Abstract

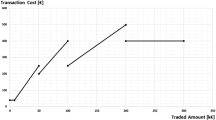

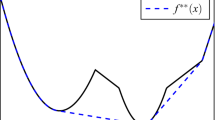

This paper is concerned with a portfolio optimization problem under concave and piecewise constant transaction cost. We formulate the problem as nonconcave maximization problem under linear constraints using absolute deviation as a measure of risk and solve it by a branch and bound algorithm developed in the field of global optimization. Also, we compare it with a more standard 0–1 integer programming approach. We will show that a branch and bound method elaborating the special structure of the problem can solve the problem much faster than the state-of-the integer programming code.

Similar content being viewed by others

References

Chvatál, V. (l983). Linear programming , Freeman and Co

J.E. Elton M.J. Gruber (1998) Modern Portfolio Theory and Investment Analysis EditionNumber6 John Wiley & Sons New York

J.E. Falk R.M. Soland (1969) ArticleTitleAn Algorithm for separable nonconvex programming problem Management Science 15 550–569

H. Konno (1990) ArticleTitlePiecewise linear risk functions and portfolio optimization Journal of the Operations Research Society of Japan 33 139–156

H. Konno A. Wijayanayake (1999) ArticleTitleMean–absolute deviation portfolio optimization model under transaction costs Journal of the Operations Research Society of Japan 42 422–435 Occurrence Handle10.1016/S0453-4514(00)87111-2

H. Konno A. Wijayanayake (2001) ArticleTitleOptimal rebalancing under concave transaction costs and minimal transaction units constraints Mathematical Programming 89 233–250

H. Konno A. Wijayanayake (2002) ArticleTitlePortfolio optimization under D.C. transaction costs and minimal transaction unit constraints Journal of Global Optimization 22 137–154 Occurrence Handle10.1023/A:1013850928936

H. Konno A. Wijayanayake (2001) ArticleTitleMinimal cost index tracking under concave transaction costs International Journal of Theoretical and Applied Finance 4 939–957 Occurrence Handle10.1142/S0219024901001292

Konno, H., Yamamoto, R. (2003). Minimal concave cost rebalance of a portfolio to the efficient frontier, to appear in Mathematical Programming

H. Konno H. Yamazaki (1991) ArticleTitleMean–absolute deviation portfolio optimization model and its applications to Tokyo stock market Management Science 37 519–531

Markowitz H. (1959). Portfolio Selection; Efficient Diversification of Investment, Wiley

J.M. Mulvey et al. (1999) Incorporating transaction costs in models for asset allocation W. Ziemba (Eds) Financial Optimization. Cambridge University Press New York 243–259

Nemhauser, G.L., Wolsey, L.A. (1998). Integer and Combinational Optimization, John Wiley & Sons

O. Ogryczak A. Ruszczynski (1999) ArticleTitleFrom stockastic dominance to mean risk model European Journal of Operational Research 116 33–50 Occurrence Handle10.1016/S0377-2217(98)00167-2

T.Q. Phong L.T.H. An P.D. Tao (1995) ArticleTitleDecomposition branch and bound method for globally solving linearly constraind indefinite quadratic minimization problems Operations Research Letters 17 215–220

Y. Simaan (1997) ArticleTitleEstimation of risk in portfolio selection: the mean–variance model and the Mean–Absolute deviation model Management science 43 1437–1446

H. Tuy (1998) Convex Analysis and Global Optimization Kluwer Academic Publishers Dordrecht

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Konno, H., Yamamoto, R. Global Optimization Versus Integer Programming in Portfolio Optimization under Nonconvex Transaction Costs. J Glob Optim 32, 207–219 (2005). https://doi.org/10.1007/s10898-004-2703-x

Received:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10898-004-2703-x