Abstract

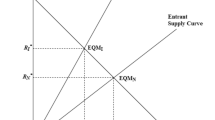

In this paper, we study the pricing of Internet services under monopoly and duopoly environments using an analytic model in which a service provider and users try to maximize their respective payoffs. We compare a few popular pricing schemes, including flat, volume-based, two-part, and nonlinear tariffs, with respect to revenue, social welfare, and user surplus. We perform a study of the sensitivity of these schemes to the estimation errors. In the duopoly situation, we formulate a simple normal form game between two service providers and study their equilibrium behaviors. Our main findings include: (1) the flat pricing generates higher revenue than the pure volume pricing when the elasticity of demand is low; (2) the volume-based pricing is better for society and users than the flat pricing regardless of the elasticity; (3) the market is segmented into two when one provider provides flat pricing and another provides volume based pricing.

Similar content being viewed by others

Notes

The price elasticity of demand is defined to be the negative ratio of percentage change in demand to the percentage change in price given by

$$ \epsilon = - \frac{\Updelta D/ D}{ \Updelta p / p }. $$Consider the discrete version of the same problem given by maximize \(\sum_{v}vx_{v}^{\alpha}\) subject to \(\sum_v x_v \leq c\) to understand the optimal solution easily.

It also can be derived by solving a tariff design problem that maximizes revenue. It can be shown that no other revenue scheme can achieve a higher revenue than that of the nonlinear tariff.

Refer to Appendix 4 for the derivation of the formula and λ.

Sequential entry in an extensive form game refines the equilibrium, which leads to volume-based pricing for the first mover and flat pricing for the second mover.

Mason introduced the term of consumer’s differentiated preference of provider (using a transport cost element) and network effect, and additional fixed costs associated with a usage component. He assumed the provider’s service was partially incompatible by arguing that partial compatibility would not change the main results. Although he mentioned that a reduction in the positive network effect is equivalent to congestion, he did not address the negative network effect in an explicit manner. He addressed that a more complete treatment of negative effects should be handled in an extensive model. He also set a utility function using a linear demand for a simple calculation. By doing so, he found critical combination values of network effects and metering costs for which flat pricing constitutes a Nash equilibrium. However, we assume that provider’s service is perfectly compatible and introduce an explicit term of congestion in a more general utility function, from which traffic demand is derived.

References

At&t Embraces Bittorrent, may Consider Volume-Based Pricing (2008). http://blog.wired.com/business/2008/06/att-embraces-bi.html

Mackie-Mason, J., Varian, H.: Pricing congestible network resources. IEEE J. Sel. Area. Commun. 13(7), 1141–1149 (1995)

Hahn, J.: Monopoly pricing of congestible resources with incomplete information. J. Econ. Res. 12, 243–270 (2007)

Kelly, F.: Charging and rate control for elastic traffic. Eur. T. Telecommun. 8, 33–37 (1997)

MacKie-Mason, J.K., Varian, H.R.: Pricing the internet. Comput. Econ. 9401002, EconWPA (1994). http://ideas.repec.org/p/wpa/wuwpco/9401002.html

Wang, X., Schulzrinne, H.: Pricing network resources for adaptive applications. IEEE/ACM Trans. Netw. 14(3), 506–519 (2006)

Shy, O.: Industrial Organization. Cambridge University Press, Cambridge (2001)

Jiang, L., Parekh, S., Walrand, J.: Time-dependent network pricing and bandwidth trading. In: IEEE Network Operations and Management Symposium Workshops (2008)

Hande, P., Chiang, M., Calderbank, R., Zhang, J.: Pricing under constraints in access networks: revenue maximization and congestion management. In: Proceedings of IEEE Infocom (2010)

Edell, R., Varaiya, P.: Providing internet access: what we learn from index. IEEE Netw. 13(5), 18–25 (1999)

Altman, J., Chu, K.: How to charge for network services—flat-rate or volume-based?. Compu. Netw. 36(5), 519–531 (2001)

Kesidis, G., Das, A., de Veciana, G.: On the flat-rate and volume-based pricing for tiered commodity internet services. In: CISS 2008 (2008)

Li, S., Huang, J., Li, S.R.: Revenue maximization for communication networks with usage-based pricing. In: Globecom 2009 (2009)

Odlyzko, A.: Internet pricing and the history of communications. Comput. Netw. J. 36(5), 493–517 (2001)

Shakkottai, S., Srikant, R., Ozdaglar, A., Acemoglu, D.: The price of simplicity. IEEE J. Sel. Area Commun. 26(7), 208–216 (2008)

Wilson, R.B.: Nonlinear Pricing. Oxford University Press, New York (1997)

Belleflamme, P., Peitz, M.: Industrial Organization: Markets and Strategies. Cambridge University Press, Cambridge (2010)

Shakkottai, S., Srikant, R.: Economics of network pricing with multiple ISPs. IEEE/ACM Trans. Netw. 14(6), 1233–1245 (2006)

Aldebert, M., Ivaldi, M., Roucolle, C.: Telecommunication demand and pricing structure. In: International Conference on Telecommunications Systems: Modeling and Analysis (1999)

Lanning, S.G, Mitra, D., Wang, Q., Wright, M.: Optimal planning for optical transport networks. Phil. Trans. R. Soc. Lond. 358(1773), 2183–2196 (2000)

Varian, H.: Microeconomic Analysis. 3rd edn. W.W. Norton & Co, New York (1992)

Acknowledgments

The authors would like to thank professor Jean Walrand for his guidance and support. This work was supported by the NRF (2011-0002663) of Korea.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Analysis of the Two-Part Tariff

In a two-part tariff, a user is charged a price p + β x for usage x. That is, a user pays a fixed price p to join the network plus a price β x proportional to usage.

The user problem (P user ) in which a user of type v chooses x to maximize her net-utility can be formulated as follows:

The maximizing value of x is

The resulting utility is then u(v; x(v)) given by

where \(k_1(\alpha) = \alpha^{\frac{\alpha}{1-\alpha}} (1-\alpha)\). This utility is nonnegative if v ≥ v 0 where

Since v is uniformly distributed, the total traffic in the network is then T where

where \(k_2(\alpha) = \alpha^{\frac{1}{1-\alpha}}\left({\frac{1-\alpha}{2-\alpha}}\right)\). The total revenue of the provider is then R where

In this expression, pN(1 − v 0) is the fixed part of the price where N(1 − v 0) users subscribe and pay a flat price p to join; the term β T is the contribution of the usage based price.

Assuming that the network has a total capacity C, the provider aims to maximize R subject to T ≤ C. That is, the provider solves the following problem:

where c = C/N, t = T/N, and r = R/N. We normalized the problem (P NSP ) by a factor of N. To solve this problem, we replace p and t as in (14) and (16) in the expression for R, and we find

We can expect the full capacity to be used at the optimal price, so that

i.e.,

Substituting this expression for β into r, we find

This expression is increasing in c, which justifies our assumption that the full network capacity is used at the optimal price. Note that r is a function of a single variable v 0 and is unimodular with a unique maximizer \(v_0^*\). Figure 7a shows the optimal \(v_0^*\) that maximizes r for \(\alpha \in [0,1]. \) When α is close to zero, \(v_0^*\)(α) is close to 0.5, and it increases to 1 when \(\alpha \rightarrow 1\). When α = 0.5, \(v_0^*\) ≈ 0.623. Substituting this value into the expression for β of (17) and then for p of (14), we can compute β and p as shown in Fig. 7b. Note that the optimal price parameters (p, β) that maximize the revenue r depend heavily on the shape of the utility function that is parameterized by α. The fixed price p decreases in α from 0.5 to around 0.25 while the unit charge β increases from 0 to 0.94. Figure 7c shows the revenue r and the social welfare w as defined by

When \(\alpha=\frac{1}{2}, \) we find that

The optimal revenue is then found to be

Thus, the optimal pricing for a user is

and a fraction 1 − v 0 ≈ 37.7 % of the users subscribe to the service.

Appendix 2: Analysis of Flat Pricing

Flat pricing is one of the most common pricing schemes. Under flat pricing, users would like to generate an infinite amount of traffic. There are two reasons why this does not happen in practice. First, the network capacity is limited, and the users experience a drop in service quality as they saturate the network. Second, users have other things to do than use the network, and the time they spend on the network has an opportunity cost that may be viewed as a parasitic volume-based cost. In this paper, we only model the first effect. Because the capacity of the network is limited, so is the traffic of each user. Users with a larger utility for the traffic still use the network more than others. To model this effect, we consider that users face a drop in quality, such as an increase in latency, when they increase their traffic. This quality drop is a disutility that depends on the total traffic. Thus, at the equilibrium, this drop in quality has some common derivative δ with respect to the degree of utilization of every user. Thus, the derivative of the utility vx α must be equal to the derivative of the latency at the equilibrium. Hence,

The value of δ is such that the total traffic is less than C. The net-utility of a user of type v is then

where \(k_3(\alpha)= \alpha^{\frac{\alpha}{1-\alpha}}\). In this analysis, the shadow price δ is introduced to constrain the traffic, but the disutility of the loss in quality is negligible as soon as the traffic is slightly less than the capacity C. Thus, a user of type v joins the network if his net-utility is positive, i.e., if v ≥ v 0, where

The difference from the previous analysis is that the revenue now consists only of the fixed price. That is,

Thus, the provider chooses p to solve the following problem:

Substituting the expressions for p and δ in r, we find that

is a unimodular function of v 0 with a single maximizer \(v_0^*\). We can find \(v_0^*\) numerically in a similar way as before and the results are shown in Fig. 8a. As 1 − v 0 is the subscription ratio, we observe that the ratio decreases with higher α. The optimal flat price \(p^*\) can be computed using (18) and is shown in Fig. 8b. The flat price \(p^*\) increases quite rapidly when α ≥ 0.8. Figure 8c shows the revenue and the social welfare of the flat pricing scheme, which can be computed in a similar way. When \(\alpha =\frac{1}{2}, \) v 0 ≈ 0.760. It follows that \(p \approx 0.67 \sqrt{c}\) and \(r \approx 0.32 \sqrt{c}\). Thus, under flat pricing, 24 % of the users join the service and the revenue is about 80 % of that of the two-part tariff.

Appendix 3: Analysis of Volume-Based Pricing

In volume-based pricing, the net utility of a type v user is

so that she chooses a usage \(x = x(v) := \left(\frac{\alpha v}{\beta}\right)^{\frac{1}{(1-\alpha)}}\) and her utility

is always positive, where \(k_1(\alpha) = \alpha^{\frac{\alpha}{1-\alpha}} (1-\alpha)\). The total traffic in the network is then

where \(k_2(\alpha) = \alpha^{\frac{1}{1-\alpha}}\left({\frac{1-\alpha}{2-\alpha}}\right). \) To meet the capacity constraint, one chooses β so that T = C, i.e.,

that gives

It follows that the revenue is

so that

The subscription ratio of volume-based pricing is 100 % regardless of α because the net-utility of any user is nonnegative. Figure 9b, c show the price parameter β, the revenue r and the social welfare w of volume-based pricing.

Appendix 4: Computing the Nonlinear Tariff

Let ϕ(x) be the nonlinear price for x units of traffic and let \(\beta(x) = \phi^{\prime}(x)\). The traffic x(v) of type v is given by

when β(x) = β.

Let D(β, x) be the demand profile defined as follows:

and let it represent a fraction of users who are willing to pay \(\beta \cdot dx\) for using marginal traffic [x, x + dx]. Assuming the uniform distribution of v, we have

The marginal price schedule β(x) that maximizes the marginal revenue (β − λ) D(β, x) using marginal traffic [x, x + dx] is given by

Here, λ is chosen such that T = C is satisfied.

Solving the equation gives

The price schedule \(\phi(x) = \int_0^x \beta(x) dx \) is then

The net-utility of a user of type v with traffic x is then

Such a user would purchase a quantity x(v) of traffic where

Total traffic is then

Since T = C = Nc, we find that

The revenue r is given by

The social welfare w of the nonlinear tariff is given by

Appendix 5: Proof of Proposition 1

Proposition 1

The social welfare of the three linear tariffs is given by

And that of the nonlinear tariff is given by

Proof

We consider the linear tariffs first. As a user of type v generates \(x(v) = \left(\frac{\alpha v}{\beta}\right)^{\frac{1}{1-\alpha}}\) to maximize her utility,Footnote 8 substituting x(v) for \(\left(\frac{\alpha v}{\beta}\right)^{\frac{1}{1-\alpha}}\) in W, we have

We replace β with (.6) to obtain identity (31). In the case of the nonlinear tariff, refer to the last part of Appendix 4. Algebraic calculations after replacing x(v) in w leads to the desired result. \(\square\)

Rights and permissions

About this article

Cite this article

Mo, J., Kim, W. & Park, H. Internet Service Pricing: Flat or Volume?. J Netw Syst Manage 21, 298–325 (2013). https://doi.org/10.1007/s10922-012-9234-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10922-012-9234-4