Abstract

This paper introduces a scheme for hedging and managing production costs of a risky generation portfolio, initially assumed to be dispatchable, to which intermittent electricity generation from non-dispatchable renewable sources like wind is further added. The proposed hedging mechanism is based on fixing the total production level in advance, then compensating any unpredictable non-dispatchable production with a matching reduction of the dispatchable fossil fuel production. This means making no recourse to short term techniques like financial hedging or storage, in a way fully internal to the portfolio itself. Optimization is obtained in the frame of the stochastic LCOE theory, in which fuel costs and \(\hbox {CO}_2\) prices are included as uncertainty sources besides intermittency, and in which long term production cost risk, proxied either by LCOE standard deviation and LCOE CVaR Deviation, is minimized. Closed form solutions for optimal hedging strategies under both risk measures are provided. Main economic consequences are discussed. For example, this scheme can be seen as a method for optimally including intermittent renewable sources in an otherwise dispatchable generation portfolio under a long term capacity expansion perspective. Moreover, within this hedging scheme, (1) production cost risk is reduced and optimized as a consequence of the substitution of the dispatchable fossil fuel generation with non-dispatchable \(\hbox {CO}_2\) free generation, and (2) generation costs can be reduced if the intermittent generation can be partially predicted.

Similar content being viewed by others

Notes

A thirty years horizon is a typical time horizon for LCOE analyses (EIA 2016a).

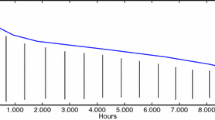

Annual variability of the intermittent source is not considered in this study. The reason is that the impact it has on the costs of generation portfolios over a thirty years time horizon is negligible, because fluctuations around the average annual electricity production are independent events that cancel each other in average over time. This risk is, in fact, very different from price risks (fossil fuels and \(\hbox {CO}_2\)) which are described by stochastic processes autocorrelated over time, and we can safely avoid to model it.

This could seem a penalizing strategy for the producer in those power markets in which all the intermittent renewable energy is injected into the grid on the basis of well defined purchasing agreements, and real time balancing is handled by the system operator. In this case, on the contrary, it is a revenues maximizing strategy too. In fact, if at the jth hour of the kth year a producer generates energy in excess from intermittent sources, say \(q^\text {wi,un}_{j,k}\), with respect to the scheduled quantity, say \(q_{j,k}\), the system operator requires for balancing reasons that some producer reduces its generation of an equivalent quantity \(q^\text {wi,un}_{j,k}\). The system (i.e. the electricity market) pays the producer for all the injected energy \(q_{j,k}+q^\text {wi,un}_{j,k}\), and the producer for its service. All in all, only the scheduled amount of electricity \(q_{j,k}\) is injected in the power system. In our scheme, the producer injects \(q_{j,k}+q^\text {wi,un}_{j,k}\), but at the same time signals to the system operator its availability for reducing its generation by \(q^\text {wi,un}_{j,k}\). In our case the producer enjoys not only the revenue from \(q_{j,k}+q^\text {wi,un}_{j,k}\) but also the revenue from its dispatching service (for reducing dispatchable production by \(q^\text {wi,un}_{j,k}\)).

We assume that the power capacity of fossil fuel components of the starting dispatchable portfolio allows for each electricity reducing admissible strategy described by Eq. (2.14).

For the CVaRD risk measure the confidence level has been taken equal to 95%.

Let us recall that if c is a constant and f is a random variable, the following relationships hold

$$\begin{aligned} D(f+c)= & {} D(f),\\ D(cf)= & {} c D(f). \end{aligned}$$

References

Chen, H. (2017). Power grid operation in a market environment: Economic efficiency and risk mitigation. Wiley-IEEE Press.

Clements, A. E., Hurn, A. S., & Li, Z. (2016). Strategic bidding and rebidding in electricity markets. Energy Economics, 59, 24–36.

DeLlano-Paz, F., Calvo-Silvosa, A., Iglesias, S., & Soares, I. (2017). Energy planning and modern portfolio theory: A review. Renewable and Sustainable Energy Reviews, 77, 636–651.

Du, Y., & Parsons, J. E. (2009). Update on the cost of nuclear power. In MIT working paper.

EIA. (2016). Levelized cost and levelized avoided cost of new generation resources in the annual energy outlook 2016. U.S. Energy Information Administration, Department of Energy.

EIA. (2016). Annual energy outlook 2016. U.S. Energy Information Administration, Department of Energy.

EIA. (2016). Capital cost estimates for utility scale electricity generating plants. U.S. Energy Information Administration, Department of Energy.

European Commission. (2010). Designing appropriate obligations and penalties. Bruxelles, Belgium: Capacity Mechanism Working Group.

Feng, Z. H., Zou, L. L., & Wei, Y. M. (2011). Carbon price volatility: Evidence from EU ETS. Applied Energy, 88, 590–598.

García-Martos, C., Rodríguez, J., & Sánchez, M. J. (2013). Modelling and forecasting fossil fuels, CO\(_{2}\) and electricity and their volatilities. Applied Energy, 101, 363–375.

Hadjipaschalis, I., & Poullikkas, A. (2009). Overview of current and future energy storage technologies for electric power applications. Renewable and Sustainable Energy Reviews, 13, 1513–1522.

Hittinger, E., Whitacre, J. F., & Apt, J. (2010). Compensating for wind variability using co-located natural gas generation and energy storage. Energy Systems, 1, 417–439.

Hodge, B.-M., et al. (2012). Wind power forecasting error distributions: An international comparison. National Renewable Energy Laboratory.

Hogue, M. T. (2012). A review of the costs of nuclear power generation. BEBR, University of Utah.

IEA. (2016). IEA Wind—2015 annual report. International Energy Agency.

IEA-NEA. (2015). Projected costs of generating electricity. Paris, France: OECD.

Joskow, P. L. (2011). Comparing the costs of intermittent and dispatchable electricity generating technologies. American Economic Review, 101, 238–241.

Jung, J., & Broadwater, R. P. (2014). Current status and future advances for wind speed and power forecasting. Renewable and Sustainable Energy Reviews, 31, 762–777.

Kagiannas, A. G., Askounis, D. T., & Psarras, J. (2004). Power generation planning: A survey from monopoly to competition. Electrical Power and Energy Systems, 26, 413–421.

Krokhml, P., Palmquist, J., & Uryasev, S. (2002). Portfolio optimization with conditional value-at-risk: Objective and constraints. The Journal of Risk, 4, 3–68.

Lazard. (2015). Lazard’s levelized cost of storage analysis—version 1.0.

Lucheroni, C., Boland, J., & Ragno, C. (2019). Scenario generation and probabilistic forecasting analysis of spatio-temporal wind speed series with multivariate autoregressive volatility models. Applied Energy, 239, 1226–1241.

Lucheroni, C., & Mari, C. (2017). CO\(_{2}\) volatility impact on energy portfolio choice: A fully stochastic LCOE theory analysis. Applied Energy, 190, 278–290.

Lucheroni, C., & Mari, C. (2018). Risk shaping of optimal electricity portfolios in the stochastic LCOE theory. Computers and Operations Research, 96, 374–385.

Lucheroni, C., & Mari, C. (2018). Optimal integration of intermittent renewables: A system LCOE stochastic approach. Energies 11.

Lujano-Rojas, J. M., Osório, G. J., Matias, J. C. O., & Catalão, J. P. S. (2016). Wind power forecasting error distributions and probabilistic load dispatch. Boston: IEEE - Power and Energy Society General Meeting.

Madureira, N. L. (2014). Key concepts in energy. London: Springer.

Mari, C. (2014). Hedging electricity price volatility using nuclear power. Applied Energy, 113, 615–621.

Markowitz, H. (1952). Porfolio selection. Journal of Finance, 77, 77–91.

MIT. (2003). The future of nuclear power. USA: Cambridge.

NREL. (2012). Renewable electricity futures study. National Renewable Energy Laboratory.

Reichelstein, S., & Sahoo, A. (2015). Time of day pricing and the levelized cost of intermittent power generation. Energy Economics, 48, 97–108.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. The Journal of Risk, 2, 21–41.

Ross, S. A., Westerfield, R. W., & Jaffe, J. (2010). Corporate finance. NY: McGraw-Hill.

Roy, S. (2016). Uncertainty of optimal generation cost due to integration of renewable energy sources. Energy Systems, 7, 365–389.

Stacy, T. F., & Taylor, G. (2015). The levelized cost of electricity from existing generation resources. Washington, DC: Institute for Energy Research.

Taylor, G., & Tanton, T. (2012). The hidden costs of wind electricity. American Tradition Institute.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Proof of Eqs. (3.4) and (3.5)

Proof of Eqs. (3.4) and (3.5)

Let us denote by D a generic deviation measure, like standard deviation or CVaRD. From Eq. (2.20), the cost risk of the hedged portfolio \(D \big (P^\text {LC,w}_h(\xi )\big )\), can be expressed asFootnote 6

Since the coefficients of \(P^\text {LC,ga}\) and \(P^\text {LC,co}\) do not sum to 1, we can rearrange Eq. (A.1) in the following way

in which Eqs. (2.18) and (2.19) were used. Since the coefficients of \(P^\text {LC,ga}\) and \(P^\text {LC,co}\) within the D operator sum to 1, in the case of the standard deviation the minimum risk hedging strategy can now be obtained by solving in h the equation

In the case of CVaRD the minimum risk hedging strategy can be instead obtained by solving in h the equation

Rights and permissions

About this article

Cite this article

Lucheroni, C., Mari, C. Internal hedging of intermittent renewable power generation and optimal portfolio selection. Ann Oper Res 299, 873–893 (2021). https://doi.org/10.1007/s10479-019-03221-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03221-2