Abstract

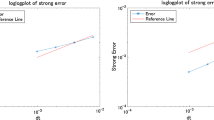

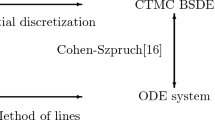

A novel time-stepping scheme, called transformed jump-adapted backward Euler method, is developed in this paper to simulate a class of jump-extended CIR and CEV models. The proposed scheme is able to preserve the positivity of the underlying problems. Furthermore, its strong convergence rate of order one is recovered for the considered models with non-Lipschitz diffusion coefficients. Numerical examples are finally reported to confirm our theoretical findings.

Similar content being viewed by others

References

Ahn, C.M., Thompson, H.E.: Jump-diffusion processes and the term structure of interest rates. J. Financ. 43(1), 155–174 (1988)

Alfonsi, A.: On the discretization schemes for the CIR (and Bessel squared) processes. Monte Carlo Methods Appl. 11(4), 355–384 (2005)

Alfonsi, A.: High order discretization schemes for the CIR process: application to affine term structure and Heston models. Math. Comput. 79(269), 209–237 (2010)

Alfonsi, A.: Strong order one convergence of a drift implicit Euler scheme: application to the CIR process. Stat. Probab. Lett. 83(2), 602–607 (2013)

Beliaeva, N., Nawalkha, S.: Pricing American interest rate options under the jump-extended constant-elasticity-of-variance short rate models. J. Bank. Financ. 36 (1), 151–163 (2012)

Bossy, M., Diop, A.: An efficient discretisation scheme for one dimensional SDEs with a diffusion coefficient function of the form |x|a,a[1/2, 1) Preprint (2007)

Berkaoui, A., Bossy, M., Diop, A.: Euler scheme for SDEs with non-Lipschitz diffusion coefficient: strong convergence. ESAIM Probab. Stat. 12, 1–11 (2008)

Bruti-Liberati, N., Platen, E.: Strong approximations of stochastic differential equations with jumps. J. Comput. Appl. Math. 205, 982–1001 (2007)

Chalmers, G.D., Higham, D.J.: First and second moment reversion for a discretized square root process with jumps. J. Differ. Equ. Appl. 16, 143–156 (2010)

Cont, R., Tankov, P.: Financial Modelling with Jump Processes, Financial Mathematics Series, Chapman & hall/CRC, London Boca Raton (2004)

Dereich, S., Neuenkirch, A., Szpruch, L.: An Euler-type method for the strong approximation of the Cox-Ingersoll-Ross process. Proc. R. Soc. A Math. Phys. Eng. Sci. 468(2140), 1105–1115 (2012)

Gardoń, A.: The order of approximations for solutions of Itô-Type stochastic differential equations with jumps. Stoch. Anal. Appl. 22(3), 679–699 (2004)

Gyöngy, I., Rásonyi, M.: A note on Euler approximations for SDEs with Hölder continuous diffusion coefficients. Stoch. Process. Appl. 121(10), 2189–2200 (2011)

Halidias, N.: An explicit and positivity preserving numerical scheme for the mean reverting CEV model, arXiv preprint arXiv:1501.03434 (2015)

Halley, W., Malham, S.J.A., Wiese, A.: Positive and implicit stochastic volatility simulation, Arxiv preprint arXiv:0802.4411. 2008 arxiv.org.

Higham, D.J., Kloeden, P.E.: Numerical methods for nonlinear stochastic differential equations with jumps. Numer. Math. 101(1), 101–119 (2005)

Higham, D.J., Mao, X.: Convergence of Monte Carlo simulations involving the mean-reverting square root process. J. Comput. Financ. 8, 35–61 (2005)

Higham, D.J., Mao, X., Szpruch, L.: Convergence, non-negativity and stability of a new Milstein scheme with applications to finance. Discret. Contin. Dyn. Syst. Ser. B 18(8), 2083–2100 (2013)

Hutzenthaler, M., Jentzen, A., Noll, M.: Strong convergence rates and temporal regularity for Cox-Ingersoll-Ross processes and Bessel processes with accessible boundaries arXiv:1403.6385v1 (2014)

Kahl, C., Günthera, M., Rossberg, T.: Structure preserving stochastic integration schemes in interest rate derivative modeling. Appl. Numer. Math. 58(3), 284–295 (2008)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus Springer Science & Business Media (1991)

Moro, E., Schurz, H.: Boundary preserving semianalytical numerical algorithms for stochastic differential equations. SIAM J. Sci. Comput. 29(4), 1525–1549 (2007)

Neuenkirch, A., Szpruch, L.: First order strong approximations of scalar SDEs defined in a domian. Numer. Math. 128(1), 103–136 (2014)

Platen, E.: An approximation method for a class of Itô processes with jump component. Liet. Mat. Rink 22(2), 124–136 (1982)

Platen, E., Bruti-Liberati, N.: Numerical solution of stochastic differential equations with jumps in finance Springer Science & Business Media (2010)

Sun, X., Gan, S.: An efficient semi-analytical simulation for the heston model. Comput. Econ. 43(4), 433–445 (2014)

Wu, F., Mao, X., Chen, K.: Strong convergence of Monte Carlo simulations of the mean-reverting square root process with jump. Appl. Math. Comput. 206(2), 494–505 (2008)

Wu, Y.: Jump-diffusion CIR model and its applications in credit risk. Hacet. J. Math. Stat. 43(6), 1095–1106 (2014)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, X., Wang, X. A transformed jump-adapted backward Euler method for jump-extended CIR and CEV models. Numer Algor 74, 39–57 (2017). https://doi.org/10.1007/s11075-016-0137-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11075-016-0137-4

Keywords

- Jump-extended CIR and CEV models

- Jump-adapted method

- Strong convergence rates

- Non-Lipschitz coefficients