Abstract

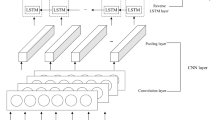

At the stock market, any investors will have to predict the overall trend of the market before making investment strategy so that their profits will be maximized. Such predictions reflect the “timing ability” of investors. Investors will only maximize economic benefits when they choose the best time to invest. As time series of stock price are related to each other, historical price trends can indicate the future direction of a stock, so they can be analyzed to forecast the closing price of the stocks. This paper regarded the stock historical data as a one-dimensional grid, in which samples were taken at fixed time intervals. By extracting spatial features with convolutional neural network, obtaining temporal features with long short-term memory network, and using the attention mechanism in natural language processing, the paper outlines a hybrid deep neural network-based model designed to predict the position ratio and solve the problem of market timing. Next, the proposed method is compared with other prediction models, in which prediction indicators and trade simulation indicators are used to measure their performances. Results show that the model proposed by this paper is more accurate in predicting position ratio, and it has more significant effect as a timing method.

Similar content being viewed by others

References

Bengio Y, Boulanger-Lewandowski N, Pascanu R (2013) Advances in optimizing recurrent networks. 2013 IEEE International Conference on Acoustics, Speech and Signal Processing, Vancouver, BC, Canada, pp. 8624–8628

Brandt MW, Santa-Clara P (2006) Dynamic portfolio selection by augmenting the asset space. J Financ 61(5):2187–2217

Dahl GE, Sainath TN , Hinton GE (2013) Improving deep neural networks for LVCSR using rectified linear units and dropout. In: 2013 IEEE international conference on acoustics, speech and signal processing, Vancouver, BC, Canada, pp. 8609–8613

Greff K, Srivastava RK, Koutník J et al (2016) LSTM: a search space odyssey. IEEE Trans Neural Netw Learn Syst 28(10):2222–2232

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9(8):1735–1780

Hu C, Dai L, Yan X et al (2020) Modified NSGA-III for sensor placement in water distribution system. Inf Sci 509:488–500

Kim K (2003) Financial time series forecasting using support vector machines. Neurocomputing 55(1–2):307–319

Leigh W, Modani N, Purvis R et al (2002) Stock market trading rule discovery using technical charting heuristics. Expert Syst Appl 23(2):155–159

Liu Q (2010) Research on stock position dynamic adjustment model. N Financ 2010(11):33–38 (in Chinese)

Lukac LP, Brorsen, BW, Irwin SH (1986) A comparison of twelve technical trading systems with market efficiency implications. Station bulletin-Dept. of Agricultural Economics, Purdue University, Agricultural Experiment Station (USA)

Maknickienė N (2014) Selection of orthogonal investment portfolio using Evolino RNN trading model. Procedia Soc Behav Sci 110:1158–1165

Nelson DMQ, Pereira ACM, de Oliveira RA (2017) Stock market’s price movement prediction with LSTM neural networks. 2017 International Joint Conference on Neural Networks (IJCNN), Anchorage, AK, USA, pp. 1419–1426

Pai P, Lin C (2005) A hybrid ARIMA and support vector machines model in stock price forecasting. Omega 33(6):497–505

Pang X, Zhou Y, Wang P et al (2020) An innovative neural network approach for stock market prediction. J Supercomput 76(3):2098–2118

Povinelli RJ (2000) Identifying temporal patterns for characterization and prediction of financial time series events. In: International Workshop on Temporal, Spatial, and Spatio-Temporal Data Mining, Springer, Berlin, Heidelberg, pp. 46–61

Roondiwala M, Patel H, Varma S (2017) Predicting stock prices using LSTM. Intern J Sci Res 6(4):1754–1756

Wang F, Li Y, Zhou A, Tang K (2020a) An estimation of distribution algorithm for mixed-variable newsvendor problems. IEEE Trans Evol Comput 24(3):479–493

Wang F, Li Y, Liao F et al (2020b) An ensemble learning based prediction strategy for dynamic multi-objective optimization. Appl Soft Comput. https://doi.org/10.1016/j.asoc.2020.106592

Yan X, Zhu Z, Hu C et al (2019) Spark-based intelligent parameter inversion method for prestack seismic data. Neural Comput Appl 31(9):4577–4593

Yan X, Hu C, Sheng V (2020a) Data-driven pollution source location algorithm in water quality monitoring sensor networks. Intern J Bio-Inspir Comput 15(3):171–180

Yan X, Li P, Tang K et al (2020b) Clonal selection based intelligent parameter inversion algorithm for prestack seismic data. Inf Sci 517:86–99

Yan X, Gong J, Wu Q (2020c) Pollution source intelligent location algorithm in water quality sensor networks. Neural Comput Appl. https://doi.org/10.1007/s00521-020-05000-8

Yu P, Yan X (2020) Stock price prediction based on deep neural network. Neural Comput Appl 32(6):1609–1628

Acknowledgements

This paper is supported by National Natural Science Foundation of China (U1911205 and 61673354), the Fundamental Research Funds for the Central Universities, China University of Geosciences (Wuhan) (CUGGC03) and Open Research Project of The Hubei Key Laboratory of Intelligent Geo-Information Processing, China University of Geosciences (Wuhan) (KLIGIP-2018B13).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Song, T., Yan, X. Dynamic adjustment of stock position based on hybrid deep neural network. J Ambient Intell Human Comput 12, 10073–10089 (2021). https://doi.org/10.1007/s12652-020-02768-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12652-020-02768-4