Abstract

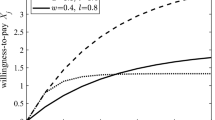

Empirical studies have shown strong evidence that a seller with a better customer feedback score is able to charge a higher price for his/her product or service. We study the problem faced by the seller of setting the price with the objective of maximizing expected revenue over a finite number of periods. Modeling the problem requires building a system of processes that includes: (1) the customer arrival and formation of customer reservation price; (2) the customer feedback collection and aggregation into a Seller Service Rating (SSR); and (3) determining how much to charge customers. Because of the technical difficulty in finding analytical solutions that fully reflect the closed-loop interconnections between these processes, we develop a simulation–optimization approach to solve the problem. We present a computational study and report on results of numerical experiments providing interesting insights on how the retailer could startegically align the price he charges with his service quality performance.

Similar content being viewed by others

Notes

"How JACK & JONES gained 35% more satisfied customers in 6 months" accessed on July 13, 2021 at https://www.happy-or-not.com/en/customer-stories/jack-jones-how-european-fashion-company-gained-35-more-satisfied-customers-in-6-months/.

Dellarocas (2003) defines a Stackelberg retailer as a reputable seller who commits to achieving a long term performance success by constantly and consistently improving his service quality.

See Nagaraj, A. Your Ultimate Guide to Maintain Amazon Seller Feedback 2020 can be accessed at https://www.sellerapp.com/blog/amazon-seller-feedback/#1.

This is in contrast to Gallego and van Ryzin (1994)’s assumption that demand intensity is exponential and that it is only dependent on price.

SSR may also be based on a time window that is much longer than a single review period. For example, eBay uses a 12 month rolling window which is longer than the entire selling period for most perishable product.

Other approaches include statistical measures such as weighted average, exponential smoothing, median etc., collaborative filtering, and adhoc algorithms (see page 30 of Dellarocas, 2001).

See Cuofano, G., “What Is The Bandwagon Effect And Why It Matters In Business,” accessed on June 11, 2021 at https://fourweekmba.com/bandwagon-effect/.

Posting online under the seller’s profile a listing of prestigious awards the retailer has won supplemented with written testimonials from credible reviewers or experts could reinforce the consumers’ belief and trust that the retailer is a Stackelberg type.

Generally, feedback submission is voluntary and fewer than K feedbacks is possible. Deferment of an SSR update is not unusual. On eBay, the average rating is calculated only when a seller has received at least 5 ratings. If a seller hasn't received at least 5 ratings in a category, the average rating won't appear. (For more details, see http://pages.ebay.com/help/feedback/detailed-seller-ratings.html).

The Nelder-Mead simplex method is an efficient derivative free solution procedure for solving an unsconstrained optimization problem (Lagarias et al., 1998).

We remark that terminals with four bottons are also employed. The two additional bottons are incribed with partial smiley or frowney faces representing customer satisfaction levels between fully satisfied and fully dissatisfied. We reserve the analysis of feedback collected from four button terminals for future research.

The parameter values originated from proprietary data and have been disguised.

Chan, M. (2017) How Your Pricing Strategy Affects Customer Satisfaction, accessed on June 11, 2021 at https://www.unleashedsoftware.com/blog/pricing-strategy-affects-customer-satisfaction

References

Alfieri, A., Matta, A., & Pedrielli, G. (2015). Mathematical programming models for joint simulation–optimization applied to closed queueing networks. Annals of Operations Research, 231, 105–127. https://doi.org/10.1007/s10479-013-1480-7

Almeder, C., Preusser, M., & Hartl, R. (2008). Simulation and optimization of supply chains: Alternative or complementary approaches? Or Spectrum, 31(1), 95–119. https://doi.org/10.1007/s00291-007-0118-z

Amaran, S., Sahinidis, N. V., Sharda, B., Sharda, B., & Bury, S. (2016). Simulation optimization: A review of algorithms and applications. Annals of Operation Research, 12, 301–333. https://doi.org/10.1007/s10288-014-0275-2

Atlason, J., Epelman, M. A., & Henderson, S. G. (2004). Call center staffing with simulation and cutting plane methods. Annals of Operations Research, 127, 333–358. https://doi.org/10.1023/B:ANOR.0000019095.91642.bb

Ba, S., & Pavlou, P. (2002). Evidence of the effect of trust building technology in electronic marketplaces: Price premiums and buyer behavior. MIS Quarterly, 26(3), 243–268.

Babaioff, M., Dughmi, S., Kleinberg, R., & Slivkins, A. (2015). Dynamic pricing with limited supply ACM. Transactions on Economics and Computation (TEAC), 3(1), 4.

Cabral, L., & Hortaçsu, A. (2010). The dynamics of seller reputation: Evidence from eBay. The Journal of Industrial Economics, 58(1), 54–78.

Cachon, G., & Terwiesch, C. (2013). Matching supply and demand: An introduction to operations management (3rd ed.). McGraw-Hill Irwin.

Chintagunta, P., Gopinath, S., & Venkataraman, S. (2010). The effects of online user reviews on movie box office performance: Accounting for sequential rollout and aggregation across local markets. Marketing Science, 29(5), 944–957.

Dellarocas, C. (2001). The digitization of Wor-of-mouth: Promise and challenges of online reputation. Management Science, 49(10), 1407–1424.

Dellarocas, C. (2003). The digitization of word of mouth: Promise and challenges on online feedback mechanisms. Management Science, 49(10), 1407–1424.

Dellarocas, C. (2004). Sanctioning reputation mechanisms in online trading environments with moral hazard (July 2004). Available at SRN: http://dx.doi.org/https://doi.org/10.2139/ssrn.393043

Dellarocas, C., & Wood, C. (2008). The sound of silence in online feedback: Estimating trading risks in the presence of reporting bias. Management Science, 54(3), 460–476.

Do, N., Nielsen, I., Chen, G., & Nielsen, P. (2016). A simulation-based genetic algorithm approach for reducing emissions from import container pick-up operation at container terminal. Annals of Operations Research, 242, 285–301.

Elmaghraby, W., & Keskinocak, W. (2003). Dynamic pricing in the presence of inventory considerations: Research overview, current practices, and future directions. Management Science, 49(10), 1287–1309.

Gallego, G., & van Ryzin, G. (1994). Optimal dynamic pricing of inventories with stochastic demand over finite horizons. Management Science, 40(8), 999–1020.

Gallego, G., & van Ryzin, G. (1997). A multiproduct dynamic pricing problem and its application to network yield management. Annals of Operations Research, 45(1), 24–41.

Harrison, M., Keskin, B., & Zeevi, A. (2011). Bayesian dynamic pricing policies: Learning and earning under a binary prior distribution. Management Science, 58(3), 570–586.

Heymans, M. (2015). Handling missing data. Amsterdam Public Health, Ouality Handbook.

Homburg, C., Hoyer, W.D., & Koschate, N. (2005). Customers’ reactions to price increases: Do customer satisfaction and perceived motive fairness matter? Journal of the Academy of Marketing Science, 33, 36. https://doi.org/10.1177/0092070304269953.

Ivanov, S. H., & Zhechev, V. S. (2011). Hotel revenue management – a critical literature review. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1977467

Jalali, H., & Van Nieuwenhuyse, I. (2015). Simulation optimization in inventory replenishment: A classification. IIE Transactions, 47(11), 1217–1235. https://doi.org/10.1080/0740817X.2015.1019162

Jian, N. and Henderson, S. (2015) An introduction to simulation optimization. In: L. Yilmaz, W. K. V. Chan, I. Moon, T. M. K. Roeder, C. Macal, and M. D. Rossetti, eds. Proceedings of the 2015 Winter Simulation Conference.

Jurca, R., Faltings, B. (2005). Reputation-based pricing of P2P services. P2PECON '05. In: Proceedings of the 2005 ACM SIGCOMM workshop on Economics of peer-to-peer systems, pp. 144–149.

Kelman, J., Stedinger, J., Cooper, L., & Hsu, E. (1990). Sampling stochastic dynamic programming applied to reservoir operation. Water Resource Research, 26(3), 447–454.

Keskin, B., & Zeevi, A. (2014). Dynamic pricing with an unknown demand model: Asymptotically optimal semi-myopic policies. Operations Research, 62(5), 1142–1167.

Lagarias, J., Reeds, J., Wright, M., & Wright, P. (1998). Convergence properties of the Nelder-Mead simplex method in low dimensions. SIAM Journal of Optimization, 9(1), 112–147.

Lariviere, M., & Porteus, E. (2001). Selling to the newsvendor: An analysis of price-only contracts. Manufacturing and Service Operations Management, 3, 293–305.

Levina, T., Levin, Y., McGill, J., & Nediak, M. (2009). Dynamic pricing with online learning and strategic consumers: An application of the aggregating algorithm. Operations Research, 57(2), 327–341.

Lieber C. (2018), "Why fashion brands destroy billions’ worth of their own merchandise every year," accessed on July 17, 2021 at www.vox.com/the-goods/2018/9/17/17852294/fashion-brands-burning-merchandise-burberry-nike-h-and-m

Luo, W., & Chung, Q. (2010). Retailer reputation and online pricing strategy. The Journal of Computer Information System., 50(4), 50–56.

Maglaras, C., & Meissner, J. (2006). Dynamic pricing strategies for multiproduct revenue management problems. Manufacturing Service and Operations Management, 8(2), 136–148.

Mayzlin, D., Dover, Y., & Chevalier, J. (2014). Promotional reviews: An empirical investigation of online review manipulation. American Economic Review, 104(8), 2421–2455.

Owen, D. (2018), Customer Satisfaction at the Push of a Button,The World of Business, February 5, 2018 Issue, access at https://www.newyorker.com/magazine/2018/02/05/customer-satisfaction-at-the-push-of-a-button

Pasupathy, R. and Henderson, S. (2011) SimOpt: A library of simulation optimization problems. In: Proceedings of the 2011 Winter Simulation Conference (WSC), Phoenix, AZ, 2011, pp. 4075–4085, doi: https://doi.org/10.1109/WSC.2011.6148097.

Pasupathy, R., & Ghosh, S. (2014). Simulation optimization: A concise overview and implementation guide. INFORMS Tutorials in Operations Research. https://doi.org/10.1287/educ.2013.0118

Pekgün, P., Galbreth, M. R., & Ghosh, B. P. (2017). How unequal perceptions of user reviews impact price competition. Decision Sciences., 49(2), 250–273.

Peng, Y., Wang, W., Xu, X., Chen, M., Song, X., & Li, X. (2018). Solving Markov decision processes for network-level post-hazard recovery via simulation optimization and rollout. Journal of Advanced Transportation. https://doi.org/10.1155/2018/4805250

Sigman, K. (2007), Simulating Markov Chains, access to article at http://www.columbia.edu/~ks20/4703-Sigman/4703-07-Notes-MC.pdf

Smith, S., & Achabal, D. (1998). Clearance pricing and inventory policies for retail chains. Management Science, 44(3), 285–300. https://doi.org/10.1287/mnsc.44.3.285

Soysal, M., & Çimen, M. (2017). A simulation based restricted dynamic programming approach for the green time dependent vehicle routing problem. Computers & Operations Research, 88, 297–305.

Tadelis, S. (2016). Reputation and feedback systems in online platform markets. Annual Review of Economics, 8(1), 321–340.

Talluri, K., & van Ryzin, G. (2004a). Revenue management under a general discrete choice model of consumer behavior. Management Science, 50(1), 15–33.

Talluri, K., & van Ryzin, G. (2004b). The theory and practice of revenue management. Kluwer Academic Publishers.

Tejada-Guibert, J. A., Johnson, S., & Stedinger, J. (1993). Comparison of two approaches for implementing multireservoir operating policies derived using stochastic dynamic programming. Water Resource Research, 29(12), 3969–3980.

Tsay, A., & Agrawal, N. (2000). Channel dynamics under price and service competition. Manufacturing and Service Operations Management, 2(4), 372–391.

Ursavas, E. (2015). Priority control of berth allocation problem in container terminals. Annals of Operations Research. https://doi.org/10.1007/s10479-015-1912-7

Yu, M., Debo, L., & Kapuscinski, R. (2016). Strategic waiting for consumer generated quality information: Dynamic pricing of new experience goods. Management Science, 62(2), 410–435.

Acknowledgements

This study has been supported by the Lary and Lori Wright Research Fellowship.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proofs

Proof of Proposition 1 Denote \(x_{2} (r) = p_{2} - \phi r - \upsilon\) and \(x_{1} (r) = p_{1} - \phi r - \upsilon\). \(x_{2} (r) > x_{1} (r)\) since \(p_{2} > p_{1}\). Because the failure rate of \(\varepsilon\) is nondecreasing, \(\frac{{f_{\varepsilon } (x_{2} )}}{{1 - F_{\varepsilon } (x_{2} )}} \ge \frac{{f_{\varepsilon } (x_{1} )}}{{1 - F_{\varepsilon } (x_{1} )}}\). But then,

Proposition 1 implies that customer demand is less sensitive to a price increase when SSR is high. We note that popular distributions, such as exponential, normal, uniform, gamma and Weibull distributions with shape parameter larger than or equal to 1, which are frequently used to model economic uncertainty have the nondecreasing failure rate property (Lariviere & Porteus, 2001). We assume, henceforth, that the distribution of \(\varepsilon\) has this property.

Proof of Lemma 1Because customer ratings are mutually independent,

\(\theta_{i} = E\left( {\frac{{\sum\limits_{\ell = 1}^{K} {w_{\ell } } }}{K}} \right) = \frac{1}{K}E\left( {\sum\limits_{\ell = 1}^{K} {w_{\ell } } } \right) = E(w(i))\) where \(w(i)\) is an arbitrary CRS provided by a customer when the SSR is equal to i. But then, \(\theta_{i} = E(w(i)) = \sum\limits_{j = 1}^{h} {jZ_{ij} }\) so that

where the inequality follows from Assumption 1.

Proof of Proposition 2 It is sufficient to show that \(m_{12}\) is nondecreasing in \(z_{12}\). For notational convenience, let \(x = z_{12}\) in what follows. For fixed x,

For \(\ell\) < K, note that

and with the exception of the single first term in ( A-4), all other terms cancel so that

But since \(0 < x \le 1\), it follows that (A-6) is nonnegative and so \(m_{12}\) is nondecreasing in \(z_{12}\).

Proof of Proposition 3 The proof is by induction. Note that \(V_{0} (c,2) = \,V_{0} (c,1)\, = \,0.\) Thus we assume the result is true for all periods k, 0 \(\le\) k \(\le\) t-1 and show it is true for time period t.

First, we note that

since \(\begin{gathered} V_{t - 1} (c - x,2)\left( {m_{22} \left( x \right) - m_{12} \left( x \right)} \right) + V_{t - 1} (c - x,1)\left( {m_{21} \left( x \right) - m_{11} \left( x \right)} \right) \ge \hfill \\ V_{t - 1} (c - x,1)\left( {m_{22} \left( x \right) - m_{12} \left( x \right)} \right) + V_{t - 1} (c - x,1)\left( {m_{21} \left( x \right) - m_{11} \left( x \right)} \right) \ge 0 \hfill \\ \end{gathered}\).when rt = 1, let \(p*\) be the price that maximizes Eq. (11). With rt = 2 it follows from Eq. (2) that there exists \(p^{\prime} > p*\) where \(\lambda (p^{\prime},2_{{}} )\) = \(\lambda (\,p*,1_{{}} )\), so that \(k_{t} (p^{\prime},2) = k_{t} (\,p*,1)\,\,.\)

Let \(h(c,\,2,\,p^{\prime})\) be (11) evaluated at \(r_{t}\) = 2 and \(p^{\prime}\). Thus we have.

\(\begin{gathered} h(c,\,2,\,p^{\prime}) {=} \left\{ {\mathop {\text{e}} \nolimits^{{ - k_{t} (p^{\prime},2)}} \sum\limits_{x = 0}^{c} \frac{{[k_{t} (p^{\prime},2)]^{x} }}{x!}\left[ {p^{\prime}(x {-} c) {+} (V_{t - 1} (c {-} x,1)m_{21} (x)+ V_{t - 1} (c {-} x,2)m_{22} (x)} \right] {+} p^{\prime}c} \right\} \ge \hfill \\ \left\{ {\mathop {\text{e}} \nolimits^{{ - k_{t} (\,\,p*,1)}} \sum\limits_{x = 0}^{c} \frac{{[k_{t} (\,\,p*,1)]^{x} }}{x!}\left[ {p^{\prime}(x - c) + (V_{t - 1} (c - x,1)m_{11} (x)\, + \,V_{t - 1} (c - x,2)m_{12} (x)} \right] + p^{\prime}c} \right\} \ge \hfill \\ \left\{ {\mathop {\text{e}} \nolimits^{{ - k_{t} (\,p*,1)}} \sum\limits_{x = 0}^{c} \frac{{[k_{t} (\,\,p*,1)]^{x} }}{x!}\left[ {\,\,p*(x - c) + (V_{t - 1} (c - x,1)m_{11} (x)\, + \,V_{t - 1} (c - x,2)m_{12} (x)} \right] + \,\,p*c} \right\} \hfill \\ = V_{t} (c,1). \hfill \\ \end{gathered}\) The result now follows since \(V_{t} (c,2)\,\,\, \ge \,\,\)\(h(c,\,2,\,p^{\prime})\).

Appendix B: Example of FBP policy

Suppose \(\Omega = \{ 1,2\}\) and c = 2 units. The dynamic programming problem has six possible states: \((c,r) = \{ (0,1),(0,2),(1,1),(1,2),(2,1),(2,2)\}\). Let the initial state be \((c,r) = (2,1)\). Assume \(K = 2\). Also, let the total number of review points be \(T = 3\) and consider the average arrival rate to be \(a = 5\). Assume that the CSR transition probability matrix \(Z_{2 \times 2} = \{ z_{ij} \}\) is \(Z = \left( {\begin{array}{*{20}c} {0.4} & {0.6} \\ {0.3} & {0.7} \\ \end{array} } \right).\) For this Z, the SSR transition matrix is \(M = \left[ \begin{gathered} .16\,\,\,\,\,\,.84 \hfill \\ .09\,\,\,\,\,\,.91 \hfill \\ \end{gathered} \right]\). In addition, suppose the consumer valuation on service rating is \(\phi = 10\), and let the intrinsic value of the product be \(\upsilon = 20\). Finally, assume the random term of reservation price follows a normal distribution with mean zero and variance 4, i.e., \(\varepsilon \sim N(0,4)\). We solve the problem and show the price paths between periods and the depletion of inventory in Fig.

6.

The expected revenues are calculated using Eq. (11) as follows:

\(\begin{gathered} V1\left( {1,1} \right)\, = \,.V1\left( {1,2} \right)\, = \,0.964\, \times \,29.16\, = \,28.10; \hfill \\ V1\left( {2,1} \right)\, = \,0.906\, \times \,2x28.36\, + \,0.075\, \times \,28.36\, + \,0\, = \,53.52; \hfill \\ \end{gathered}\)

\(\begin{gathered} V2\left( {1,1} \right)\, = \,0.720\, \times \,31.32\, + \,28.10x.280\, = \,30.42;V2\left( {2,1} \right)\, = \,2\, \times \,30.61x.567\, \hfill \\ + \,0.284x\left( {28.10\, + \,30.61} \right)\, + \,0.149\, \times \,53.52\, = \,59.36;{\text{ and}}, \hfill \\ \end{gathered}\)

\(V3\left( {2,1} \right)\, = \,0.296\, \times \,2x31.56\, + \,0.367x\left( {31.56\, + \,30.42} \right)\, + \,0.337\, \times \,59.36\, = \,61.44\)

Consider nodes 1–6. The shaded circles represent either all available units are sold or it is the end of the season. Each unshaded circle represents the states (c, r) at the beginning of each period and the expected revenue with t periods to go. At the start of the selling season (which is t = 3 in Fig. 6), we price the product at \(31.56\). All units are sold in period 1 when the demand is 2 units or more with a probability 0.296 (according to (8)). If we sell 1 unit with a probability of 0.367, then SSR is not updated (i.e. r = 1 since items sold is less than K = 2 and thus \(m_{11}\) = 1 according to (9)). The price at the beginning of period 2 (i.e. t = 2) is lowered to 31.32. If we sell 1 unit in period 2 with probability 0.720 then selling ends. If we do not sell in period 2, then the price is lowered further to 29.16 at the beginning of period 3 (t = 1). The states (c,r) and the corresponding prices represented by the remaining nodes are interpreted in a similar way. The total expected profit of this FBP policy is given by V3(2,1) = $61.44. (See detailed calculations at the bottom of the figure.)

Appendix C: How the average price and revenue are computed.

In this appendix we provide the details how we computed the average price and average revenue using y = 0.2 and SSR = 1 as example. Consider the results shown in Table

10 for y = 0.2 with current SSR = 1. The recorded price in each period is a weighted average of prices over the 10 replications, where weights are determined by quantities sold in the various runs. By way of further explanation, for a given case, let \(p_{\eta t}\) be the price and \(Q_{\eta t}\) be the quantity sold in replication \(\eta\) corresponding to period t. The recorded “quantity sold” for period t is \(\sum\limits_{\eta } {Q_{\eta t} } /10\), whereas the recorded price is \(\sum\limits_{\eta } {Q_{\eta t} } p_{\eta t} /\sum\limits_{\eta } {Q_{\eta t} }\). Finally, at the bottom of each column, the “Weighted Average Price” aggregates the period prices using proportions of quantity sold. The “Expected Revenue” is an aggregation of period prices multiplied by the quantities sold.

See Table 10.

Rights and permissions

About this article

Cite this article

de Matta, R., Lowe, T.J. Product price alignment with seller service rating and consumer satisfaction. Ann Oper Res 320, 695–725 (2023). https://doi.org/10.1007/s10479-021-04318-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04318-3