Abstract

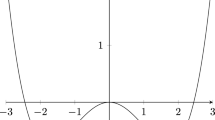

The literature that conducts numerical analysis of equilibrium in models with hyperbolic (quasi-geometric) discounting reports difficulties in achieving convergence. Surprisingly, numerical methods fail to converge even in a simple, deterministic optimal growth problem that has a well-behaved, smooth closed-form solution. We argue that the reason for nonconvergence is that the generalized Euler equation has a continuum of smooth solutions, each of which is characterized by a different integration constant. We propose two types of restrictions that can rule out the multiplicity: boundary conditions and shape restrictions on equilibrium policy functions. With these additional restrictions, the studied numerical methods deliver a unique smooth solution for both the deterministic and stochastic problems in a wide range of the model’s parameters.

Similar content being viewed by others

Notes

The related literature includes Laibson et al. [35], Barro [9], O’Donoghue and Rabin [55], Harris and Laibson [24], Angeletos et al. [3], Krusell and Smith [29–31], Krusell et al. [32], Luttmer and Mariotti [37], Maliar and Maliar [39–44], Judd [25], Sorger [61], Gong et al. [23], Chatterjee and Eyigungor [16], Balbus et al. [6, 7], Bernheim et al. [11], among others.

Other methods can be used in the context of models with quasi-geometric discounting. One of them is a “recursive optimization” approach suggested in Strotz [65], and Caplin and Leahy [14]. A possible implementation of this approach is found in the “pseudo-state space/enlarged state space” analysis of Kydland and Prescott [33] and Feng et al. [22]. Recently, in the context of the game theoretic approach, some literature have suggested turning the problem into a stochastic game (e.g., [24], Balbus et al. [6]). Also, in this latter tradition, one could also attempt to apply incentive-constrained dynamic programming methods [60], recursive dual approaches [49, 52, 56], and [17], or set-value dynamic programming methods proposed in Abreu, Pearce and Stachetti [1] (e.g., Balbus and Wozny [6]).

For the case of the standard geometric discounting, there is a general turnpike theorem that shows that an optimal program of a finite horizon economy asymptotically converges to an optimal program of the corresponding infinite horizon economy under very general assumptions; see Brock and Mirman [13], McKenzie [51], Joshi [26], Majumdar and Zilcha [38], Mitra and Nyarko [54], Becker [10], and Maliar et al. [47]. Turnpike theorems are also known for some dynamic games (see [28] for a survey), but they are not yet established for the economy with quasi-geometric discounting like ours.

Maliar and Maliar [40] shows another example of the model with quasi-geometric discounting that admits a closed-form solution under the assumption of the exponential utility function.

References

Abreu D, Pearce D, Stachetti E (1986) Optimal cartel equilibria with imperfect monitoring. J Econ Theory 39:251–269

Amann H (1976) Fixed point equations and nonlinear eigenvalue problems in ordered banach spaces. SIAM Rev 18(4):620–709

Angeletos M, Laibson D, Repetto A, Tobacman J, Weinberg S (2001) The hyperbolic consumption model: calibration, simulation, and empirical evaluation. J Econ Perspect 15(3):47–68

Arellano C, Maliar L, Maliar S, Tsyrennikov V (2014) Envelope condition method with an application to default risk models (Manuscript)

Aruoba SB, Fernández-Villaverde J, Rubio-Ramí rez J (2006) Comparing solution methods for dynamic equilibrium economies. J Econ Dyn Control 30:2477–2508

Balbus Ł, Reffet K, Woźny Ł (2015) Time consistent Markov policies in dynamic economies with quasi-hyperbolic consumers. Int J Game Theory 44(1):83–112

Balbus L, Reffet K, Wozny L (2012) Existence and uniqueness of time-consistent Markov policies for quasi-hyperbolic consumers under uncertainty (Manuscript)

Barillas F, Fernandez-Villaverde J (2007) A generalization of the endogenous grid method. J Econ Dyn Control 31(8):2698–2712

Barro R (1999) Ramsey meets Laibson in the neoclassical growth model. Q J Econ 114(4):1125–1152

Becker R (2012) Optimal growth with heterogeneous agents and the twisted turnpike: an example. Int J Econ Theory 8(1):24–47

Bernheim D, Ray D, Yeltekin S (2015) Poverty and self-control. Econometrica (forthcoming)

Bernheim D, Ray D (1986) On the existence of Markov-consistent plans under production uncertainty. Rev Econ Stud 53(5):877–882

Brock W, Mirman L (1972) Optimal economic growth and uncertainty: the discounted case. J Econ Theory 4:479–513

Caplin A, Leahy J (2006) The recursive approach to time inconsistency. J Econ Theory 131(1):134–156

Carroll K (2005) The method of endogenous grid points for solving dynamic stochastic optimal problems. Econ Lett 91:312–320

Chatterjee S, Eyigungor B (2014) Continuous Markov equilibria with quasi-geometric discounting. Working Papers 14–6, Federal Reserve Bank of Philadelphia

Cole H, Kubler F (2012) Recursive contracts, lotteries and weakly concave pareto sets. Rev Econ Dyn 15(4):479–500

Coleman W (1991) Equilibrium in a production economy with an income tax. Econometrica 59(4):1091–1104

Coleman W (2000) Uniqueness of an equilibrium in infinite-horizon economies subject to taxes and externalities. J Econ Theory 95(1):71–78

Datta M, Mirman L, Reffett K (2002) Existence and uniqueness of equilibrium in distorted dynamic economies with capital and labor. J Econ Theory 103(2):377–410

Fella G (2014) A generalized endogenous grid method for non-smooth and non-concave problems. Rev Econ Dyn 17(2):329–344

Feng Z, Miao J, Peralta-Alva A, Santos M (2014) Numerical simulation of nonoptimal dynamic equilibrium models. Int Econ Rev 55:83–110

Gong L, Smith W, Zou H (2011) Asset prices and hyperbolic discounting. CEMA Working Papers 486

Harris C, Laibson D (2001) Dynamic choices of hyperbolic consumers. Econometrica 69(4):935–959

Judd K (2004) Existence, uniqueness, and computational theory for time consistent equilibria: a hyperbolic discounting example (Manuscript)

Joshi S (1997) Turnpike theorems in nonconvex nonstationary environments. Int Econ Rev 38:245–248

Kocherlakota NR (1996) Reconsideration-proofness: a refinement for infinite horizon time inconsistency. Games Econ Behav 15(1):33–54

Kolokoltsov V, Yang W (2012) The turnpike theorems for Markov games. Dyn Games Appl 2(3):294–312

Krusell P, Smith A (2000) Consumption-savings decisions with quasi-geometric discounting. CEPR discussion paper no. 2651

Krusell P, Smith A (2003) Consumption-savings decisions with quasi-geometric discounting. Econometrica 71:365–375

Krusell P, Smith A (2008) Consumption-savings decisions with quasi-geometric discounting: the case with a discrete domain (Manuscript)

Krusell P, Kuruşçu B, Smith A (2002) Equilibrium welfare and government policy with quasi-geometric discounting. J Econ Theory 105(1):42–72

Kydland F, Prescott E (1980) Dynamic optimal taxation, rational expectations and optimal control. J Econ Dyn Control 2(1):79–91

Laibson D (1997) Golden eggs and hyperbolic discounting. Q J Econ 112(2):443–477

Laibson D, Repetto A, Tobacman J (1998) Self-control and saving for retirement. Brookings Pap Econ Act 1:91–172

Leininger W (1986) The existence of perfect equilibria in a model of growth with altruism between generations. Rev Econ Stud LIII:349–367

Luttmer E, Mariotti T (2003) Subjective discounting in an exchange economy. J Polit Econ 111(5):959–989

Majumdar M, Zilcha I (1987) Optimal growth in a stochastic environment: some sensitivity and turnpike results. J Econ Theory 43:116–133

Maliar L, Maliar S (2003) Solving the neoclassical growth model with quasi-geometric discounting: non-linear Euler-equation methods, IVIE WP AD 2003–23

Maliar L, Maliar S (2004) Quasi-geometric discounting: a closed-form solution under the exponential utility function. Bull Econ Res 56(2):201–206

Maliar L, Maliar S (2005) Solving the neoclassical growth model with quasi-geometric discounting: a grid-based Euler-equation method. Comput Econ 26:163–172

Maliar L, Maliar S (2006a) The neoclassical growth model with heterogeneous quasi-geometric consumers. J Money Credit Bank 38(3):635–654

Maliar L, Maliar S (2006b) Indeterminacy in a log-linearized neoclassical growth model with quasi-geometric discounting. Econ Model 23(3):492–505

Maliar L, Maliar S (2007) Short-run patience and wealth distribution. Stud Nonlinear Dyn Econ 11(1), Article 4

Maliar L, Maliar S (2013) Envelope condition method versus endogenous grid method for solving dynamic programming problems. Econ Lett 120:262–266

Maliar L, Maliar S (2014) Numerical methods for large scale dynamic economic models. In: Schmedders K, Judd K (eds) Handbook of computational economics, chapter 7, vol 3. Elsevier Science, Amsterdam

Maliar L, Maliar S, Taylor JB, Tsener I (2015) A tractable framework for analyzing a class of nonstationary Markov models. NBER 21155

Manuelli R, Sargent T (1987) Exercises in dynamic macroeconomic theory. Harvard University Press, Cambridge

Marcet A, Marimon R (1998) Recursive contracts, economics Working Papers, European University Institute

Maskin E, Tirole J (2001) Markov perfect equilibrium: I. Observable actions. J Econ Theory 100(2):191–219

McKenzie L (1976) Turnpike theory. Econometrica 44:841–865

Messner M, Pavoni N, Sleet C (2012) Recursive methods for incentive problems. Rev Econ Dyn 15(4):501–525

Mirman L, Morand O, Reffett K (2008) A qualitative approach to markovian equilibrium in infinite horizon economies with capital. J Econ Theory 139(1):75–98

Mitra T, Nyarko Y (1991) On the existence of optimal processes in nonstationary environments. J Econ 53:245–270

O’Donoghue T, Rabin M (1999) Doing it now or later. Am Econ Rev 89(1):103–124

Pavoni N, Sleet C, Messner M (2015) The dual approach to recursive optimization: theory and examples, 2014 meeting papers 1267, society for economic dynamics

Peleg B, Yaari M (1973) On the existence of a consistent course of action when tastes are changing. Rev Econ Stud 40(3):391–401

Phelps ES, Pollak RA (1968) On second-best national saving and game-equilibrium growth. Rev Econ Stud 35:185–199

Pollak RA (1968) Consistent planning. Rev Econ Stud 35:201–208

Rustichini A (1998) Dynamic programming solution of incentive constrained problems. J Econ Theory 78(2):329–354

Sorger G (2004) Consistent planning under quasi-geometric discounting. J Econ Theory 118(1):118–129

Santos M (1999) Numerical solution of dynamic economic models. In: Taylor J, Woodford M (eds) Handbook of macroeconomics. Elsevier Science, Amsterdam, pp 312–382

Stachurski J (2009) Economic dynamics: theory and computation. MIT Press, Cambridge

Stokey NL, Lucas RE Jr, Prescott E (1989) Recursive methods in economic dynamics. Harvard University Press, Cambridge

Strotz RH (1955–1956) Myopia and inconsistency in dynamic utility maximization. Rev Econ Stud 23:165–180

Tauchen G (1986) Finite state Markov chain approximations to univariate and vector autoregressions. Econ Lett 20:177–181

White M (2015) The method of endogenous gridpoints in theory and practice. Working Papers 15-03, University of Delaware

Acknowledgments

Lilia Maliar and Serguei Maliar acknowledge support from the Hoover Institution and Department of Economics at Stanford University, University of Alicante, Santa Clara University and MECD Grant ECO2012-36719. We thank the editors Edward Prescott and Kevin Reffett for many useful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Maliar, L., Maliar, S. Ruling Out Multiplicity of Smooth Equilibria in Dynamic Games: A Hyperbolic Discounting Example. Dyn Games Appl 6, 243–261 (2016). https://doi.org/10.1007/s13235-015-0177-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-015-0177-8

Keywords

- Hyperbolic discounting

- Quasi-geometric discounting

- Time inconsistency

- Markov perfect equilibrium

- Markov games

- Turnpike theorem

- Neoclassical growth model

- Endogenous gridpoints

- Envelope condition