Abstract

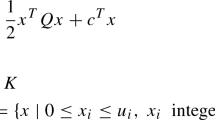

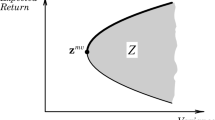

In this paper, we will develop an algorithm for solving a quadratic fractional programming problem which was recently introduced by Lo and MacKinlay to construct a maximal predictability portfolio, a new approach in portfolio analysis. The objective function of this problem is defined by the ratio of two convex quadratic functions, which is a typical global optimization problem with multiple local optima. We will show that a well-designed branch-and-bound algorithm using (i) Dinkelbach's parametric strategy, (ii) linear overestimating function and (iii) ω-subdivision strategy can solve problems of practical size in an efficient way. This algorithm is particularly efficient for Lo-MacKinlay's problem where the associated nonconvex quadratic programming problem has low rank nonconcave property.

Similar content being viewed by others

References

W. Dinkelbach, “On nonlinear fractional programming,” Management Science, vol. 13, no. 7, pp. 492–498, 1967.

J.E. Falk and R.M. Soland, “An algorithm for separable nonconvex programming problems,” Management Science, vol. 15, pp. 550–569, 1969.

F.R. Gantmacher, The Theory of Matrices, Chelsea: New York, 1959.

T. Ibaraki, “Parametric approaches to fractional programs,” Mathematical Programming, vol. 26, pp. 345–362, 1983.

H. Konno, P.T. Thach, and H. Tuy, Optimization on Low Rank Nonconvex Structures, Kluwer Academic Publishers: Dordrecht, The Netherlands, 1997.

H. Konno, T. Suzuki, and D. Kobayashi, “A branch and bound algorithm for solving mean-risk-skewness portfolio models,” Optimization Methods and Software, vol. 10, pp. 297–317, 1998.

H. Konno and A. Wijayanayake, “Mean-absolute deviation portfolio optimization model under transaction costs,” Journal of the Operations Research Society of Japan, vol. 42, no. 4, pp. 422–435, 1999.

A. Lo and C. MacKinlay, “Maximizing predictability in the stock and bond markets,” Macroeconomic Dynamics, vol. 1, pp. 102–134, 1997.

P.M. Pardalos and A.T. Phillips, “Global optimization of fractional programs,” Journal of Global Optimization, vol. 1, pp. 173–182, 1991.

T.Q. Phong, L.T.H. An, and P.D. Tao, “Decomposition branch and bound method for globally solving linearly constrained indefinite quadratic minimization problems,” Operations Research Letters, vol. 17, pp. 215–220, 1995.

S. Schaible, “Fractional programming II, On Dinkelbach's algorithm,” Management Science, vol. 22, no. 8, pp. 868–873, 1976.

S. Schaible, “Fractional programming,” in Handbook of Global Optimization, R. Horst and P. Pardalos (Eds.), Kluwer Academic Publishers: Dordrecht, The Netherlands, 1995.

H. Tuy, Convex Analysis and Global Optimization, Kluwer Academic Publishers: Dordrecht, The Netherlands, 1998.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Gotoh, JY., Konno, H. Maximization of the Ratio of Two Convex Quadratic Functions over a Polytope. Computational Optimization and Applications 20, 43–60 (2001). https://doi.org/10.1023/A:1011219422283

Issue Date:

DOI: https://doi.org/10.1023/A:1011219422283