Abstract

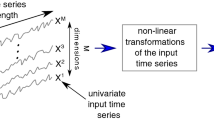

Traditional financial analysis systems utilize low-level price data as their analytical basis. For example, a decision-making system for stock predictions regards raw price data as the training set for classifications or rule inductions. However, the financial market is a complex and dynamic system with noisy, non-stationary and chaotic data series. Raw price data are too random to characterize determinants in the market, preventing us from reliable predictions. On the other hand, high-level representation models which represent data on the basis of human knowledge of the problem domain can reduce the randomness in the raw data. In this paper, we present a high-level representation model easy to translate from low-level data into the machine representation. It is a generalized model in that it can accommodate multiple financial analytical techniques and intelligent trading systems. To demonstrate this, we further combine the representation with a probabilistic model for automatic stock trades and provide promising results.

Similar content being viewed by others

References

Bao D, Yang Z (2008) Intelligent stock trading system by turning point confirming and probabilistic reasoning. Expert Syst Appl 34(1):620–627

Chung FL, Fu TC, Luk R, Ng V (2001) Flexible time series pattern matching based on perceptually important points. In: Proceedings of the international joint conference artificial intelligence workshop (learning from temporal and spatial data), Seattle, WA, 4–10 August 2001, pp 1–7

Kovalerchuk B, Vityaev E (2000) Data mining in finance: advances in relational and hybrid methods. Kluwer Academic, Dordrecht

Pearl J (1988) Probabilistic reasoning in intelligent systems: networks of plausible inference. Kaufmann, San Francisco

Perng CS, Wang H, Zhang SR, Parker DS (2000) Landmarks: a new model for similarity based pattern querying in time series databases. In: Proceedings of the 16th international conference on data engineering, San Diego

Peters EE (1994) Fractal market analysis: applying chaos theory to investment and economics. Willey, New York

Pring M (2002) Technical analysis explained, 4th edn. McGraw–Hill, New York. ISBN 0071226699

Singla P, Domingos P (2005) Discriminative training of Markov logic networks. In: Proceedings of the twentieth national conference on artificial intelligence, Pittsburgh, PA. AAAI, Menlo Park, pp 868–873

Vanstone B, Tan C (2003) A survey of the application of soft computing to investment and financial trading. In: Proceedings of the 8th Australian & New Zealand intelligent information systems conference (ANZIIS 2003), Sydney, Australia, 10–12 December 2003

Vanstone B, Tan CNW (2005) Artificial neural networks in financial trading. In: Khosrow-Pour M. (ed) Encyclopedia of information science and technology. Idea Group

Walsh B (2002) Markov chain Monte Carlo and Gibbs sampling. Lecture notes for EEB 596z

Author information

Authors and Affiliations

Corresponding author

Additional information

An erratum to this article can be found at http://dx.doi.org/10.1007/s10489-007-0104-9

Rights and permissions

About this article

Cite this article

Bao, D. A generalized model for financial time series representation and prediction. Appl Intell 29, 1–11 (2008). https://doi.org/10.1007/s10489-007-0063-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10489-007-0063-1