Abstract

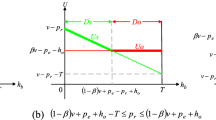

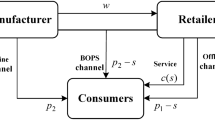

Practical and anecdotal evidence indicates that the drop-shipping policy has been extensively adopted in electronic commerce (E-commerce) practice. However, how the different structures of dual channels affect the drop-shipping strategy of a retailer and supply chain efficiency has not been adequately investigated. To fill this research gap, this study performs a game-theoretic analysis of the drop-shipping strategy of a retailer under two practical dual-channel supply chain structures, namely, manufacturer-owned and retailer-owned online channel structures (MOS and ROS). Under each structure, the optimal pricing and the variations in profits are analytically presented with reselling or drop shipping in the corresponding channel. We show that under MOS, drop shipping can lower both wholesale and retail prices. By contrast, under ROS, drop shipping can decrease the offline retail price and the wholesale price but lower the online retail price only when the ratio of the unit fulfillment fee to overstock inventory is relatively low. The retailer prefers to adopt the drop-shipping policy under both MOS and ROS. Counterintuitively, the profits of both retailer and manufacturer are independent of the unit order fulfillment fee under MOS; however, under ROS, the profit of the manufacturer indicates a decreasing trend, whereas that of the retailer continuously increases with the unit order fulfillment fee. In terms of the performance of the entire supply chain, ROS dominates MOS when the proportion of brick-and-mortar (BM) shoppers is sufficiently high. In specific, beyond a certain service level, drop shipping in the retailer-owned online channel is preferred; otherwise, reselling in such channel is dominant. When the proportion of BM shoppers is moderate, MOS with drop shipping in the BM channel is the best choice for the entire supply chain. When the proportion of BM shoppers is low, MOS with reselling in the BM channel becomes the dominant option.

Similar content being viewed by others

Notes

In practice, the drop shipping strategy is usually implemented in the BM channel under MOS and in the online channel under the ROS. To make our research more practical and relevant, we focus on these two cases with regard to the drop shipping strategy.

In the remainder of this paper, we use “service level” to represent “safety stock level” for convenience and comparison. Specifically, we assume that the online channel and the BM channel have an equal service level. The rationality behind this assumption is as follows. As implied by several research papers, a firm may adopt the same strategy as its rival owing to certain consumer behaviors (e.g., pricing fairness concerns [17] or competitive situations, such as Bertrand super traps [7]).

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2015). Agency selling or reselling? Channel structures in electronic retailing. Management Science,62(8), 2259–2280.

Alba, J., Lynch, J., Weitz, B., Janiszewski, C., Lutz, R., Sawyer, A., et al. (1997). Interactive home shopping: Consumer, retailer, and manufacturer incentives to participate in electronic marketplaces. Journal of Marketing,61(3), 38–53.

Bell, D. R., Gallino, S., & Moreno, A. (2018). Offline showrooms in omnichannel retail: Demand and operational benefits. Management Science,64(4), 1629–1651.

Bok, K., Lee, S., Choi, D., Lee, D., & Yoo, J. (2019). Recommending personalized events based on user preference analysis in event based social networks. Electronic Commerce Research. https://doi.org/10.1007/s10660-019-09335-w.

Boyaci, T. (2005). Competitive stocking and coordination in a multiple-channel distribution system. IIE Transactions,37(5), 407–427.

Brynjolfsson, E., & Smith, M. D. (2000). Frictionless commerce? A comparison of Internet and conventional retailers. Management Science,46(4), 563–585.

Cabral, L. M., & Villas-Boas, M. (2005). Bertrand supertraps. Management Science,51(4), 599–613.

Cai, G. G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing,86(1), 22–36.

Cai, G. G., Zhang, Z. G., & Zhang, M. (2009). Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. International Journal of Production Economics,117(1), 80–96.

Cao, E. (2014). Coordination of dual-channel supply chains under demand disruptions management decisions. International Journal of Production Research,52(23), 7114–7131.

Cao, K., Xu, X., Bian, Y., & Sun, Y. (2019). Optimal trade-in strategy of business-to-consumer platform with dual-format retailing model. Omega,82, 181–192.

Cattani, K., Gilland, W., Heese, H. S., & Swaminathan, J. (2005). Boiling frogs: Pricing strategies for a manufacturer adding a direct channel that competes with the traditional channel. Production and Operations Management,15(1), 40–56.

Chakraborty, T., Chauhan, S. S., & Vidyarthi, N. (2015). Coordination and competition in a common retailer channel: Wholesale price versus revenue-sharing mechanisms. International Journal of Production Economics,166, 103–118.

Chen, B., & Chen, J. (2017). When to introduce an online channel, and offer money back guarantees and personalized pricing? European Journal of Operational Research,257(2), 614–624.

Chen, J., Zhang, H., & Sun, Y. (2012). Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega,40(5), 571–583.

Chen, K. Y., Kaya, M., & Özer, Özalp. (2008). Dual sales channel management with service competition. Manufacturing & Service Operations Management,10(4), 654–675.

Chen, Y., & Cui, T. H. (2013). The benefit of uniform price for branded variants. Marketing Science,32(1), 36–50.

Cheong, T., Goh, M., & Song, S. H. (2015). Effect of inventory information discrepancy in a drop-shipping supply chain. Decision Sciences,46(1), 193–213.

Chiang, W. K., & Feng, Y. (2010). Retailer or e-tailer? Strategic pricing and economic-lot-size decisions in a competitive supply chain with drop-shipping. Journal of the Operational Research Society,61(11), 1645–1653.

Constantinides, P., Henfridsson, O., & Parker, G. G. (2018). Introduction-platforms and infrastructures in the digital age. Information Systems Research,29(2), 381–400.

Dan, B., Xu, G., & Liu, C. (2012). Pricing policies in a dual-channel supply chain with retail services. International Journal of Production Economics,139(1), 312–320.

Forman, C., Ghose, A., & Goldfarb, A. (2009). Competition between local and electronic markets: How the benefit of buying online depends on where you live. Management Science,55(1), 47–57.

Gan, X., Sethi, S. P., & Zhou, J. (2010). Commitment-penalty contracts in drop-shipping supply chains with asymmetric demand information. European Journal of Operational Research,204(3), 449–462.

Geng, Q., & Mallik, S. (2007). Inventory competition and allocation in a multi-channel distribution system. European Journal of Operational Research,182(2), 704–729.

Hagiu, A., & Wright, J. (2014). Marketplace or reseller? Management Science,61(1), 184–203.

Ho, Y. C., Ho, Y. J., & Tan, Y. (2017). Online cash-back shopping: Implications for consumers and e-Businesses. Information Systems Research,28(2), 250–264.

Hsiao, L., & Chen, Y. (2014). Strategic motive for introducing internet channels in a supply chain. Production and Operations Management,23(1), 36–47.

Hu, H., & Tadikamalla, P. R. (2019). When to launch a sales promotion for online fashion products? An empirical study. Electronic Commerce Research, doi: https://doi.org/10.1007/s10660-019-09330-1

Lee, H. L., & Whang, S. (2001). Winning the last mile of e-commerce. MIT Sloan Management Review,42(4), 54–62.

Li, B., Chen, P., Li, Q., & Wang, W. (2014). Dual-channel supply chain pricing decisions with a risk-averse retailer. International Journal of Production Research,52(23), 7132–7147.

Li, G., Li, L., & Sun, J. (2019). Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transportation Research Part E: Logistics and Transportation Review,126, 32–48.

Li, G., Li, L., Sethi, S. P., & Guan, X. (2019). Return strategy and pricing in a dual-channel supply chain. International Journal of Production Economics,215, 153–164.

Li, G., Wu, H., & Xiao, S. (2019). Financing strategies for a capital-constrained manufacturer in a dual-channel supply chain. International Transactions in Operational Research. https://doi.org/10.1111/itor.12653.

Li, G., Zhang, X., Chiu, S. M., Liu, M., & Sethi, S. P. (2019). Online market entry and channel sharing strategy with direct selling diseconomies in the sharing economy era. International Journal of Production Economics,218, 135–147.

Li, G., Li, L., Choi, T. M., & Sethi, S. P. (2019). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. Journal of Operations Management. https://doi.org/10.1002/joom.1061.

Li, G., Zhang, X., & Liu, M. (2019). E-tailer’s procurement strategies for drop-shipping: Simultaneous vs. sequential approach to two manufacturers. Transportation Research Part E: Logistics and Transportation Review,130, 108–127.

Li, G., Zheng, H., Sethi, S. P., & Guan, X. (2018). Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decision Sciences. https://doi.org/10.1111/deci.12340.

Li, W., & Chen, J. (2018). Backward integration strategy in a retailer Stackelberg supply chain. Omega,75, 118–130.

Luo, L., & Sun, J. (2016). New product design under channel acceptance: Brick and-mortar, online-exclusive, or brick-and-click. Production and Operations Management,25(12), 2014–2034.

Ma, S., Jemai, Z., Sahin, E., & Dallery, Y. (2017). The news-vendor problem with drop-shipping and resalable returns. International Journal of Production Research,55(22), 6547–6571.

Mehra, A., Kumar, S., & Raju, J. S. (2017). Competitive strategies for brick-and-mortar stores to counter “Showrooming”. Management Science,64(7), 3076–3090.

Modak, N. M., & Kelle, P. (2019). Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. European Journal of Operational Research,272(1), 147–161.

Netessine, S., & Rudi, N. (2006). Supply chain choice on the internet. Management Science,52(6), 844–864.

Panda, S., Modak, N. M., Sana, S. S., & Basu, M. (2015). Pricing and replenishment policies in dual-channel supply chain under continuous unit cost decrease. Applied Mathematics and Computation,256, 913–929.

Peinkofer, S. T., Esper, T. L., Smith, R. J., & Williams, B. D. (2019). Assessing the impact of drop-shipping fulfilment operations on the upstream supply chain. International Journal of Production Research,57(11), 3598–3621.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research,47(2), 183–194.

Reinhardt, G., & Lévesque, M. (2004). A new entrant’s decision on virtual versus bricks-and-mortar retailing. Journal of Electronic Commerce Research,5(3), 136–152.

Rofin, T. M., & Mahanty, B. (2018). Optimal dual-channel supply chain configuration for product categories with different customer preference of online channel. Electronic Commerce Research,18(3), 507–536.

Shi, P., Yan, B., & Zhao, J. (2018). Appropriate timing for SMEs to introduce an internet-based online channel under uncertain operating costs: A real options analysis. Electronic Commerce Research. https://doi.org/10.1007/s10660-018-9311-1.

Thakur, S. (2019). A reputation management mechanism that incorporates accountability in online ratings. Electronic Commerce Research,19(1), 23–57.

Tian, L., Vakharia, A. J., Tan, Y. R., & Xu, Y. (2018). Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Production and Operations Management,27(8), 1595–1610.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the e-commerce age. Production and Operations Management,13(1), 93–110.

Webb, K. L., & Lambe, C. J. (2007). Internal multi-channel conflict: An exploratory investigation and conceptual framework. Industrial Marketing Management,36(1), 29–43.

Xiao, W., & Xu, Y. (2018). Should an online retailer penalize its independent sellers for stockout? Production and Operations Management,27(6), 1124–1132.

Xie, J., Liang, L., Liu, L., & Ieromonachou, P. (2017). Coordination contracts of dual-channel with cooperation advertising in closed-loop supply chains. International Journal of Production Economics,183, 528–538.

Xu, G., Dan, B., Zhang, X., & Liu, C. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics,147, 171–179.

Yan, Y., Zhao, R., & Liu, Z. (2018). Strategic introduction of the marketplace channel under spillovers from online to offline sales. European Journal of Operational Research,267(1), 65–77.

Yang, S., Joo, H., & Youm, S. (2019). Demand forecasting model development through big data analysis. Electronic Commerce Research. https://doi.org/10.1007/s10660-019-09337-8.

Yao, D. Q., Kurata, H., & Mukhopadhyay, S. K. (2008). Incentives to reliable order fulfillment for an internet drop-shipping supply chain. International Journal of Production Economics,113(1), 324–334.

Yao, D. Q., Yue, X., Mukhopadhyay, S. K., & Wang, Z. (2009). Strategic inventory deployment for retail and e-tail stores. Omega,37(3), 646–658.

Yoo, W. S., & Lee, E. (2011). Internet channel entry: A strategic analysis of mixed channel structures. Marketing Science,30(1), 29–41.

Yu, D. Z., Cheong, T., & Sun, D. (2017). Impact of supply chain power and drop-shipping on a manufacturer’s optimal distribution channel strategy. European Journal of Operational Research,259(2), 554–563.

Yu, X., Wang, S., & Zhang, X. (2019). Ordering decision and coordination of a dual-channel supply chain with fairness concerns under an online-to-offline model. Asia-Pacific Journal of Operational Research,36(2), 1940004.

Zettelmeyer, F. (2000). Expanding to the Internet: Pricing and communications strategies when firms compete on multiple channels. Journal of Marketing Research,37(3), 292–308.

Zhang, L., & Wang, J. (2017). Coordination of the traditional and the online channels for a short-life-cycle product. European Journal of Operational Research,258(2), 639–651.

Zhang, P., Xiong, Y., & Xiong, Z. (2015). Coordination of a dual-channel supply chain after demand or production cost disruptions. International Journal of Production Research,53(10), 3141–3160.

Acknowledgements

The authors sincerely thank the editors and anonymous reviewers for their insightful comments and suggestions. This research is partially supported by the National Natural Science Foundation of China under the Grant Nos. 71971027, 71372019, 91746110, 71871091, 71471057, and 71521002; the Special Items Fund of Beijing Municipal Commission of Education.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Lemma 1

For the given \(z_{r}\) and \(z_{e}\), we solve the first-order partial derivative of \(p_{r}\) and \(p_{e}\) from (6). We obtain

Obtaining the Hessian matrix of (6) at point \((p_{r} ,p_{e} )\) is easy:

Its first-order principal minor is \(- 2\alpha < 0\), and the second-order principal minor is \(4(\alpha^{2} - \beta^{2} ) > 0\). The total profit of the dual-channel supply chain is about the joint concave function of \(p_{r}\) and \(p_{e}\). Therefore, the only optimal solution can be obtained from the first-order condition of \((p_{r} ,p_{e} )\) by (6). \(\partial E(\pi_{t} )/\partial p_{r} = 0\), \(\partial E(\pi_{t} )/\partial p_{e} = 0\), we can obtain,

1.2 Proof of Lemma 2

The decision-making questions of a retailer include the traditional retail channel pricing when her profit is maximized. By solving the first-order partial derivative of \(p_{r}\) and making it equal to 0, namely, \(\frac{{\partial E(\pi_{r} )}}{{\partial p_{r} }} = 0\), we can obtain

We put the upper substitution into (10), and then find the partial derivatives of \(w\) and \(p_{e}\), respectively:

We can easily obtain the Hessian matrix of (10) at point \((w,p_{e} )\),

Its first-order principal minor is \(- 2\alpha < 0\), and its second-order principal minor is \(8\alpha (\alpha^{2} - \beta^{2} ) > 0\). Thus, \(E(\pi_{m} )\) is a concave function associated with \((w,p_{e} )\). Thus, the optimal solution \(w_{s}^{ * } ,p_{es}^{ * }\) can be obtained by solving the first-order condition of (10) about \((w,p_{e} )\). \(\frac{{\partial E(\pi_{m} )}}{{\partial p_{e} }} = 0\), \(\frac{{\partial E(\pi_{m} )}}{\partial w} = 0\), we can obtain

We can obtain the optimal pricing of \(p_{rs}^{ * }\) by taking \(w_{s - M}^{ * } ,p_{es - M}^{ * }\) into \(p_{r} (w,p_{e} )\).

1.3 Proof of Lemma 3

The decision-making questions of a retailer include the traditional retail channel pricing when the profit of the retailer is maximized. We solve the first-order partial derivative of \(p_{r}\) about (13) and make it equal to 0, namely, \(\partial E(\pi_{r} )/\partial p_{r} = 0\). We can obtain

We place the upper substitution (14) and then find the partial derivatives of \(w\) and \(p_{e}\) about \(E(\pi_{m} )\) respectively,

We can easily obtain the Hessian matrix of \(E(\pi_{m} )\) at point \((w,p_{e} )\),

Its first-order principal minor is \(- 2\alpha < 0\), and its second-order principal minor is \(8\alpha (\alpha^{2} - \beta^{2} ) > 0\). Thus, \(E(\pi_{m} )\) is a concave function associated with \((w,p_{e} )\). Thus, the optimal solution can be obtained by solving the first-order condition of (14) about \((w,p_{e} )\), which is equal to 0.\(\frac{{\partial E(\pi_{m} )}}{{\partial p_{e} }} = 0\), \(\frac{{\partial E(\pi_{m} )}}{\partial w} = 0\), we can obtain

The optimal pricing of \(p_{rs - DMS}^{ * }\) can be obtained by taking \(w_{{^{s - DMS} }}^{*}\), \(p_{{_{es - DMS} }}^{*}\) into \(p_{r} (w,p_{e} ).\)

1.4 Proof of Lemma 4

The decision-making issues of a retailer are the pricing of online and offline channels when maximizing profits. By solving the first-order partial derivatives of \(p_{r}\) and \(p_{e}\), and making them equal to 0, namely, \(\frac{{\partial E(\pi_{r} )}}{{\partial p_{r} }} = 0\) and \(\frac{{\partial E(\pi_{r} )}}{{\partial p_{e} }} = 0\), we can obtain the expression about the wholesale price.

We can easily obtain the Hessian matrix of (17) at point \((p_{r} ,p_{e} )\):

Its first-order principal minor is \(- 2\alpha < 0\), and second-order principal minor is \(4(\alpha^{2} - \beta^{2} ) > 0\). Thus, \(E(\pi_{r} )\) is the joint concave function associated with \((p_{r} ,p_{e} )\).

We put the upper substitution (18) and then make \(\frac{{\partial E(\pi_{m} )}}{\partial w} = 0\) to obtain the optimal wholesale price of the manufacturer:

By putting \(w_{{^{s - RS} }}^{ * }\) into the \(p_{r} (w)\), \(p_{e} (w)\), we can obtain the retailer’s optimal pricing of the traditional retail and online channels.

1.5 Proof of Lemma 5

The decision-making issues of the retailer include the pricing of online and offline channels when maximizing profits. By solving the first-order partial derivative of \(p_{r}\) and \(p_{e}\) for (21) and making them equal to 0, namely, \(\frac{{\partial E(\pi_{r} )}}{{\partial p_{r} }} = 0\) and \(\frac{{\partial E(\pi_{r} )}}{{\partial p_{e} }} = 0\), we can obtain the expression about wholesale price as follows:

We can easily obtain the Hessian matrix of (21) at point \((p_{r} ,p_{e} )\),

Thus, \(E(\pi_{r} )\) is the joint concave function associated with \((p_{r} ,p_{e} )\).

We put the upper substitution (22) and then make \(\frac{{\partial E(\pi_{m} )}}{\partial w} = 0\) to obtain the optimal wholesale price of the manufacturer,

By putting \(w_{s - DRS}^{*}\) into \(p_{r} (w)\), \(p_{e} (w)\) we can obtain the retailer’s optimal pricing of the traditional retail and online channels.

Rights and permissions

About this article

Cite this article

Li, G., Zheng, H. & Liu, M. Reselling or drop shipping: Strategic analysis of E-commerce dual-channel structures. Electron Commer Res 20, 475–508 (2020). https://doi.org/10.1007/s10660-019-09382-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-019-09382-3