Abstract

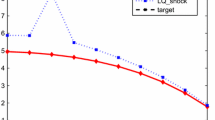

In this paper, we consider expected value, variance and worst–case optimization of nonlinear models. We present algorithms for computing optimal expected value, and variance policies, based on iterative Taylor expansions. We establish convergence and consider the relative merits of policies based on expected value optimization and worst–case robustness. The latter is a minimax strategy and ensures optimal cover in view of the worst–case scenario(s) while the former is optimal expected performance in a stochastic setting.

Both approaches are used with a small macroeconomic model to illustrate relative performance, robustness and trade-offs between the alternative policies.

Similar content being viewed by others

References

Başar, T., Bernhard, P.: H ∞-Optimal Control and Related Minimax Design Problems, 2nd edn. Systems & Control: Foundations & Applications. Birkhäuser Boston, Boston (1995). A dynamic game approach

Birge, J.R., Wets, R.J.-B.: Designing approximation schemes for stochastic optimization problems, in particular for stochastic programs with recourse. Math. Program. Stud. 27, 54–102 (1986). Stochastic programming 84. I

Chow, G., Corsi, P.: Evaluating the Reliability of Macroeconomic Models. Wiley, New York (1982)

Dudley, R.M.: Real analysis and probability, Cambridge Studies in Advanced Mathematics, vol. 74. Cambridge University Press, Cambridge (2002)

Ermoliev, Y., Gaivoronski, A., Nedeva, C.: Stochastic optimization problems with incomplete information on distribution functions. SIAM J. Control Optim. 23(5), 697–716 (1985)

Fair, R.C.: Specification Estimation and Analysis of Macroeconometric Models. Harvard University Press, Cambridge (1984)

Hall, S.G., Henry, S.G.B.: Macroeconomic Modelling. North-Holland, Amsterdam (1988)

Hall, S.G., Stephenson, S.J.: Optimal control of stochastic non-linear models. In: Christodoulakis, N. (ed.) Dynamic Modelling & Control of National Economies. Pergamon, Elmsford (1990)

Hansen, L., Sargent, T.J., Tallarini, T.D.: Robust permanent income and pricing. Rev. Econ. Stud. 66, 873–907 (1999)

Hansen, L.P., Sargent, T.J.: Robust estimation and control under commitment. J. Econ. Theor. 124(2), 258–301 (2005)

Jacobson, D.H.: New interpretations and justifications for worst case min–max design of linear control systems. In: Guardabassi, G., Locatelli, A., Rinaldi, S. (eds.) Sensitivity, Adaptivity and Optimality: Proceedings of the Third IFAC Symposium, June 1973

Kall, P.: Approximation to optimization problems: an elementary review. Math. Oper. Res. 11(1), 9–18 (1986)

Kolbin, V.V.: Decision Making and Programming. World Scientific, River Edge (2003). Translated from the Russian by V.M. Donets

Orphanides, A., Wieland, V.: Inflation zone targeting. Eur. Econ. Rev. 44(7), 1351–1387 (2000)

Rustem, B.: Stochastic and robust control of nonlinear economic systems. Eur. J. Oper. Res. 73, 304–318 (1994)

Rustem, B.: Algorithms for Nonlinear Programming and Multiple-Objective Decisions, Wiley-Interscience Series in Systems and Optimization. Wiley, Chichester (1998)

Rustem, B., Howe, M.: Algorithms for Worst–Case Design and Applications to Risk Management. Princeton University Press, Princeton (2002)

Rustem, B., Becker, R.G., Marty, W.: Robust min-max portfolio strategies for rival forecast and risk scenarios. J. Econ. Dyn. Cont. 24(11–12), 1591–1621 (2000)

Rustem, B., Zakovic, S., Wieland, V.: A continuous minimax problem and its application to inflation targeting. In: Zaccour, G. (ed.) Decision and Control in Management Science. Kluwer Academic, Dordrecht (2002)

Rustem, B., Zakovic, S., Parpas, P.: Convergence of an interior point algorithm for continuous minimax. J. Optim. Theory Appl. (2008, to appear)

Tetlow, R.J., Muehlen, P.: Robust monetary policy with misspecified models: does model uncertainty always call for attenuated policy? J. Econ. Dyn. Control 25, 911–949 (2001)

Zakovic, S., Pantelides, C., Rustem, B.: An interior point algorithm for computing saddle points of constrained continuous minimax. Ann. Oper. Res. 99, 59–77 (2001)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Parpas, P., Rustem, B., Wieland, V. et al. Mean and variance optimization of non–linear systems and worst–case analysis. Comput Optim Appl 43, 235–259 (2009). https://doi.org/10.1007/s10589-007-9136-7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10589-007-9136-7