left( \alpha \right) \) satisfy

and

\( \pi^{1} \left( \alpha \right) \) is on the convexity of \( \alpha \). \( \hat{\alpha }^{R} \) stands for the level of environment impact in supply phase, where profit of the manufacturer is minimum, and the quadratic function graph are right-and-left symmetric. The minimum value of \( \pi^{1} \left( \alpha \right) \) is obtained when \( \alpha = \hat{\alpha }^{R} \). Therefore, the supplier and the manufacturer will choose the value farthest from \( \hat{\alpha }^{R} \). Similar result of \( \pi^{*} \left( \alpha \right) \) is derived in Model S under the tax & subsidy governance.

Proof of Proposition 6

Given that

When \( \hat{\alpha }^{R} \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \), \( \alpha_{L} \) is the farthest point from both the symmetry axis \( \hat{\alpha }^{R} \) and \( \hat{\alpha }^{S} \). Therefore, \( \pi^{1} \left( \alpha \right) \) and \( \pi^{*} \left( \alpha \right) \) reach the maximum at \( \alpha_{L} \). Afterward, we obtained the result (1) in Proposition 6.

When \( \hat{\alpha }^{S} < \frac{{\alpha_{H} + \alpha_{L} }}{2} \), \( \alpha_{H} \) is the farthest point from the symmetry axis \( \hat{\alpha }^{R} \) and \( \hat{\alpha }^{S} \). Therefore, \( \pi^{1} \left( \alpha \right) \) and \( \pi^{*} \left( \alpha \right) \) reach the maximum at \( \alpha_{L} \). Afterward, we acquired the result (2) in Proposition 6.

When \( \hat{\alpha }^{R} < \frac{{\alpha_{L} + \alpha_{H} }}{2} \le \hat{\alpha }^{S} \),\( \pi^{1} \left( \alpha \right) \) and \( \pi^{*} \left( \alpha \right) \) appear as different trends. \( \alpha_{H} \) is the farthest point from \( \hat{\alpha }^{R} \). On the contrary, \( \alpha_{L} \) is the farthest point from \( \hat{\alpha }^{S} \). Afterward, we obtained the result (3) in Proposition 6.

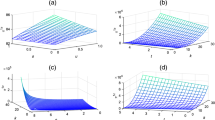

Appendix 2: Simulations

Rights and permissions

About this article

Cite this article

Li, Y., Deng, Q., Zhou, C. et al. Environmental governance strategies in a two-echelon supply chain with tax and subsidy interactions. Ann Oper Res 290, 439–462 (2020). https://doi.org/10.1007/s10479-018-2975-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2975-z