Abstract

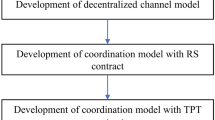

This paper aims to explore a rarely studied mutual promotional effects, operational strategies and cross-channel subsidy policies in a two-stage/two-player online-to-offline (O2O) supply chain. The centralized, decentralized and coordination decision models are developed, analyzed and compared for O2O mode without offline subsidy, O2O mode with offline subsidy and the pure online/offline channel mode. The revenue sharing contract (RSC) and two-part tariff contract (TTC) with Nash bargaining game are incorporated into the coordination models as the coordinating mechanisms. The numerical and sensitivity analyses based on an industry representative product (a popular smart phone product) are conducted and the corresponding results are compared to derive managerial insights and practice implications. The key findings show that a coordination strategy with offline subsidy can create the highest value to a two-player O2O supply chain and its members. As far as whether RSC or TTC coordinating mechanism should be undertaken, it depends on the risk-taking attitude and the relative power of both players in the supply chain. With a focus on the O2O supply chain strategy exploration, this study amends the literature shortage problem and broaden the much-needed knowledgebase in the O2O supply chain coordination studies.

Similar content being viewed by others

References

Baltic, S. (2018). Suning to boost online, offline retail. Nov 13, 2017. Retrieved May 3, 2018, from https://www.cpexecutive.com/post/suning-to-boost-online-offline-retail.

Binmore, K. G., Rubinstein, A., & Wolinsky, A. (1986). The Nash bargaining solution in economic modeling. The RAND Journal of Economics, 17(2), 176–188.

Bogaisky, J. (2014). Retail in crisis: These are the changes brick-and-mortar stores must make. [EB/OL]. Retrieved October 27, 2018, from https://www.forbes.com/sites/jeremybogaisky/2014/02/12/retail-in-crisis-these-are-the-changes-brick-and-mortar-stores-must-make/#4811f21113f9.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 51(1), 30–44.

Cai, G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86(1), 22–36.

Chen, J., Zhang, H., & Sun, Y. (2012). Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega, 40(5), 571–583.

Chen, K. Y., Kaya, M., & Özer, Ö. (2008). Dual sales channel management with service competition. Manufacturing & Service Operations Management, 10(4), 563–691.

Chen, X., Wang, X., & Jiang, X. (2016). The impact of power structure on the retail service supply chain with an O2O mixed channel. Journal of the Operational Research Society, 67(2), 294–301.

Chiang, W. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(1), 1–20.

China Ministry of Commerce. (2018). 2017–2018 China Retail Industry Development Report [EB/OL]. Retrieved November 3, 2018, from http://images.mofcom.gov.cn/www/201803/20180330182138013.pdf.

China Ministry of Commerce. (2017). 2016–2017 China Retail Industry Development Report [EB/OL]. Retrieved November 3, 2018, from http://images.mofcom.gov.cn/www/201707/20170703104141651.pdf.

Cowsky, A. (2017). Cost Comparison-Huawei Mate 10, iPhone 8, Samsung Galaxy S8. [EB/OL]. Retrieved November 3, 2018, from http://techinsights.com/about-techinsights/overview/blog/cost-comparison-huawei-mate-10-iphone-8-samsung-galaxy-s8/.

Duggan, W. (2015). What does O2O mean for the future of E-Commerce? Yahoo Finance, August 17, 2015.

Dumrongsiri, A., Fan, M., Jain, A., & Moinzadeh, K. (2008). A supply chain model with direct and retail channels. European Journal of Operational Research, 187(3), 691–718.

Dan, B., Xu, G., & Liu, C. (2012). Pricing policies in a dual-channel supply chain with retail services. International Journal of Production Economics, 139(1), 312–320.

Gao, F., & Su, X. (2016). Omnichannel retail operations with buy-online-and-pick-up-in-store. Management Science, 63(8), 2478–2492.

Gao, F., & Su, X. (2016). Online and offline information for omnichannel retailing. Manufacturing & Service Operations Management, 19(1), 84–98.

Gao, F., & Su, X. (2018). Omnichannel service operations with online and offline self-order technologies. Management Science. https://doi.org/10.1287/mnsc.2017.2787.

Grieder, P., Buck, R., Banfi, F., Kment, V., & Fitzner, J. (2016). The future of retail: How to make your bricks click, McKinsey Insights, September 2016.

He, H. (2018). Suning’s net profit increased by 498.02% year-on-year: investment income accounted for the bulk. April 1, 2018. Retrieved May 3, 2018, from http://westdollar.com/sbdm/finance/news/1354,20180401851686285.html.

Ince, D. (2009). Web application meets bricks and mortar, in a dictionary of the internet (2nd ed.). Oxford: Oxford University Press.

Investopedia. (2018). Online-to-offline commerce. Retrieved May 24, 2018, from https://www.investopedia.com/terms/o/onlinetooffline-commerce.asp#ixzz5GNPyJCIX.

Ji, J., Zhang, Z., & Yang, L. (2017). Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. International Journal of Production Economics, 187, 68–84.

Kalai, E., & Smorodinsky, M. (1975). Other solutions to Nash’s bargaining problem. Econometrica, 43(3), 513–518.

Kim, W., Chung, S., & Bae, Y. H. (2017). O2O trend and future: Focused on difference from each case. Journal of Marketing Thought, 3(4), 42–59.

Kong, L., Liu, Z., Pan, Y., Xie, J., & Yang, G. (2017). Pricing and service decision of dual-channel operations in an O2O closed-loop supply chain. Industrial Management & Data Systems, 117(8), 1567–1588.

Lariviere, M. A. (2006). A note on probability distributions with increasing generalized failure rates. Operations Research, 54(3), 602–604. https://doi.org/10.1287/opre.1060.0282.

Lariviere, M. A., & Porteus, E. L. (2001). Selling to the newsvendor: An analysis of price-only contracts. Manufacturing and Service Operations Management, 3(4), 293–305.

Lee, E. (2017). Alibaba is revamping China’s offline retailing through a bottom-up approach. Aug 31, 2017. Retrieved May 3, 2018, from https://technode.com/2017/08/31/alibaba-is-revamping-chinas-offline-retailing-through-a-bottom-up-approach/.

Lennane, A. (2014). SF express expands supply chain with online-to-offline plan. July 7, 2014. Retrieved May 3, 2018, from https://theloadstar.co.uk/sf-express-expands-supply-chain-online-offline-plan/.

Li, X., Li, Y., & Cao, W. (2019). Cooperative advertising models in O2O supply chains. International Journal of Production Economics, 215, 144–152.

Martin, D. (2017) From online to offline—China leads in O2O. July 24, 2017. Retrieved January 16, 2018, from https://www.linkedin.com/pulse/from-online-offline-china-leads-o2o-darryl-martin-j-d.

Moon, Y., Yao, T., & Friesz, T. L. (2010). Dynamic pricing and inventory policies: A strategic analysis of dual channel supply chain design. Service Science, 2(3), 196–215.

Muthoo, A. (1999). Bargaining theory with applications. Cambridge, MA: Cambridge University Press.

Nash, J. F. (1950). The bargaining problem. Econometrica, 18(2), 155–162.

Oliveira, F. S., Ruiz, C., & Conejo, A. J. (2013). Contract design and supply chain coordination in the electricity industry. European Journal of Operational Research, 227(3), 527–537.

Petruzzi, N., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research, 47(2), 184–194.

Thau, B. (2017). Five signs that stores (not E-Commerce) are the future of retail, Forbes.

Think With Google. (2013). How mobile is transforming the shopping experience in stores [EB/OL]. Retrieved October 27, 2018, from https://www.thinkwithgoogle.com/advertising-channels/mobile-marketing/mobile-in-store.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the E-Commerce age. Production and Operations Management, 13(1), 93–110.

Vinhas, A. S., & Heide, J. B. (2015). Forms of competition and outcomes in dual distribution channels: The distributor’s perspective. Marketing Science, 34(1), 1–178.

Virgillito, D. (2018). O2O (online to offline) Commerce’s Multi-Billion Dollar Opportunity, Sep 11, 2017. Retrieved October 2, 2018, from https://www.shopify.com/enterprise/o2o-online-to-offline-commerce.

Wallace, T. (2018). The complete omni-channel retail report: What brands need to know about modern consumer shopping habits in 2018 [EB/OL]. Retrieved October 27, 2018, from https://www.bigcommerce.com/blog/omni-channel-retail.

Wang, Y. (2006). Joint pricing-production decisions in supply chains of complementary products with uncertain demand. Operations Research, 54(6), 1110–1127.

Wang, Y., Jiang, L., & Shen, Z. (2004). Channel performance under consignment contract with revenue sharing. Management Science, 50(1), 34–47.

Weise, E. (2018). In best buy deal, Amazon acknowledges you sometimes need to touch things to buy. USA TODAY, April 18.

Xu, G., Dan, B., Zhang, X., & Liu, C. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147(1), 171–179.

Yan, R., Pei, Z., & Ghose, S. (2018). Reward points, profit sharing, and valuable coordination mechanism in the O2O era. International Journal of Production Economics, 215, 34–47.

Yu, Y., Han, X., Liu, J., & Cheng, Q. (2015). Supply chain equilibrium among companies with offline and online selling channels. International Journal of Production Research, 53(22), 6672–6688.

Zhang, J., Chen, H., & Wu, X. (2015). Operation models in O2O supply chain when existing competitive service level. International Journal of u- and e- Service, Science and Technology, 8(9), 279–290.

Zhang, J., Chen, H., Ma, J., & Tang, K. (2015). How to coordinate supply chain under O2O business model when demand deviation happens. Management Science and Engineering, 9(3), 24–28.

Zhao, F., Wu, D., Liang, L., & Dolgui, A. (2016). Lateral inventory transshipment problem in online-to-offline supply chain. International Journal of Production Research, 54(7), 1951–1963.

Acknowledgements

This work is supported by the National Natural Science Foundation of China (Grant Nos. 71603125, 71433003, 71672013), China Scholarship Council (Grant No. 201706865020), the National Key R&D Program of China (Grant No. 2017YFC0404600), the Natural Science Research Project of Colleges and Universities in Jiangsu Province (Grant No. 15KJB110012), Young Leading Talent Program of Nanjing Normal University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Model assumptions

Appendix: Model assumptions

Assumption 1

Ageneric two-stage O2O supply chain system is composed of a single supplier and a single O2O retailer with online and offline channel integration. In this O2O supply chain, the final product is provided by the supplier to the O2O retailer and sold to the consumers in the market via either an online or offline channel by the O2O retailer. The O2O supply chain is designed to remove barriers between the online and offline channels to bring better shopping experiences to the consumers and more business opportunities to the supply chain members, which gives full play to the fast information search advantage of the online electronic/mobile commerce platforms and the convenient product experience advantage of the offline brick-and-mortar stores. Specifically, the integrated e- and m-commerce online platform provides customers information of the shopping guide staff in the nearest offline brick-and-mortar stores to guide them to offline brick-and-mortar stores for free product experiences and free consulting services; meanwhile, the offline brick-and-mortar store posts QR code posters and places physical products in the store to facilitate the customer’s product experience, and arranges shopping guide staff to provide free product experience consultation and guide customers to online electronic/mobile commerce platform for product information acquisition and query. Thus, different from a conventional dual-channel supply chain with the characteristics of mutual competition, the information acquisition advantage of online channel and the product experience advantage of offline channel are seamlessly docked and perfectly fused in an O2O supply chain to create a mutual promotional effect between the online and offline channels, thus generate more product demands. The mutual promotional effect is positively related to the service quality in both online and offline channels, i.e., the higher the service quality is in an O2O supply chain, the stronger the mutual promotional effect will be.

Assumption 2

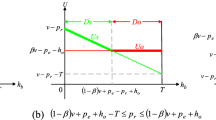

Following Petruzzi and Dada [37], the total market demand function of online- and offline-channels under the O2O mode is \(d\left( p \right) = y\left( p \right)x\), which is composed of the offline-channel demand function \(d_{s} \left( p \right)\) and the online-channel demand function \(d_{e} \left( p \right)\), i.e., \(d\left( p \right) = d_{s} \left( p \right) + d_{e} \left( p \right)\). The demand functions of the offline brick-and-mortar store channel and the online e-commerce platform channel in O2O supply chain can be defined as \(d_{s} \left( p \right) = \lambda y\left( p \right)x\) and \(d_{e} \left( p \right) = \left( {1 - \lambda } \right)y\left( p \right)x\) respectively. In the demand functions, λ is the offline channel demand share of the market and \(\left( {1 - \lambda } \right)\) is the online channel demand share, \(0 < \lambda < 1\). y(p) is a deterministic and decreasing function of price p. \(y\left( p \right) = ap^{ - b} p^{\theta } = ap^{{ - \left( {b - \theta } \right)}}\), where a is the potential market demand and b is the price-elasticity index of the expected demand, and \(b > 1 + \theta\); the larger the value of b, the more sensitive the demand is to a change in price. \(\theta \in \left( {0,1} \right)\) measures the mutual promotional coefficient between channels. x is a random factor defined in the range \(\left[ {A,B} \right]\) with \(B > A > 0\). The CDF (Cumulative distribution function) and PDF (Probability density function) of x are F(·) and f(·), and the mean value and standard deviation of x are μ and σ.

Assumption 3

Following Petruzzi and Dada [37], Wang et al. [45], and Wang [44], \(z = \frac{q}{y\left( p \right)}\) is defined as the ‘stock factor’, where q is the ordering quantity. Thus, \(q = y\left( p \right)z\).

Assumption 4

When the distribution of random factor x in the demand function satisfies the Increasing Generalized Failure Rate (IGFR) condition:\({{dg\left( x \right)} \mathord{\left/ {\vphantom {{dg\left( x \right)} {dx}}} \right. \kern-0pt} {dx}} > 0\), where \(g\left( x \right) \equiv xh\left( x \right)\) and \(h\left( x \right) \equiv \frac{f\left( x \right)}{1 - F\left( x \right)}\), the first order conditions of the expect profit function with respect to p and z, provides a unique solution to the problem of maximizing the expected profit function. Many distributions, such as normal distribution and exponential distribution, satisfy IGFR condition [27, 28, 45].

Assumption 5

When the distribution of random factor x in the demand function satisfies the Increasing Generalized Failure Rate (IGFR) condition:\({{dg\left( x \right)} \mathord{\left/ {\vphantom {{dg\left( x \right)} {dx}}} \right. \kern-0pt} {dx}} > 0\), where \(g\left( x \right) \equiv xh\left( x \right)\)

Assumption 6

Under the centralized decision, supplier and O2O retailer jointly determine the optimal price and stock factor to maximize the expected profit of O2O supply chain.

Assumption 7

Under the decentralized decision, the supplier and the O2O retailer make decisions separately to maximize their own profits. The decision sequence is as follows: the supplier firstly determines the wholesale price of unit product, and then the O2O retailer determines the retail price and stock factor.

Assumption 8

Under the coordination decision based on revenue sharing contract with Nash bargaining, the dominant supplier offers the O2O retailer a revenue sharing contract, and the O2O retailer either accepts or rejects the contract. If the O2O retailer accepts it, he will share a proportion of his revenue to the supplier. The revenue keeping rate will be determined via Nash bargaining between the supplier and the O2O retailer. After the revenue sharing rate is set, the supplier will produce and deliver these products at a lower wholesale price w to the O2O retailer before the selling season, and the O2O retailer will place the product order with quantity q to the supplier and he will sell the product at regular retail price when the selling season starts, and sell the leftover stock at salvage price in promotion season. Afterwards, the O2O retailer will share a fraction (\(1 - \phi\)) of his revenue to the supplier, where ϕ is the O2O retailer’s revenue keeping rate, and \(0 < \phi < 1\).

Assumption 9

Under the coordination decision based on two-part tariff contract (TTC) with Nash bargaining is designed for the O2O supply chain, the dominant supplier offers the O2O retailer a two-part tariff contract in which the supplier charges a lump-sum fee, and the O2O retailer either accepts or rejects the contract. If the O2O retailer accepts it, he needs to first pay a lump-sum fee to obtain the right to purchase products from the supplier, and he will need to pay for the other part which is equal to the multiplication of the product’s wholesale price by the production quantity after he place the product order. The lump-sum fee will be determined via Nash bargaining between the supplier and the O2O retailer. After the lump-sum fee F is set, the supplier will produce and deliver these products at a cost price w to the O2O retailer before the selling season, and the O2O retailer will place the product order with quantity q to the supplier and he will sell the product at regular retail price when the selling season starts, and sell the leftover stock at salvage price in promotion season.

Rights and permissions

About this article

Cite this article

Chen, Z., Fang, L. & Su, SI.I. The value of offline channel subsidy in bricks and clicks: an O2O supply chain coordination perspective. Electron Commer Res 21, 599–643 (2021). https://doi.org/10.1007/s10660-019-09386-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-019-09386-z