Abstract

The stock market is complex in nature and it is very difficult to predict. Investors have many factors that affect the stock values. The stock market plays an important role in the financial aspect of the country’s growth. The demand to predict stock values is very high, hence is the need for stock market analysis. This article is basically focused on always taking risks to invest his money in the stock market to gain profit. There are various machine-learning techniques available to predict the stock market. There are on predicting the stock market values. In the current scenario, the stock market forecasting is done using machine learning and artificial intelligence which makes the prediction process easier and based on the values of the current stock rate by training on the previous values. Basically, stock price prediction is based on time series data means every new data are dependent or based on previous data value. The dataset used for this is Dell daily stock for the period 17 Aug 2016–21 May 2021 which was used in this article. There are different kinds of models that can help in predicting the stock market. A simple machine-learning model cannot be applied to time series data, that is why we studied many models such as LSTM and ARIMA model, which are best for time series data. In addition, at the end, we saw that ARIMA is one of the best models for predicting the stock market values for short time series. This model is based on previous values. This model gives the more accurate and best results as compared to another one.

Similar content being viewed by others

References

Malkiel BG, Fama EF. Efficient capital markets: a review of theory and empirical work. J Finance. 1970;25(2):383–417.

Wang X, Lin W. Stock market prediction using neural networks: does trading volume help in short-term prediction?. n.d.

Jeon S, Hong B, Chang V. Pattern graph tracking-based stock price prediction using big data. Future Gener Comput Syst. 2018;80:171–87. https://doi.org/10.1016/j.future.2017.02.010.

Lin X, Yang Z, Song Y. Expert systems with applications short-term stock price prediction based on echo state networks. Expert Syst Appl. 2009;36(3):7313–7. https://doi.org/10.1016/j.eswa.2008.09.049.

Shih D, Hsu H, Shih P. A study of early warning system in volume burst risk assessment of stock with big data platform. In: 2019 IEEE 4th international conference on cloud computing and big data analysis (ICCCBDA). 2019. p. 244–248. https://doi.org/10.1109/ICCCBDA.2019.8725738.

Liu G, Wang X. A new metric for individual stock trend prediction. Eng Appl Artif Intell. 2019;82:1–12. https://doi.org/10.1016/j.engappai.2019.03.019.

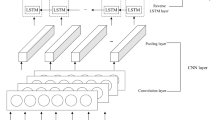

Liu S, Zhang C, Ma J. CNN-LSTM neural network model for quantitative strategy analysis in stock markets. 2017;1:198–206. https://doi.org/10.1007/978-3-319-70096-0.

Eapen J, Bein D, Verma A. Novel deep learning model with CNN and bi-directional LSTM for improved stock market index prediction. In: 2019 IEEE 9th annual computing and communication workshop and conference (CCWC). 2019. pp. 264–70. https://doi.org/10.1109/CCWC.2019.8666592.

Lee K, Yoo S, Jongdae JJ. Neural network model vs SARIMA model in forecasting Korean Stock Price Index (KOSPI). Issues Inf Syst. 2007;8(2):372–8.

Ariyo AA, Adewumi AO, Ayo CK (2014) Stock price prediction using the ARIMA model. In: 2014 UKSim-AMSS 16th international conference on computer modelling and simulation. 2014. p. 106–112.

Islam MR, Nguyen N. Comparison of financial models for stock price prediction. J Risk Financ Manag. 2020;13(8):181.

Uma Devi B, Sundar D, Alli P. An effective time series analysis for stock trend prediction using ARIMA model for nifty Midcap-50. Int J Data Min Knowl Manag Process. 2013;3(1).

Almasarweh M, Al Wadi S. ARIMA model in predicting banking stock market data. Mod Appl Sci. 2018;12(11)

Hochreiter S, Schmidhuber J. Long short-term memory. Neural Comput. 1997;9(8):1735–1780. https://doi.org/10.1162/neco.1997.9.8.1735

Edward A..J., & Manoj Jyothi. (2016).Forecast Model Using ARIMA for stock prices of Automobile sector. International Journal of Research in Finance and Marketing(Impact Factor 5.861), 6(4), 174-178.

Srivastava AK, Kumar Y, Singh PK. A rule-based monitoring system for accurate prediction of diabetes: monitoring system for diabetes. Int J E-Health Med Commun. 2020;11(3):32–53. https://doi.org/10.4018/IJEHMC.2020070103.

Moghar A, Hamiche M. Stock market prediction using LSTM recurrent neural network. Procedia Comput Sci. 2020;170:1168–1173. https://doi.org/10.1016/j.procs.2020.03.049.

Nochai R, Nochai T. ARIMA model for forecasting oilpalm price. In: Proceedings of 2nd IMT-GT reginal conference on mathematics, statistics and applications Universiti Sains Malaysia, Penang, June 13–15, 2006, 2006.

Roondiwala R, Patel H, Varma S. Predicting stock prices using LSTM. Int J Sci Res. 2015.

Srivastava AK, Singh PK, Kumar Y. A taxonomy on machine learning based techniques to identify the heart disease. In: Prateek M, Sharma D, Tiwari R, Sharma R, Kumar K, Kumar N, editors. Next generation computing technologies on computational intelligence. NGCT 2018. Communications in computer and information science, vol 922. Springer, Singapore; 2019. https://doi.org/10.1007/978-981-15-1718-1_2.

https://machinelearningmastery.com/time-series-prediction-lstm-recurrent-neural-networks-python-keras/. Accessed 5 Aug 2021 (for complete understanding of LSTM model).

https://machinelearningmastery.com/arima-for-time-series-forecasting-with-python/. Accsessed 5 Aug 2021 (for complete understanding of ARIMA model).

https://machinelearningmastery.com/how-to-load-visualize-and-explore-a-complex-multivariate-multistep-time-series-forecasting-dataset/(how to load, visualize and explore a time series dataset).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors state that no conflict of interest exists.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the topical collection “Security for Communication and Computing Application” guest edited by Karan Singh, Ali Ahmadian, Ahmed Mohamed Aziz Ismail, R S Yadav, Md. Akbar Hossain, D. K. Lobiyal, Mohamed Abdel-Basset, Soheil Salahshour, Anura P. Jayasumana, Satya P. Singh, Walid Osamy, Mehdi Salimi and Norazak Senu.

Rights and permissions

About this article

Cite this article

Srivastava, A.K., Srivastava, A., Singh, S. et al. Design of Machine-Learning Classifier for Stock Market Prediction. SN COMPUT. SCI. 3, 88 (2022). https://doi.org/10.1007/s42979-021-00970-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42979-021-00970-5