Abstract

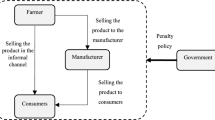

In this paper, we examine the impact of manufacturers’ dishonest reports of product sustainability. We first investigate the Volkswagen emissions scandal and Wal-Mart fake organic food scandal in terms of the overstatement of product sustainability. Based on these two cases, we construct a two-echelon supply chain model consisting of one manufacturer and one retailer. The supply chain members can use inspections or deferred payments in trading. We find that the inspection and deferred payment mechanisms do not always help reduce the overstatements of sustainability. With the inspection mechanism, when the basic demand is higher (lower) than the threshold, inspections can (cannot) effectively reduce the levels of overstatement. With the deferred payment mechanism, when the manufacturer’s expected proportion of payments is sufficiently small (large), the deferred payments can (cannot) help reduce the levels of overstatement. Moreover, we find that when overstatements are difficult (easy) to identify by the retailer, the deferred payment (inspection) mechanism is the more effective means for the retailer to reduce overstatements. Furthermore, our numerical results indicate that when a third party organization perceives a low probability of product overstatement, the manufacturer and the retailer use neither inspections nor the deferred payment mechanism. In contrast, when a third party organization perceives a high probability of product overstatement, the inspection mechanism is more beneficial to the manufacturer, while the deferred payment is more beneficial to the retailer. The managerial implications of our findings are discussed.

Similar content being viewed by others

Notes

In this paper, the penalty is paid by the retailer because we consider the retailer to be a well-known enterprise and a Stackelberg leader. In future research, we will extend our analysis to the case that the manufacturer pays the penalty for overstatement.

References

Babich, V., & Tang, C. S. (2012). Management opportunistic supplier product adulteration: Deferred payments, inspection, and combined mechanisms. Manufacturing and Service Operations Management,14(2), 301–314.

Bounds, G. (2009). As eco-seals proliferate, so do doubts. The Wall Street Journal.

Chait, J. (2017). Learn how to shop for real organic food and products. The Balance. October 29. Available at: https://www.thebalance.com/how-to-shop-for-real-organic-food-and-products-2538172,

Chan, L., Shen, B., & Cai, Y. (2018). Quick response strategy with cleaner technology in a supply chain: Coordination and win–win situation analysis. International Journal of Production Research. (in Press).

Chen, C., Zhang, J., & Delaurentis, T. (2014). Quality control in food supply chain management: An analytical model and case study of the adulterated milk incident in China. International Journal of Production Economics,152, 188–199.

Choi, T. M., Cheng, T. C. E., & Zhao, X. (2016). Multi-methodological research in operations management. Production and Operations Management,25, 379–389.

Curry, L. (2018). Is Walmart defrauding consumers into spending more for “organic” eggs? New Food Economy. January 19. Available at: https://newfoodeconomy.org/walmart-organic-egg-outdoor-access-fraud-lawsuit/.

Davis, A. M., & Hyndman, K. (2018). An experimental investigation of managing quality through monetary and relational incentives. Management Science (in Press).

DeYong, G. D., & Pun, H. (2015). Is dishonesty the best policy? Supplier behaviour in a multi-tier supply chain. European Journal of Operational Research,170, 1–13.

Dong, C. W., Shen, B., Chow, P. S., Yang, L., & Ng, C. T. (2016). Sustainability investment under cap-and-trade regulation. Annals of Operations Research,240(2), 509–531.

Ewing, J. (2015). Volkswagen says 11 million cars worldwide are affected in diesel deception. The New York Times. 22 September. Available at: https://www.nytimes.com/2015/09/23/business/international/volkswagen-diesel-car-scandal.html.

Gao, C., Cheng, T. C. E., Shen, H., & Xu, L. (2016). Incentives for quality improvement efforts coordination in supply chains with partial cost allocation contract. International Journal of Production Research,54(20), 6216–6231.

Goedkoop, M., Subramanian, V., & Morin, R. (2015). Product sustainability information state of play and way forward. United Nations Environment Programme. https://www.lifecycleinitiative.org/wp-content/uploads/2015/07/PSI_28.7.15-web.pdf.

Greencar (2008). http://www.greencar.com/features/2009-vw-jetta-clean-diesel-wins. Accessed 1 Feb 2018.

Guo, L. (2011). 10 Chongqing Wal-Mart stores closed for rectification and pay 2.69 million fine. October 9. Available at: http://finance.ifeng.com/news/corporate/20111009/4763407.shtml.

Hakim, D. (2016). VW’s crisis strategy: Forward, reverse, U-turn. The New York Times. February 26. Available at: https://www.nytimes.com/2016/02/28/business/international/vws-crisis-strategy-forward-reverse-u-turn.html.

Lee, H., & Li, C. (2018). Supplier quality management: Investment, inspection, and incentives. Production and Operations Management (in Press).

Li, X., Li, Q., Guo, P., & Lian, Z. (2017). On the uniqueness and stability of equilibrium in quality-speed competition with boundedly-rational customers: The case with general reward function and multiple servers. International Journal of Production Economics,193, 726–736.

Mayyas, A., Qattawi, A., Omar, M., & Shan, D. (2012). Design for sustainability in automotive industry: A comprehensive review. Renewable and Sustainable Energy Reviews,16(4), 1845–1862.

Neate, R. (2015). Volkswagen under investigation over illegal software that masks emissions. September 18. The Guardian. Available at: https://www.theguardian.com/business/2015/sep/18/epa-california-investigate-volkswagen-clean-air-violations.

Pickett-Bakerand, J., & Ozaki, R. (2008). Pro-environmental products: Marketing influence on consumer purchase decision. Journal of Consumer Marketing.,25(5), 281–293.

Rainey, C. (2017). USDA warns that millions of pounds of fake ‘organic’ imports are pouring into U.S. Grub Street. September 20. Available at: http://www.grubstreet.com/2017/09/millions-of-pounds-of-fake-organic-food-entering-america.html.

Rogers, C., & Spector, M. (2017). Judge slaps VW with $2.8 billion criminal fine in emissions fraud. Wall Street Journal. 21 April. Available at: https://www.wsj.com/articles/judge-slaps-vw-with-2-8-billion-criminal-fine-in-emissions-fraud-1492789096.

Rui, H., & Lai, G. (2015). Sourcing with deferred payment and inspection under supplier product adulteration risk. Production and Operations Management.,24(6), 934–946.

Shao, H., Xiang, H., & Wang, Q. (2011). Fake pork scandal in Chongqing Wal-Mart. September 7. Available at: http://finance.ifeng.com/news/bgt/20110907/4553381.shtml.

Shen, B. (2014). Sustainable fashion supply chain: Lessons from H&M. Sustainability,6(9), 6239–6249.

Shen, B., Choi T. M., & Chan, H. L. (2018a). Selling green first or not? A Bayesian analysis with service levels and environmental impact considerations in the big data era. Technological Forecasting and Social Change (in Press).

Shen, B., Choi, T. M., Minner, S. (2018b). A review on supply chain contracting with information considerations: Information updating and information asymmetry. International Journal of Production Research (in Press).

Shen, B., Ding, X. M., Chen, L. Z., & Chan, H. L. (2017). Low carbon supply chain with energy consumption constraints: Case studies from China’s Textile Industry and simple analytical model. Supply Chain Management: An International Journal,22(3), 258–269.

Shen, B., Zheng, J. H., Chow, P. S., & Chow, K. Y. (2014). Perception of fashion sustainability in online community. Journal of the Textile Institute,105(9), 971–979.

Shi, X., Qian, Y., & Dong, C. (2017). Economic and environmental performance of fashion supply chain: The joint effect of power structure and sustainable investment. Sustainability,9(6), 961.

Tang, C. S., & Babich, V. (2014). Using social and economic incentives to discourage Chinese suppliers from product adulteration. Business Horizons,57, 497–508.

Wang, L., & Shen, B. (2017). A product line analysis for eco-designed fashion products: Evidence from an outdoor sportswear brand. Sustainability,9(7), 1136.

Wang, Z., Yao, D., & Yue, X. (2015). E-business investment for fresh agricultural food industry in China. Annals of Operations Research,254, 1–16.

Whoriskey, P. (2017). Millions of pounds of apparently fake ‘organic’ grains convince the food industry there may be a problem. Washington Post. June 12. Available at: https://www.washingtonpost.com/news/wonk/wp/2017/06/12/millions-of-pounds-of-apparently-fake-organic-grains-convince-the-food-industry-there-may-be-a-problem/?utm_term=.d230ce8c3bc9.

Xie, W., Zhao, Y., Jiang, Z., & Chow, P. (2016). Optimizing product service system by franchise fee contracts under information asymmetry. Annals of Operations Research,240(2), 709–729.

Yin, R. K. (2009). Case study research: Design and Methods. Newbury Park: Sage.

Acknowledgements

This paper is supported by ‘National Natural Science Foundation of China [grant number 71501037, 71871051, 71871052, 71832001]’.

Author information

Authors and Affiliations

Corresponding author

Appendix—Proofs

Appendix—Proofs

1.1 Proof of Theorem 1

Recall the optimal overstated level in the inspection mechanism is:

As \( (1 - \theta )\eta \ge \varepsilon ((1 - \theta )\alpha - \beta \varepsilon ) \), i.e. denominator is positive, we can rearrange the numerator and yield that if \( \lambda \le \frac{{(1 - \theta )\varepsilon b + ((1 - \theta )\alpha - \beta \varepsilon )(w_{o} - c) - \beta \varepsilon (w_{o} - \theta v)}}{{(1 - \theta )\varepsilon b + ((1 - \theta )\alpha - \beta \varepsilon )(w_{o} - v) - \beta \varepsilon (w_{o} - \theta v)}} \), then \( s_{I}^{ * } \le 0 \). In other words, the manufacturer will not overstate when \( \lambda \le \frac{{(1 - \theta )\varepsilon b + ((1 - \theta )\alpha - \beta \varepsilon )(w_{o} - c) - \beta \varepsilon (w_{o} - \theta v)}}{{(1 - \theta )\varepsilon b + ((1 - \theta )\alpha - \beta \varepsilon )(w_{o} - v) - \beta \varepsilon (w_{o} - \theta v)}} \), vice verse. □

1.2 Proof of Theorem 2

Recall the optimal overstated levels in the benchmark and inspection mechanism are as follows.

Let \( s_{B}^{ * } = \left( {\frac{{(1 - \theta )\varepsilon b - \varepsilon \beta (w_{o} - \theta v) + (w_{o} - c)((1 - \theta )\alpha - \beta \varepsilon )}}{{2(1 - \theta )\eta + 2\beta \varepsilon^{2} - 2(1 - \theta )\alpha \varepsilon }}} \right)^{ + } = \frac{K}{L} \ge 0 \), we can rewrite \( s_{I}^{ * } \) to,

Suppose \( s_{I}^{ * } \le s_{B}^{ * } \), we find

that is, if \(\Leftrightarrow b \ge \frac{{(1 - \theta )\eta [\beta \varepsilon (w_{o} - \theta v) - ((1 - \theta )\alpha - \beta \varepsilon )(w_{o} - v)] + ((1 - \theta )\alpha - \beta \varepsilon )^{2} \varepsilon (c - v)}}{{(1 - \theta )^{2} \varepsilon \eta }} \), then \( s_{I}^{ * } \le s_{B}^{ * } \); otherwise, \( s_{I}^{ * } > s_{B}^{ * } \).

Based on the comparison of the overstated level, the optimal sale price in the benchmark and inspection are:

We can get that, if

then \( r_{I}^{ * } \le r_{B}^{ * } \); otherwise, \( r_{I}^{ * } > r_{B}^{ * } \). □

1.3 Proof of Theorem 3

In order to simplify our calculation, let \( N = 2\beta \varepsilon w_{o} \), \( Y = (1 - \theta )\varepsilon b + \beta \varepsilon \theta v + (1 - \theta )\alpha w_{0}+ \beta \varepsilon c \), we can rewrite \( s_{D}^{ * } \) to

Let \( F(A) = - A^{2} N + AY - (1 - \theta )\alpha c \), let \( F(A) = 0 \), there are two roots of \( F(A) \), one of the roots is \( A_{1} = \frac{{Y + \sqrt {Y^{2} - 4N(1 - \theta )\alpha c} }}{2N} \) and \( A_{2} = \frac{{Y - \sqrt {Y^{2} - 4N(1 - \theta )\alpha c} }}{2N} \).

For \( A_{ 1} \), we assume \( A_{1} \ge 1 \), then we have

As \( s_{B}^{ * } = \left( {\frac{ - N + Y - (1 - \theta )\alpha c}{{2(1 - \theta )\eta + 2\beta \varepsilon^{2} - 2(1 - \theta )\alpha \varepsilon }}} \right)^{ + } \ge 0 \) and \( 2(1 - \theta )\eta + 2\beta \varepsilon^{2} - 2(1 - \theta )\alpha \varepsilon \ge 0 \), we can see \( - N + Y - (1 - \theta )\alpha c \ge 0 \). Thus, we can eliminate this root \( A_{ 1} \).

For \( A_{2} = \frac{{Y - \sqrt {Y^{2} - 4N(1 - \theta )\alpha c} }}{2N} \), we find when \( 0 \le A \le \frac{{Y - \sqrt {Y^{2} - 4N(1 - \theta )\alpha c} }}{2N} \), \( F(A) \le 0 \), then \( s_{D}^{ * } \le 0 \). This implies that the manufacturer will not overstate. □

1.4 Proof of Theorem 4

Recall \( s_{B}^{ * } = \left( {\frac{ - N + Y - (1 - \theta )\alpha c}{{2(1 - \theta )\eta + 2\beta \varepsilon^{2} - 2(1 - \theta )\alpha \varepsilon }}} \right)^{ + } \) and \( s_{D}^{ * } = \left( {\frac{{ - A^{2} N + AY - (1 - \theta )\alpha c}}{{2(1 - \theta )\eta + 2A^{2} \beta \varepsilon^{2} - 2A(1 - \theta )\alpha \varepsilon }}} \right)^{ + } \).

Suppose \( s_{D}^{ * } \le s_{B}^{ * } \), then we have \( \frac{{ - A^{2} N + AY - (1 - \theta )\alpha c}}{{2(1 - \theta )\eta + 2A^{2} \beta \varepsilon^{2} - 2A(1 - \theta )\alpha \varepsilon }} \le \frac{ - N + Y - (1 - \theta )\alpha c}{{2(1 - \theta )\eta + 2\beta \varepsilon^{2} - 2(1 - \theta )\alpha \varepsilon }} \)

Dividing both sides by \( (1 - A) \) and shifting the items, we can get when \( 0 \le A \le \frac{{(1 - \theta )\eta (Y - N){ + }(1 - \theta )\alpha \varepsilon c(\beta \varepsilon - (1 - \theta )\alpha )}}{{(1 - \theta )N(\eta - \alpha \varepsilon ) + \beta \varepsilon^{2} (Y - (1 - \theta )\alpha c)}} \), then, \( s_{D}^{ * } \le s_{B}^{ * } \); otherwise, \( s_{D}^{ * } > s_{B}^{ * } \).

Recall the optimal retail price in the benchmark and the deferred payment are:

Compare \( r_{B}^{*} \) and \( r_{D}^{*} \), we can have

\( r_{D}^{ * } \le r_{B}^{ * } \). We can rewrite the inequality to,

We divide both sides by \( (1 - A) \) and shift the items, we can get if

then \( r_{D}^{ * } \le r_{B}^{ * } \); otherwise, \( r_{D}^{ * } > r_{B}^{ * } \). □

1.5 Proof of Theorem 5

Recall \( s_{I}^{ * } { = }\left( {\frac{K - [K + ((1 - \theta )\alpha - \beta \varepsilon )(c - v)]\lambda }{L - [L - 2(1 - \theta )\eta ]\lambda }} \right)^{ + } \) and \( s_{D}^{ * } = \left( {\frac{{ - A^{2} N + AY - (1 - \theta )\alpha c}}{{2(1 - \theta )\eta + 2A^{2} \beta \varepsilon^{2} - 2A(1 - \theta )\alpha \varepsilon }}} \right)^{ + } \).

Let \( G = [(1 - \theta )\eta + A^{2} \beta \varepsilon^{2} - A(1 - \theta )\alpha \varepsilon ] \),\( J = [ - A^{2} N + AY - (1 - \theta )\alpha c] \) and \( Z = [K + ((1 - \theta )\alpha - \beta \varepsilon )(c - v)] \).

We find that if \( \frac{2KG - JL}{2ZG - J[L - 2(1 - \theta )\eta ]} \le \lambda \le 1 \), then \( s_{D}^{ * } \ge s_{I}^{ * } \); otherwise, \( s_{D}^{ * } < s_{I}^{ * } \).

For the retail price in the inspection,

Recall the expression of the optimal sale price in the deferred payment at Proof of Theorem 4, when \( r_{D}^{ * } \ge r_{I}^{ * } \), we have,

In order to simplify calculation, let \( X = ((1 - \theta )\alpha + \beta \varepsilon )K + 2\beta w_{o} ((1 - \theta )\eta { + }\beta \varepsilon^{2} - (1 - \theta )\alpha \varepsilon ) \),

the inequality can be simplified as,

Thus, if \( 0 \le \lambda \le \frac{{(1 - \theta )\eta (H - X) + \beta \varepsilon^{2} (H - A^{2} X) + (1 - \theta )\alpha \varepsilon (AX - H)}}{{-(1 - \theta )\eta Q + \beta \varepsilon^{2} (H - A^{2} Q) + (1 - \theta )\alpha \varepsilon (AQ - H)}} \), \( r_{D}^{ * } \ge r_{I}^{ * } \); otherwise, \( r_{D}^{ * } < r_{I}^{ * } \).(Q.E.D.)

Rights and permissions

About this article

Cite this article

Shen, B., Deng, Y., Wang, X. et al. Overstated product sustainability: real cases and a game-theoretical analysis. Ann Oper Res 291, 779–797 (2020). https://doi.org/10.1007/s10479-018-3002-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3002-0