Abstract

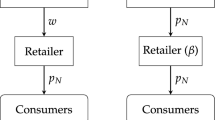

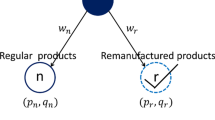

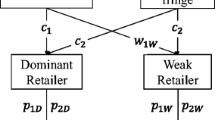

The emergence of online retail platforms and new retail technologies have enabled retailers to sell refurbished products to different markets, which exposes manufacturers to new challenges to control refurbished product market. This study investigates the incentives of supply chain members for refurbished products in a dual-channel supply chain. We examine the conditions under which the retailer is willing to sell refurbished products and the impact of refurbished products on manufacturer’s profits in three different cases, i.e., local market selling, across market selling, and dual market selling. Our results reveal that the manufacturer can effectively control the selling of refurbished products by a wholesale price contract when the retailer can only deliver refurbished products to her local market. However, when the retailer has the ability to deliver refurbished products into a cross-border market, supply chain members encounter different incentives for refurbished products.

Similar content being viewed by others

References

Abbey, J. D., Meloy, M. G., Blackburn, J., & Guide, V. D. R, Jr. (2015). Consumer markets for remanufactured and refurbished products. California Management Review, 57(4), 26–42.

Abbey, J. D., Blackburn, J. D., & Guide, V. D. R, Jr. (2015). Optimal pricing for new and remanufactured products. Journal of Operations Management, 36, 130–146.

Arya, A., Mittendorf, B., & Sappington, D. E. (2007). The bright side of supplier encroachment. Marketing Science, 26(5), 651–659.

Businesswire (2014). Consumers choosing refurbished products to be environmentally responsible, according to Liquidity Services’ survey. Online: https://www.businesswire.com/news/home/20140424005308/en/.

Cai, G. G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86(1), 22–36.

Cattani, K., Gilland, W., Heese, H. S., & Swaminathan, J. (2006). Boiling frogs: Pricing strategies for a manufacturer adding a direct channel that competes with the traditional channel. Production and Operations Management, 15(1), 40.

Chen, J., & Bell, P. C. (2013). The impact of customer returns on supply chain decisions under various channel interactions. Annals of Operations Research, 206(1), 59–74.

Chen, K. Y., Kaya, M., & Özer, Ö. (2008). Dual sales channel management with service competition. Manufacturing & Service Operations Management, 10(4), 654–675.

Chiang, W. Y. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(1), 1–20.

Fein, A. J., & Anderson, E. (1997). Patterns of credible commitments: Territory and brand selectivity in industrial distribution channels. Journal of Marketing, 61(2), 19–34.

Frazier, G. L., & Lassar, W. M. (1996). Determinants of distribution intensity. Journal of Marketing, 60(4), 39–51.

Gross, J., & Holahan, W. L. (2003). Credible collusion in spatially separated markets. International Economic Review, 44(1), 299–312.

Guo, H., Zhang, Y., Zhang, C., Liu, Y., & Zhou, Y. (2018). Location-inventory decisions for closed-loop supply chain management in the presence of the secondary market. Annals of Operations Research, 291, 361.

Ha, A., Long, X., & Nasiry, J. (2016). Quality in supply chain encroachment. Manufacturing & Service Operations Management, 18(2), 280–298.

Huang, S., Guan, X., & Chen, Y. J. (2018). Retailer information sharing with supplier encroachment. Production and Operations Management, 27(6), 1133–1147.

Jin, Y., Muriel, A., & Lu, Y. (2016). When to offer lower quality or remanufactured versions of a product. Decision Sciences, 47(4), 699–719.

Kleber, R., Reimann, M., Souza, G. C., & Zhang, W. (2018). On the robustness of the consumer homogeneity assumption with respect to the discount factor for remanufactured products. European Journal of Operational Research, 269(3), 1027–1040.

Kumar, M. P., & Kumar, T. S. (2014). E-business: Pros and cons in Customer Relationship Management. International Journal of Management and International Business Studies, 4(3), 349–356.

Li, Q., Li, B., Chen, P., & Hou, P. (2017). Dual-channel supply chain decisions under asymmetric information with a risk-averse retailer. Annals of Operations Research, 257(1–2), 423–447.

Liu, Y., & Zhang, Z. J. (2006). Research note: The benefits of personalized pricing in a channel. Marketing Science, 25(1), 97–105.

Liu, H., Lei, M., Huang, T., & Leong, G. K. (2018). Refurbishing authorization strategy in the secondary market for electrical and electronic products. International Journal of Production Economics, 195, 198–209.

Montero, J. P. (2001). Multipollutant markets. RAND Journal of Economics, 32, 762–774.

Mussa, M., & Rosen, S. (1978). Monopoly and product quality. Journal of Economic theory, 18(2), 301–317.

Nidhi, S. (2015). Business Today. As Good as New: refurbished gadgets, which have caught the fancy of the Indian consumer, come at a considerable discount.

Niu, B., Chen, L., Zou, Z., & Ji, P. (2019). Demand signal transmission in a certified refurbishing supply chain: rules and incentive analysis. Annals of Operations Research,. https://doi.org/10.1007/s10479-019-03397-7.

Ovchinnikov, A. (2011). Revenue and cost management for remanufactured products. Production and Operations Management, 20(6), 824–840.

Rallo J. (2018). The rise of refurbished products. Liquidity.

Rodríguez, S. V., Plà, L. M., & Faulin, J. (2014). New opportunities in operations research to improve pork supply chain efficiency. Annals of Operations Research, 219(1), 5–23.

Shao, J., Krishnan, H., & McCormick, S. T. (2016). Gray markets and supply chain incentives. Production and Operations Management, 25(11), 1807–1819.

Stock, J., Speh, T., & Shear, H. (2006). Managing product returns for competitive advantage. MIT Sloan Management Review, 48(1), 57.

Taleizadeh, A. A., Sane-Zerang, E., & Choi, T. M. (2016). The effect of marketing effort on dual-channel closed-loop supply chain systems. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 48(2), 265–276.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the e-commerce age. Production and Operations Management, 13(1), 93–110.

Van Der Laan, E., Salomon, M., Dekker, R., & Van Wassenhove, L. (1999). Inventory control in hybrid systems with remanufacturing. Management Science, 45(5), 733–747.

Vasudevan, H., Kalamkar, V., & Terkar, R. (2012). Remanufacturing for Sustainable Development: KeyChallenges, Elements, and Benefits. International Journal of Innovation, Management and Technology, 3(1), 84.

Vorasayan, J., & Ryan, S. M. (2006). Optimal price and quantity of refurbished products. Production and Operations Management, 15(3), 369–383.

Wang, X., Mai, F., & Chiang, R. H. (2014). Database submission: Market dynamics and user-generated content about tablet computers. Marketing Science, 33(3), 449–458.

Wu, J., Chen, Z., & Ji, X. (2020). Sustainable trade promotion decisions under demand disruption in manufacturer-retailer supply chains. Annals of Operations Research, 290(1), 115–143.

Yang, Z., Hu, X., Gurnani, H., & Guan, H. (2018). Multichannel distribution strategy: Selling to a competing buyer with limited supplier capacity. Management Science, 64(5), 2199–2218.

Yenipazarli, A. (2016). Managing new and remanufactured products to mitigate environmental damage under emissions regulation. European Journal of Operational Research, 249(1), 117–130.

Yoo, S. H., & Kim, B. C. (2016). Joint pricing of new and refurbished items: A comparison of closed-loop supply chain models. International Journal of Production Economics, 182, 132–143.

Zhao, D., & Li, Z. (2018). The impact of manufacturer’s encroachment and nonlinear production cost on retailer’s information sharing decisions. Annals of Operations Research, 264(1–2), 499–539.

Zhang, Z., Wu, J., & Wei, F. (2019). Refurbishment or quality recovery: joint quality and pricing decisions for new product development. International Journal of Production Research, 57(8), 2327–2343.

Zhou, S. X., Tao, Z., & Chao, X. (2011). Optimal control of inventory systems with multiple types of remanufacturable products. Manufacturing & Service Operations Management, 13(1), 20–34.

Zikopoulos, C., & Tagaras, G. (2007). Impact of uncertainty in the quality of returns on the profitability of a single-period refurbishing operation. European Journal of Operational Research, 182(1), 205–225.

Acknowledgements

The authors thank three anonymous referees for their constructive comments that improve the contents and presentation of the paper significantly. Shijian Hong gratefully acknowledges the research support by National Social Science Foundation of China through grant 20BJL108. The work is also financially supported by National Natural Science Funds of China (Nos. 71801206, 71971203, 71921001), National Social Science Foundation of China (No. 20BJL108), USTC Research Funds of the Double First-Class Initiative (YD2040002004), Special Research Assistant Support Program of Chinese Academy of Sciences, the Four Batch Talent Programs of China, and the Fundamental Research Funds for the Central Universities (WK2040000027).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: proof

Appendix: proof

Proof of Lemma 1

We use the backward induction method to solve the problem. First we analyze the retailer’s profit function \(\pi _R^N=(p_n^N-w_n^N-c_{ns})(1-p_n^N)\), and get the optimal \(p_n^{N}\) as a function of \(w_n^N\). As two markets are independent, after solving the manufacturer’s problem \(\pi _M^N=(w_n^N-c_n)(1-p_n^N)+(p_d^N-c_n-c_{ns})(1-p_d^N)\), we can get the optimal \(p_d^{N}\) and \(w_n^N\) respectively.

Proof of Lemma 2

We first show that \(\pi _R^{L}\) is jointly concave in \(p_n^L\) and \(p_r^L\) by examining the Hessian matrix \(H_1= \begin{bmatrix} \frac{2}{(\gamma -1)\lambda } &{} \frac{2}{(1-\gamma )\lambda } \\ \frac{2}{(1-\gamma )\lambda } &{} \frac{2}{(\gamma -1)\lambda \gamma } \end{bmatrix}\). It is straightforward to check that \(H_1\) is negative definite. So the first order conditions (FOC) are necessary and sufficient to obtain the solutions. We find \(p_n^{L*}=\frac{\lambda +c_{ns}+w_n}{2}\), \(p_r^{L*}=\frac{\lambda \gamma +w_r}{2}\). Similarly, we solve the manufacturer’s problem. As two markets are independent, we can obtain the optimal retail price set by the manufacturer in his direct channel \(p_d^{L*}=\frac{1+c_n+c_{ns}}{2}\) by FOC. Then, we show that \(\pi _M^{L}\) is jointly concave in \(w_n^L\) and \(w_r^L\) by examining the Hessian matrix \(H_2= \begin{bmatrix} \frac{1}{(\gamma -1)\lambda } &{} \frac{1}{(1-\gamma )\lambda } \\ \frac{1}{(1-\gamma )\lambda } &{} \frac{1}{(\gamma -1)\lambda \gamma } \end{bmatrix}\). It is straightforward to check that \(H_2\) is negative definite. So the FOCs again are necessary and sufficient to find the solutions. We find \(w_n^{L*}=\frac{\lambda +c_{n}-c_{ns}}{2}\), \(w_r^{L*}=\frac{\lambda \gamma }{2}\). Finally, we can obtain the demands for the new and refurbished products in two markets, \(D_{1n}^L=\frac{\lambda (1-\gamma )-(c_{n}+c_{ns})}{4\lambda (1-\gamma )}, D_{1r}=\frac{c_{n}+c_{ns}}{4\lambda (1-\gamma )}\). To make sure \(D_{1n}^L\ge 0\), we need \(c_{n}+c_{ns}\le \lambda (1-\gamma )\). Using the similar way, we can obtain the optimal decisions in Lemma 4 and Lemma 6, we’ve omitted the proofs.

All the propositions in this paper are based on the comparison of the manufacturer’s and retailer’s profits in different cases.

Rights and permissions

About this article

Cite this article

Chen, Z., Hong, S., Ji, X. et al. Refurbished products and supply chain incentives. Ann Oper Res 310, 27–47 (2022). https://doi.org/10.1007/s10479-021-04016-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04016-0