Abstract

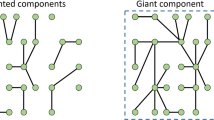

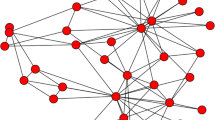

In this paper, we carry out a sensitivity analysis for an agent-based model of the use of public resources as manifested by the El Farol Bar problem. An early study using the same model has shown that a good-society equilibrium, characterized by both economic efficiency and economic equality, can be achieved probabilistically by a von Neumann network, and can be achieved surely with the presence of some agents having social preferences, such as the inequity-averse preference or the ‘keeping-up-with-the-Joneses’ preference. In this study, we examine this fundamental result by exploring the inherent complexity of the model; specifically, we address the effect of the three key parameters related to size, namely, the network size, the neighborhood size, and the memory size. We find that social preferences still play an important role over all the sizes considered. Nonetheless, it is also found that when network size becomes large, the parameter, the bar capacity (the attendance threshold), may also play a determining role.

Similar content being viewed by others

References

Arthur B (1994) Complexity in economic theory: inductive reasoning and bounded rationality. Am Econ Rev 82(2):406–411

Chen S-H, Gostoli U (2015) Coordination in the El Farol Bar problem: The role of social preferences and social networks. J Econ Interact Coord Forthcom. doi:10.1007/s11403-015-0150-z

Chen S-H, Liao C-C, Chou P-J (2008) On the plausibility of sunspot equilibria: simulations based on agent-based artificial stock markets. J Econ Interact Coord 3(1):25–41

LeBaron B (2001) Evolution and time Horizons in an agent-based stock market. Macroecon Dyn 5:225–254

Lo T, Chan H, Hui P, Johnson N (2004) Theory of networked minority games based on strategy pattern dynamics. Phys Rev E 70:056102

Lux T, Schornstein S (2005) Genetic learning as an explanation of stylized facts of foreign exchange markets. J Math Econ 41(1–2):169–196

Wolfram S (2002) A new kind of science. Wolfram Media, Champaign

Acknowledgments

The research support in the form of the Ministry of Science and Technology (MOST) Grant, MOST 103-2410-H-004-009-MY3, is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chen, SH., Gostoli, U. On the complexity of the El Farol Bar game: a sensitivity analysis. Evol. Intel. 9, 113–123 (2016). https://doi.org/10.1007/s12065-016-0138-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12065-016-0138-1