Abstract

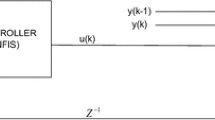

This paper adopts the concept of dynamic feedback systems to model the behavior of financial markets, or more specifically, the stock market from a dynamic system point of view. Based on a feedback adaptation scheme, the authors model the movement of a stock market index within a framework that is composed of an internal dynamic model and an adaptive filter. The output-error model is adopted as the internal model whereas the adaptive filter is a time-varying state space model with instrumental variables. Its input-output behavior, and internal as well as external forces are then identified. Special attention has also been paid to the recent financial crisis by examining the movement of Dow Jones Industrial Average (DJIA) as an example to illustrate the advantage of the proposed framework. Supported by time-varying causality tests, five influential factors from economic and sentiment aspects are introduced as the input of this framework. Testing results show that the proposed framework has a much better prediction performance than the existing methods, especially in complicated economic situations. An application of this framework is also presented with focuses on forecasting the turning periods of the market trend. Realizing that a market trend is about to change when the external force begins to exhibit clear patterns in its frequency responses, the authors develop a set of rules to recognize this kind of clear patterns. These rules work well for stock indexes from US, China and Singapore.

Similar content being viewed by others

References

F. J. Fabozzi, F. G. Modigliani, and F. J. Jones, Foundations of Financial Markets and Institutions, 4th edition, Prentice Hall, New Jersey, 2009.

W. F. Sharpe, G. J. Alexander, and J. V. Bailey, Investments, Prentice Hall, New Jersey, 1998.

D. M. Hanssens, L. J. Parsons, and R. L. Schultz, Market Response Models: Econometric and Time Series Analysis, Kluwer Academic Publishers, Boston, 1990.

G. Box and G. Jenkins, Time Series Analysis: Forecasting and Control, Holden-Day, San Francisco, 1970.

J. Y. Campbell and J. Ammer, What moves the stock and bond markets? A variance decomposition for long-term asset returns, Journal of Finance, 1993, 48(1): 3–37.

J. Friedman and Y. Shachmurove, Using Vector Autoregression Models to Analyze the Behavior of the European Community Stock Markets, CARESS Working Paper, 1997.

R. F. Engle, Autoregressive conditional heteroscedasticity with estimates of variance of United Kingdom inflation, Econometrica, 1982, 50(4): 987–1008.

E. M. J. H. Hol, Empirical Studies on Volatility in International Stock Markets, Kluwer Academic Publishers Boston, 2003.

A. N. Refenes, A. Zapranis, and G. Francis, Stock performance modeling using neural networks: A comparative study with regression models, Neural Networks, 1994, 7: 375–388.

H. Q. Yang, Margin Variations in Support Vector Regression for the Stock Market Prediction, Master’s thesis, Chinese University of Hong Kong, 2003.

D. I. Michael, Interaction between Economics and Systems Theory, Optimization Techniques: Lecture Notes in Control and Information Sciences, Springer, Berlin/Heidelberg, 1980.

T. Poggio, A. W. Lo, B. D. LeBaron, and N. T. Chan, Agent-based models of financial markets: A comparison with experimental markets, MIT Sloan Working Paper, 2001, 4195–01.

S. H. Chen and C. H. Yeh, On the emergent properties of artificial stock markets: The efficient market hypothesis and the rational expectations hypothesis, Journal of Economic Behavior & Organization, 2001, 49(2): 217–239.

S. H. Chen and C. C. Liao, Agent-based computational modeling of the stock price-volume relation, Information Sciences, 2005, 170(1): 75–100.

D. Orrell and P. E. McSharry, System economics: Overcoming the pitfalls of forecasting models via a multidisciplinary approach, International Journal of Forecasting, 2009, 25(4): 734–743.

C. Chiarella and S. Gao, Modelling the value of the S&P 500 — A system dynamics perspective, University of Technology Working Paper, 2002, 115.

X.R. Cao and D. X. Wang, How good is technique analysis? Keynote Speech of the 6th International Conference on Computer Science and Education, 2011.

L. Gerencsér and Z. Mátyás, A behavioral stock market model, Mathematical Methods of Operations Research, 2008, 67: 43–63.

X. Zheng and B. M. Chen, Modeling and analysis of financial markets using system adaptation and frequency domain approach, Proceedings of the 7th IEEE International Conference on Control and Automation, Christchurch, New Zealand, 2009.

X. Zheng and B. M. Chen, Identification of market forces in the financial system adaptation framework, Proceedings of the 8th IEEE International Conference on Control and Automation, Xiamen, China, 2010.

P. C. Young, Time-variable parameter and trend estimation in non-stationary economic time series, Journal of Forecasting, 1994, 13(2): 179–210.

J. J. Binder and M. J. Merges, Stock market volatility and economic factors, Review of Quantitative Finance and Accounting, 2001, 17: 5–26.

P. C. Young, Stochastic, dynamicmodeling and signal processing, time variable and state dependent parameter estimation, in Nonlinear and Nonstationary Signal Processing (ed. by W. J. Fitzgerald, R. L. Smith, A. T. Walden and P. C. Young), Cambridge University Press, Cambridge, 2000.

C. J. Taylor, D. J. Pedregal, P. C. Young, and W. Tych, Environmental time series analysis and forecasting with the Captain toolbox, Environmental Modelling and Software, 2007, 22(6): 797–814.

N. Chen, R. Roll, and S. Ross, Economic forces and the stock market, Journal of Business, 1986, 59: 383–403.

K.H. Kim, Dollar exchange rate and the stock price: Evidence from multivariate cointegration and error correction model, Review of Financial Economics, 2003, 12: 301–313.

M. Baker and J. Wurgler, Investor sentiment in the stock market, Journal of Economic Perspectives, 2007, 21: 129–151.

W. Y. Lee, C. X. Jiang, and D. C. Indro, Stock market volatility, excess returns, and the role of investor sentiment, Journal of Banking & Finance, 2002, 26(12): 2277–2299.

S. P. Kothari, J. Lewellen, and J. B. Warner, Stock returns, aggregate earnings surprises, and behavioral finance, Journal of Financial Economics, 2006, 79(3): 537–568.

G. Kaplanski and H. Levy, Sentiment and stock prices: The case of aviation disasters, Journal of Financial Economics, 2010, 95(2): 174–201.

W. Sun, A comprehensive approach to predicting market bottoms, Bachelor of Engineering Thesis, Department of Electrical & Computer Engineering, National University of Singapore, 2009.

D. L. Thornton, Tests of the market’s reaction to federal funds rate target changes, Federal Reserve Bank of St. Louis Review, 1998, 1998: 25–36.

K. N. Kuttner, Monetary policy surprises and interest rates: Evidence from the Fed funds futures market, Journal of Monetary Economics, 2001, 47(3): 523–544.

B. S. Bernanke and K. N. Kuttner, What explains the stock market’s reaction to federal reserve policy? Journal of Finance, 2005, 60(3): 1221–1257.

J. F. Geweke, Measurement of linear dependence and feedback between multiple time series, Journal of the American Statistical Association, 1982, 77: 304–324.

W. Hesse, E. Moller, M. Arnold, and B. Schack, The use of time-variant EEG Granger causality for inspecting directed interdependencies of neural assemblies, Journal of Neuroscience Methods, 2003, 124: 27–44.

A. Roebroeck, E. Formisano, and R. Goebel, Mapping directed influence over the brain using Granger causality and fMRI, Neuroimage, 2005, 25: 230–242.

L. Ljung, System Identification: Theory for the User, Prentice Hall, New Jersey, 1999.

J. Ding, F. Ding, and S. Zhang, Parameter identification of multi-input, single-output systems based on FIR models and least squares principle, Applied Mathematics and Computation, 2008, 197(1): 297–305.

A. C. Harvey, Forecasting Structural Time Series Models and the Kalman Filter, Cambridge University Press, Cambridge, 1989.

J. C. Lagarias, J. A. Reeds, M. H. Wright, and P. E. Wright, Convergence properties of the nelder-Mead simplex method in low dimensions, IAM Journal of Optimization, 1998, 9(1): 112–147.

R. G. D. Steel and J. H. Torrie, Principles and Procedures of Statistics: A Biometrical Approach, McGraw-Hill, New York, 1960.

P. A. McKay, Oil lifts Dow to 10062.94 in late rally, Wall Street Journal, 16 October, 2009, 1.

P. Chen, Random walk or color chaos on the stock market? — Time-Frequency analysis of S&P indexes, Studies in Nonlinear Dynamics & Econometrics, 1996, 1(2): 87–103.

P. Chen, Trends, shocks, persistent cycles in evolving economy: business cycle measurement in Time-Frequency representation, Nonlinear Dynamics and Economics (ed. by W. A. Barnett, A. P. Kirman and M. Salmon), Cambridge University Press, Cambridge, 1996.

G. Turhan-Sayan and S. Sayan, Use of Time-Frequency representations in the analysis of stock market data, Computational Methods in Decision-making, Economics and Finance/Applied Optimization Series (ed. by E. J. Kontoghiorghes, B. Rustem and S. Siokos), Kluwer Academic Publishers, Dordrecht, 2002.

M. P. Niemira, Forecasting turning points in the stock market cycle and asset allocation implications, Analyzing Modern Business Cycles: Essays Honoring Geoffrey H. Moore (ed. by P. A. Klein), M. E. Sharpe, New York, 1990.

S. Kim and F. In, The relationship between stock returns and inflation: New evidence from wavelet analysis, Journal of Empirical Finance, 2005, 12(3): 435–444.

G. Chow, Tests of equality between sets of coefficients in two linear regressions, Econometrica, 1960, 28(3): 591–605.

D. W. K. Andrew and W. Ploberger, Optimal tests when a nuisance parameter is present only under the alternative, Econometrica, 1994, 62(6): 1383–1414.

J. Bai and P. Perron, Estimating and testing linear models with multiple structural changes, Econometrica, 1998, 66(1): 47–78.

J. Bai and P. Perron, Computation and analysis of multiple structural change models, Journal of Applied Econometrics, 2003, 18(1): 1–22.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was recommended for publication by Editor Shouyang WANG.

Rights and permissions

About this article

Cite this article

Zheng, X., Chen, B.M. Modeling and forecasting of stock markets under a system adaptation framework. J Syst Sci Complex 25, 641–674 (2012). https://doi.org/10.1007/s11424-012-1034-0

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-012-1034-0