Abstract

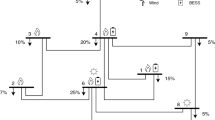

The electricity industry is undergoing a substantial process of restructuring, with an emphasis on the introduction of competition in the generation sector. Traditional planning methods are not necessarily appropriate for this new environment. This paper extends a previously developed linear programming model to the problem of optimal expansion planning in the face of uncertainty. The model explicitly accounts for equipment availability and load duration curves in selecting optimal investment. The use of the model is illustrated with a simple 2-region problem calibrated with data from Hydro-Québec and the northeastern United States that suggests how the LP model can help decision makers.

Similar content being viewed by others

References

D. Anderson, Models for determining least-cost investments in electricity supply, Bell J. Econom. (1972) 267–299.

J.-T. Bernard and J. Chatel, The application of marginal cost pricing principles to a hydro-electric system: The case of Hydro-Québec, Resources and Energy 7(4) (1985) 353–375.

J.-T. Bernard and J.A. Doucet, L'ouverture du marché d'exportation d'électricité québécoise: Réalité ou mirage à l'horizon?, Canadian Public Policy/Analyse de Politiques XXV(2) (1999) 247–258.

J.A. Bloom, Long range generation planning problem using decomposition and probabilistic simulation, IEEE Trans. Power Apparatus Systems 101(4) (1982) 797–802.

J.A. Bloom, Solving an electricity generating capacity expansion planning problem by generalized Benders' decomposition, Oper. Res. 31(1) (1983) 84–100.

G. Brown and M.B. Johnson, Public utility pricing and output under risk, Amer. Econom. Rev. 59(3) (1969) 119–128.

D.W. Carlton, Peak load pricing with stochastic demand, Amer. Econom. Rev. 67(3) (1977) 106–110.

H.P. Chao, Peak load pricing and capacity planning with demand and supply uncertainty, Bell J. Econom. 14(1) (1983) 179–190.

C. Chaton, Fuel price and demand uncertainties and investment in an electricity model: A two-period model, J. Energy Develop. 23(1) (1997) 29–58.

M.A. Crew and P.R. Kleindorfer, Peak load pricing with diverse technology, Bell J. Econom. 7(1) (1976) 207–231.

M.A. Crew and P.R. Kleindorfer, Reliability and public utility pricing, Amer. Econom. Rev. 68(3) (1978) 31–40.

Final report of the Market Design Committee, Ontario (1999).

R.J. Gilbert and E.P. Kahn, International Comparisons of Electricity Regulation (Cambridge Univ. Press, Cambridge, 1996).

Hydro-Québec, http://www.hydroquebec.com/profil/ (1999).

L'énergie: Un métier québécois, un marché mondial, brochure d'information, Hydro-Québec, Montréal, Québec (1997) 8 pages.

L'énergie au Québec, Québec (1998).

N. Levin, A. Tishler and J. Zahavi, Capacity expansion of power generation systems with uncertainty in the prices of primary energy resources, Managm. Sci. 31(2) (1985) 175–187.

F.A. Lootsma, P.G.M. Boonekamp, R.M. Cooke and F. Van Oostrvoorn, Choice of a long-term strategy for the national electricity supply via scenario analysis and multi-criteria analysis, European J. Oper. Res. (48) (1990) 189–203.

R.A. Meyers, Monopoly pricing and capacity choice under uncertainty, Amer. Econom. Rev. 37 (1975) 326–337.

P. Murto, Models of capacity investment in deregulated electricity markets, Licentiate's thesis, Helsinki University of Technology (2000).

F. Noonan and R.J. Giglio, Planning electric power generation: A nonlinear mixed integer model employing Benders' decomposition, Managm. Sci. (23) (1977) 946–956.

Plan Stratégique 1998–2002, Hydro-Québec (1997).

Projected costs of generating electricity, update dy1998, OECD (1998).

P.V. Schaeffer and L.J. Cherene, The inclusion of spinning reserves in investment and simulation models for electricity generation, European J. Oper. Res. (42) (1989) 178–189.

A. Tishler, Optimal production with uncertain interruptions in the supply of electricity: Estimation of electricity outage costs, European Econom. Rev. 37 (1993) 1259–1274.

R. Turvey, Optimal Pricing and Investment in Electricity Supply (Alden Press, Oxford, 1968).

J.T. Wenders, Peak load pricing in the electric utility industry, Bell J. Econom. 7 (1976) 237–241.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Chaton, C., Doucet, J.A. Uncertainty and Investment in Electricity Generation with an Application to the Case of Hydro-Québec. Annals of Operations Research 120, 59–80 (2003). https://doi.org/10.1023/A:1023370211456

Issue Date:

DOI: https://doi.org/10.1023/A:1023370211456