Abstract

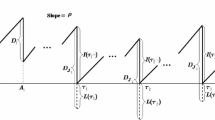

This paper studies the classical discrete-time, single-location inventory model with stochastic demand, lost sales, and positive lead time. We transform the problem into an equivalent problem of the Markovian demand inventory model with zero lead time and zero initial inventory, which provides a better understanding to the original problem. Based on this transformation, we introduce a key concept—effectual demand, which determines both the performance in the current period and the evolution into future periods. In this way, we provide a bridge of two research streams in the literature: Markovian demand inventory model and lost sales inventory model. We believe this Markovian approach is more straightforward to work with various applications. In this way, we easily show the existence of optimal policies in discounted and average cost, and finite and infinite horizon cases, when cost functions are of polynomial growth. The polynomial growth cost functions virtually cover all practical scenarios in real business settings. We then present simpler proofs and examples for the linear order cost case. The analytical solutions are first. We also derive bounds analytically on the optimal policy; these bounds are equivalent to those of the myopic policy but tighter than the popular bound in the literature.

Similar content being viewed by others

References

Gruen, T.W., Corsten, D., Bharadwaj, S.: Retail Out-of-Stocks: A Worldwide Examination of Extent, Causes and Consumer Responses. Grocery Manufacturers of America, Washington DC (2002).

Bijvank, M., Vis, I.F.A.: Lost-sales inventory theory: a review. Eur. J. Oper. Res. 215, 1–13 (2011)

Zipkin, P.: Foundations of Inventory Management. McGraw-Hill, New York (2000)

Holt, C., Modigliani, F., Muth, J.F., Simon, H.A.: Planning Production, Inventory, and Workforce. Prentice-Hall, Englewood Cliffs (1960)

Beyer, D., Sethi, S.P., Taksar, M.: Inventory models with Markovian demands and cost functions of polynomial growth. J. Optim. Theory Appl. 98(3), 281–323 (1998)

Li, X.: Managing dynamic inventory systems with product returns: a Markov decision process framework. J. Optim. Theory Appl. 157(2), 577–592 (2013)

Karlin, S., Scarf, H.: Inventory models of the Arrow–Harris–Marschak type with time lag. In: Arrow, K.J., Karlin, S., Scarf, H. (eds.) Studies in the Mathematical Theory of Inventory and Production, pp. 155–178. Stanford University Press, Stanford (1958)

Morton, T.: Bounds on the solution of the lagged optimal inventory equation with no demand backlogging and proportional costs. SIAM Rev. 11, 572–596 (1969)

Morton, T.: The near-myopic nature of the lagged-proportional-cost inventory problem with lost sales. Oper. Res. 19(7), 1708–1716 (1971)

Nahmias, S.: Simple approximations for a variety of dynamic lead time lost sales inventory models. Oper. Res. 27(5), 904–924 (1979)

van Donselaar, K., de Kok, T., Rutten, W.: Two replenishment strategies for the lost sales inventory model: a comparison. Int. J. Prod. Econ. 46–47, 285–295 (1996)

Bijvank, M., Johansen, S.G.: Periodic review lost-sales inventory models with compound Poisson demand and constant lead times of any length. Eur. J. Oper. Res. 220, 106–114 (2012)

Zipkin, P.: Old and new methods for lost sales inventory systems. Oper. Res. 56(5), 1256–1263 (2008)

Zipkin, P.: On the structure of lost sales inventory models. Oper. Res. 56(4), 937–944 (2008)

Veinott, A., Wagner, H.M.: Computing optimal (s, S) inventory policies. Manag. Sci. 11(5), 525–552 (1965)

Veinott, A.: On the optimality of (s, S) inventory policies: new conditions and a new proof. SIAM J. Appl. Math. 14(5), 1067–1083 (1966)

Cheng, F., Sethi, S.P.: Optimality of state-dependent (s, S) policies in inventory models with Markov-modulated demand and lost sales. Prod. Oper. Manag. 8(2), 183–192 (1999)

Song, J., Zipkin, P.: Inventory control in a fluctuating demand environment. Oper. Res. 41, 351–370 (1993)

Iglehart, D.L., Karlin, S.: Optimal policy for dynamic inventory process with nonstationary stochastic demands. In: Arrow, K.J., Karlin, S., Scarf, H. (eds.) Studies in Applied Probability and Management Science, pp. 127–147. Stanford University Press, Stanford (1962)

Puterman, M.L.: Markov Decision Process: Discrete Stochastic Dynamic Programming. Wiley-Interscience, Hoboken (1994)

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs

Appendix: Proofs

1.1 Proof of Lemma 5.1a

-

(1)

Obviously \(\alpha ^2cu_1 \) is convex in \(u_1 \).

-

(2)

\(\alpha ^2E\left[ {g_1 \left( {{x_1 ,u_1 }}\right) } \right] \) is convex in \(u_1 \)because \(\alpha ^2E\left[ {g_1 \left( {{x_1 ,u_1 }}\right) } \right] \) is the expected cost of the newsvendor problem facing effectual demand, \(D_1 ( {x_1 ,u_1 })=u_1 -z_2 =-( {{x_1} -{d_1}}){^+}+d_2 \).

1.2 Proof of Lemma 5.1b.

-

(1)

We try to show the optimal expected single-period cost

is convex and nondecreasing in \(\left[ {z_1 } \right] ^+\).

\(\alpha ^2E\left[ {g_1 ( {x_1 ,u_1 })} \right] \hbox {is convex in} [z_1 ]^+\hbox { because}\)

is the single-period cost of newsvendor problem with \([z_1 ]{^+}+u_1 \).

To show nondecreasing in \(\left[ {z_1 } \right] ^+\), for any given \(\left[ {z_1 } \right] {^{+{\prime }}}\) let \(\left[ {z_1 } \right] {^{+{\prime \prime }}}=\left[ {z_1 } \right] {^{+{\prime }}}-\delta \), where \(\delta >0\) is very small; we compare optimal cost between \(\left[ {z_1 } \right] {^{+{\prime }}}\) and \(\left[ {z_1 } \right] {^{+{\prime \prime }}}\). Let the optimal order size be \(u_1^{{\prime }*} \) for

\(\left[ {z_1 } \right] {^{+{\prime }}}\). The optimal expected single-period cost for a given \(\left[ {z_1 } \right] {^{+{\prime }}}\) thus is

where \(u_1^{\prime *} =\left[ {F_{^{d_2 -[z_1 ]{^+{\prime }}}}^{-1} ( \theta )} \right] {^+}\)that means \((h+b)F_{d_2 -[z_1 ]{^{+\prime }}} (u_1^{{\prime }*} )-b=(h+b)F_{d_2 } (u_1^{\prime *} +[z_1 ]{^{+\prime }})-b\ge 0\).

For a \(\left[ {z_1}\right] ^+{\prime \prime }=\left[ {z_1}\right] ^+{\prime }-\delta \), the single-period cost with same order size \(u_1^{\prime *}\) is

Applying (9) and (10), we have

We thus show \(\alpha ^2E\left[ {cu_1^{\prime *} +g_{_1 }^*( {[z_1 ]^{\prime }})} \right] \ge \alpha ^2E\left[ {cu_1^{\prime *} +g{_{1}}{^*}} \left( [z_1]^{\prime \prime }\right) \right] \). In other words, the optimal expected single-period cost is nondecreasing in \(\left[ {z_1 } \right] ^+\).

(2) \(\left[ {z_1 } \right] ^+=\left[ {x_1 -d_1 } \right] ^+\)is convex and nondecreasing in \(x_1 \) because \(\left[ {z_1 } \right] ^+=\left[ {x_1 -d_1 } \right] ^+=\int \limits _0^{x_1 } {F_d (y)\mathrm{d}y} \).

Combining (1) and (2) together, we prove the result.

1.3 Proof of Lemma 5.2.

The proof is done by induction.

-

(1)

From Lemma 5.1, we know above results hold for the single-period cost, \(t=T\).

-

(2)

We assume that these results hold for \(t+1\). We need to show that they are true for \(t\).

-

6a.

(i) The one-period cost \(\alpha ^2cu_t +\alpha ^2E\left[ {g_t (x_t ,u_t ;u_t )} \right] \) is convex in \(u_t \). (ii) \(v_{\alpha ,t+1} ( {x_{t+1} ,\text{ u }_{t+1} })\) is nondecreasing and convex in \(x_{t+1} \) and\(x_{t+1} =( {x_t -d_t }){^+}+u_t \) is convex in \(u_t \), so \(\alpha E\left[ {v_{\alpha ,t+1} ( {x_{t+1} ,u_{t+1} })} \right] \)is convex in \(u_t\). Combining (i) and (ii), we have \(v_{\alpha ,t} (x_t ,u_t )=\mathop {\inf }\limits _{u_t \ge 0}\) \(\left\{ {\alpha ^2cu_t +\alpha ^2E\left[ {g_t (x_t ,u_t ;u_t )} \right] +\alpha E\left[ {v_{\alpha ,t+1} ( {x_{t+1} ,u_{t+1}})} \right] } \right\} ,\) is convex in \(u_t \).

-

6b.

(i) The one-period cost \(\alpha ^2cu_t +\alpha ^2E\left[ {g_t\left( {x_t ,u_t ;u_t}\right) }\right] \) is convex in \(x_t \). (ii) To show nondecreasing, the proof is in a same manner as for the single-period case. For any given \(x_t \), the optimal order size \({u_t}{^*}\) is the smallest number such that the decrease rate of the one-period cost, \(\alpha ^2cu_t +\alpha ^2E\left[ {g_t (x_t ,u_t ;u_t )} \right] \), is not smaller than the increase rate of the optimal expected cost for \(t+1\), \(\alpha v_{\alpha ,t+1} ( {x_{t+1} ,u_{t+1} })\) because \(\alpha ^2cu_t +\alpha ^2E\left[ {g_t (x_t ,{{{\varvec{u}}}_t} ;u_t)} \right] \) is convex in \(u_t \) and \(\alpha v_{\alpha ,t+1} ( {x_{t+1} ,u_{t+1} })\) is always nondecreasing in \(x_{t+1} \). Following the proof of Lemma 5.1b, we thus show the optimal expected cost of \(x_t^{\prime }\) and \(u_t^{\prime *} \) is not smaller than that of \(x_t^{\prime \prime }\) and\(u_t^{\prime *} \), where again \(x_t^{\prime \prime } =x_t^{\prime } -\delta \) and \(\delta >0\) are very small. \(\square \)

Rights and permissions

About this article

Cite this article

Li, X. Optimal Policies and Bounds for Stochastic Inventory Systems with Lost Sales. J Optim Theory Appl 164, 359–375 (2015). https://doi.org/10.1007/s10957-014-0537-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-014-0537-3